This article provides an overview of smart contracts platform Avalanche ($AVAX) price action, news, and commentary by influencers, analysts, traders, and investors as of Sunday (September 12).

Below is a brief description of Avalanche from its developer documentation:

“Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. Avalanche is the first smart contracts platform that processes 4,500+ transactions/second and instantly confirms transactions. Ethereum developers can quickly build on Avalanche as Solidity works out-of-the-box.

“A key difference between Avalanche and other decentralized networks is the consensus protocol. Over time, people have come to a false understanding that blockchains have to be slow and not scalable. The Avalanche protocol employs a novel approach to consensus to achieve its strong safety guarantees, quick finality, and high-throughput, without compromising decentralization.

“AVAX is the native token of Avalanche. It’s a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche. 1 nAVAX is equal to 0.000000001 AVAX.“

Latest Price Action

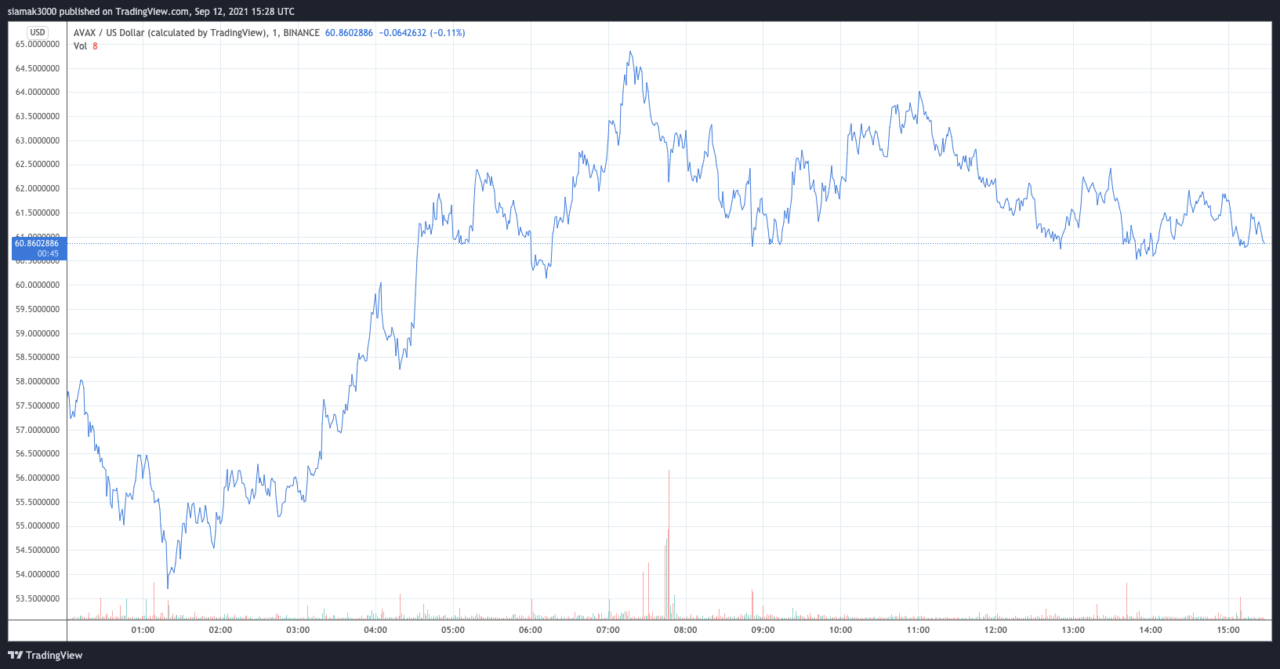

64.8487 at 07:17

According to data by TradingView, on crypto exchange Bitstamp, $AVAX managed to set a new all-time high of $64.8487 at 07:17 UTC (on September 12). Currently (as of 15:28 UTC on September 12), $AVAX is trading around $60.8602, up 18.93% in the past 24-hour period, which means that it is the highest percentage gainer among the top 20 cryptoassets by market cap.

As for the $AVAX’s return on investment (vs USD) in the past one-month and year-to-date periods speak for themselves: up 287% and up 1567% respectively.

The ‘Avalanche Rush’ DeFi Incentive Program

In case you are wondering why $AVAX has performed so well this past month, the biggest driver has been “Avalanche Rush”, a $180M liquidity mining incentive program announced by Avalanche Foundation on August 18.

The blog post explained that this program would bring two of the most popular DeFi projects to Avalanche:

“Avalanche Rush will bring Aave and Curve, two of the largest DeFi protocols by total value locked (TVL), to launch on Avalanche. Phase 1 of the Rush program will launch soon and provide the Avalanche native token, AVAX, as liquidity mining incentives for Aave and Curve users over a 3 month period. The Avalanche Foundation has allocated up to $20M AVAX for Aave users and $7M AVAX for Curve users, with additional allocations planned for Phase 2 in the coming months.“

This program follows in the footsteps of “Avalanche Bridge” (currently in beta), “a next-generation cross-chain bridging technology that transfers assets between blockchains.”

What Analysts Are Saying

On September 10, Jason Yanowitz, Co-Founder of Blockworks, explained what he has discovered so far as the result of his research on Avalanche.

On September 9, pseudonymous crypto analyst “Bluntz” told his over 163K Twitter followers that believes that it will be “fairly easy” for $AVAX to reach $100.

Another pseudonymous crypto analyst who also seems to believe that $AVAX could be headed to $100 is “KALEO”, who told his over 379K Twitter followers about this prediction on September 3.

Back in March, crypto analyst Lark Davis reviewed Avalanche– which went live on the mainnet on 21 September 2020 — in a video for his very popular YouTube channel.

Here are a few highlights from his comments about Avalanche:

“The specific use cases that Avalanche is developing to accommodate for include things like private securities, initial litigation offers… basically allowing investors to take a cut of lawsuits… There’s actually one going on right now for like a billion dollars using Avalanche. So, that’s a really interesting use case. As well as decentralized exchanges,… stable coins, prediction markets, equities, bonds, debt, real estate…

“So, largely we’re looking at something on the more traditional side of finance when it comes to it. In total, there are already over 1,800 tokenized assets on Avalanche, which I think is really incredible considering that Avalanche has only been operational for less than a year right now. So, that’s crazy. Avalanche also has partnerships in place with loads of hot cryptocurrency companies… So, in terms of having a functioning ecosystem, it’s actually way ahead of many of the 2017-2018 zombie chains… It’s also quite impressive that they have done so much in just a such a short amount of time.

“Now the Avalanche token, called AVAX, has a maximum supply of 720 million AVAX, of which half are currently locked into the network for staking… The AVAX token has a current staking ratio of around almost 84% of the entire network…

“So, overall, Avalanche is a very very interesting blockchain network. They’ve done an incredible amount of building in a very short amount of time, putting many other networks, whom you know have been around for a longer time, basically to shame with what they’ve already been able to deliver for their blockchain ecosystem.

“Their technical specifications [are] top-notch, very interesting, obviously team behind it makes this quite exceptional as well. The stake rewards are attractive. It’s no wonder we’ve seen so many people piling into Avalanche to get those stake rewards. Token burns make for interesting token velocity over time. My guess is that we’re going to hear a lot more about Avalanche moving forward.“

Upcoming Events

On September 10, Ava Labs founder and CEO Professor Emin Gün Sirer, who does computer science research at Cornell University, said that he will be giving an update on the current state of Avalanche at Messari’s Mainnet 2021 conference, which is being held September 20-22 in New York City.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured Image by “_anaposa_” via Pixabay.com