The price of Ethereum could soar to hit $8,000 by the end of the year, according to analysts from Goldman Sachs who found that the cryptoasset has traded in line with inflation breakevens since 2019.

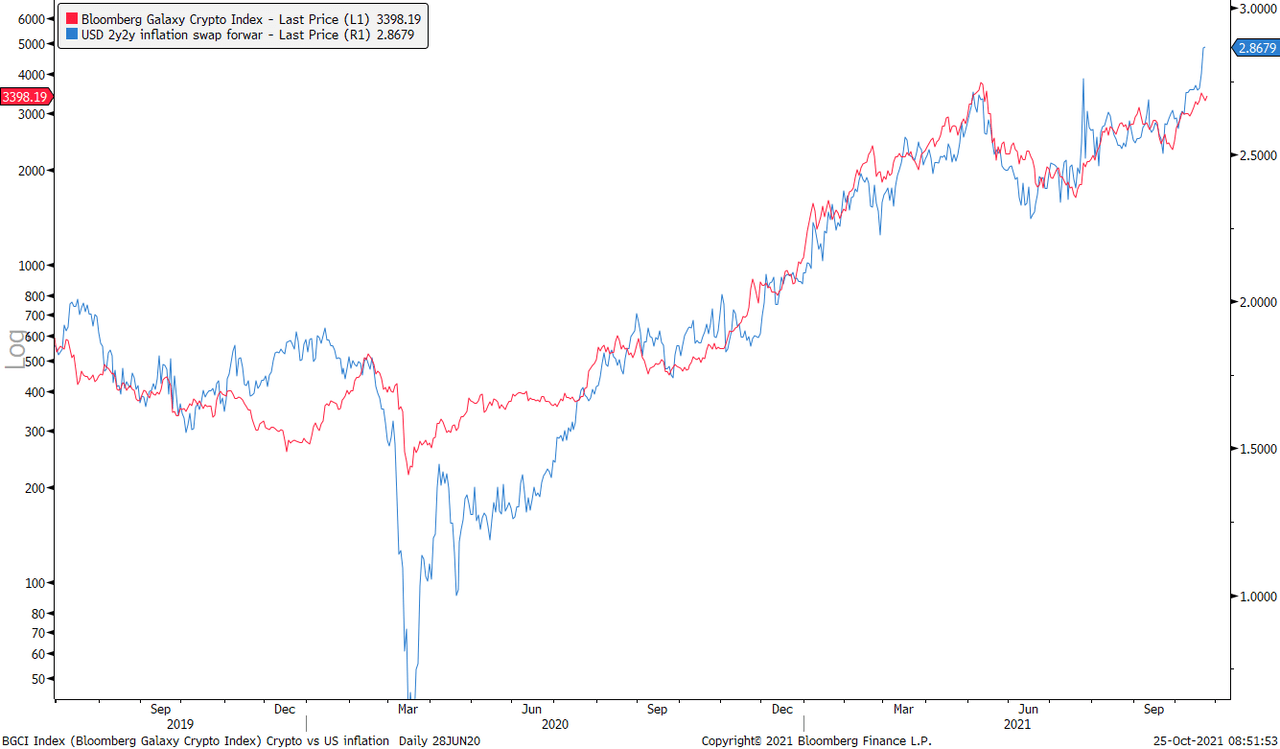

According to ZeroHedge, Goldman Sachs’ Global Market managing director Bernhard Rzymelka compared Bloomberg’s Galaxy Crypto Index versus the USD 2-year forward rate and the 2-year inflation swap, suggesting inflation is a driving force helping Ethereum and other cryptoassets move up.

Rzymelka wrote in a note sent to clients that the local backdrop looks positive for Ethereum as the cryptocurrency has “tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as “network based” asset.” The strategist added that the “latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold.”

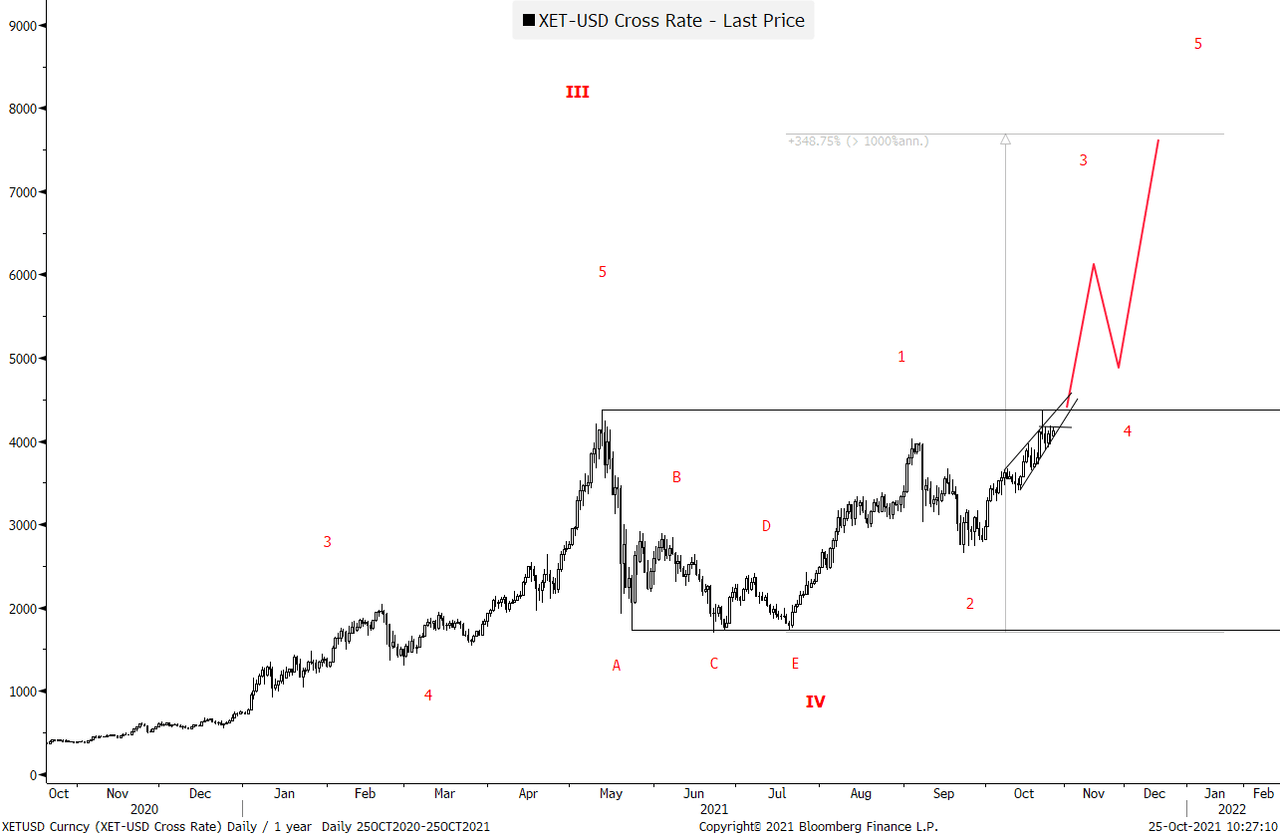

Over the last few weeks, the price of Ethereum broke past its previous all-time high to hit a new one above $4,400 and formed a narrowing wedge pattern, which to Goldman Sachs is either a sign of exhaustion and that the peak is near or has already occurred, not a “starting point of an acceleration rally upon a break higher.”

To Goldman Sachs, the answer is Ethereum could move up over the $8,000 in the last two months of the year, as the analysts hint at such a rise in the report. To the analysts, while Ethereum could appear to be due for a pullback, its Relative Strength Index (RSI) has “yet to hit the overbought levels seen at past market highs.”

The analysts concluded by saying that the projected inflation lines up “rather well with the Ethereum chart,” which suggests a market rally that will culminate with a “longer term market top ahead.”

As CryptoGlobe reported, former Goldman Sachs executive Raoul Pal has revealed on social media that he is “more than irresponsibly long ETH right now,” even adding leverage to his position on the second-largest cryptocurrency by market capitalization.

Pal has notably suggests he sees ETH go to $20,000 “this cycle” based on Metcalfe’s Law. Raoul Pal said at the time that it’s “all Metcalfe´s Law,” and that “ETH = BTC” whether investors like it or not. He started pointing towards a model his team created to demonstrate Metcalfe’s Law on the BTC network using active addresses and the cryptocurrency’s price, as well as market capitalization, before showing Ethereum looks like BTC in its early days based on that metric.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash