On Tuesday (November 2), CME Group announced that it is expanding its crypto derivatives offerings by launching a new product — Micro Ether ($ETH) futures — on December 6 (subject to regulatory review).

This news comes approximately seven months after the world’s leading derivatives marketplace announced its plans for the launch of Micro Bitcoin futures on May 3, which it said would be 1/10 the size of one bitcoin ($BTC). The idea was for this smaller-sized contract to “provide market participants – from institutions to sophisticated, active, individual traders – with one more tool to hedge their spot bitcoin price risk or execute bitcoin trading strategies in an efficient, cost-effective way, all while retaining the features and benefits of CME Group’s standard Bitcoin futures.”

In a press release issued earlier today, CME Group said that Micro Ether future which are 1/10 the size of one ether ($ETH), would “provide an efficient, cost-effective way for a range of market participants – from institutions to sophisticated, active, individual traders – to hedge their spot ether price risk or more nimbly execute ether trading strategies, all while retaining the features and benefits of CME Group’s larger-sized Ether futures.”

Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products, had this to say:

“Since the launch of Ether futures in February, we have seen steady growth in liquidity in these contracts, especially among institutional traders. At the same time, the price of ether has more than doubled since these contracts were introduced, creating demand for a micro-sized contract to make this market even more accessible to a broader range of participants. Micro Ether futures will offer even more choice and precision in how they trade Ether futures in a transparent, regulated and efficient manner at CME Group.“

The press release also mentioned that so far 675,500 of its Ether futures contracts (equivalent to about 33.8 million ether) have been traded.

It is worth noting that this new contract will be “cash-settled, based on the CME CF Ether-Dollar Reference Rate, which serves as a once-a-day reference rate of the U.S. dollar price of ether.”

The new contract will be cash-settled, based on the CME CF Ether-Dollar Reference Rate, which serves as a once-a-day reference rate of the U.S. dollar price of ether.

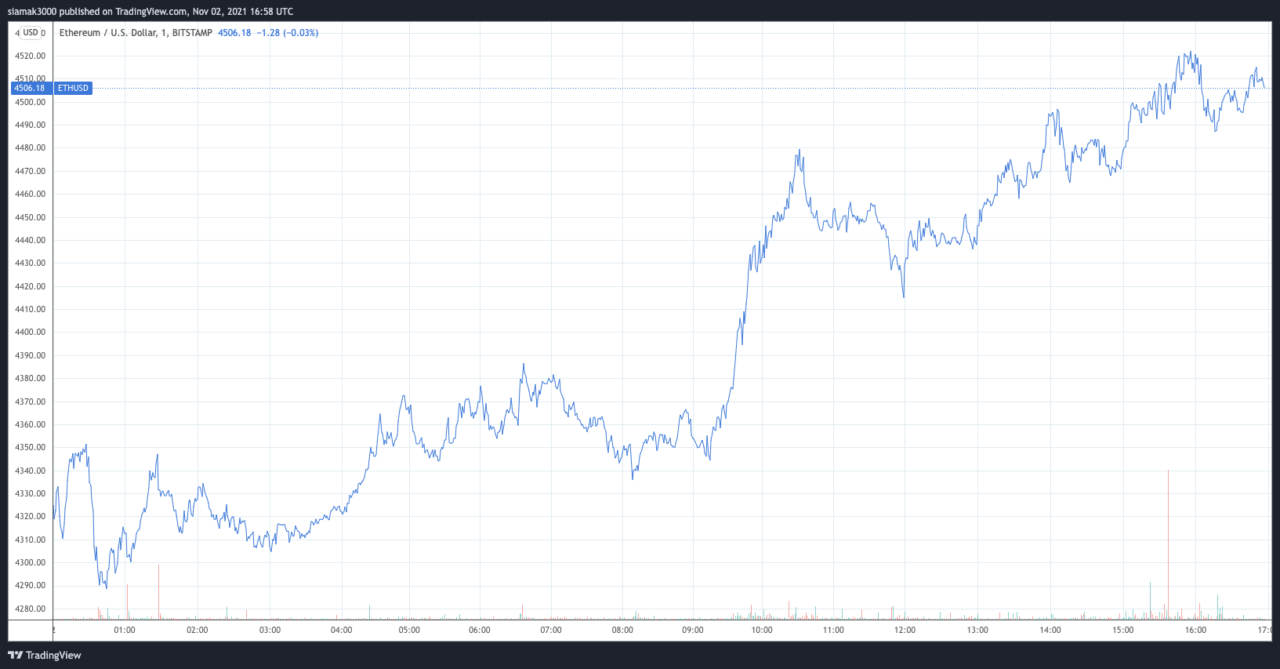

CME Group made the above announcement around 13:30 UTC today:

At that time, according to data by TradingView, on crypto exchange Bitstamp, Ethereum was trading around $4,466. Less than two and half hours later, the $ETH price had reached $4,522 to set another new all-time high.

Currently (as of 17:00 UTC on November 2), Ethereum is trading around $4,506, up 4.71% in the past 24-hour period.

As for the past three-month period, partly thanks to the popularity of Ethereum-based non-fungible tokens (NFTs) and Ethereum-powered altcoins such as Shiba Inu ($SHIB), partly due to the growing realization that post “The Merge” (when Ethereum’s blockchain moves to proof-of-stake consensus) $ETH should become even more of a deflationary asset than it is today, and partly due to additional interest from institutional investors, the $ETH price has gone up 70.55%. And if that is not impressive enough, it needs to be pointed out that just one year ago you could buy one $ETH for around $383.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.