On Wednesday (August 11), American attorney John E. Deaton, the Managing Partner of the Deaton Law Firm, as well as the Founder of CryptoLaw, talked about the significance of the recent written communication between Senator Elizabeth Warren and Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC).

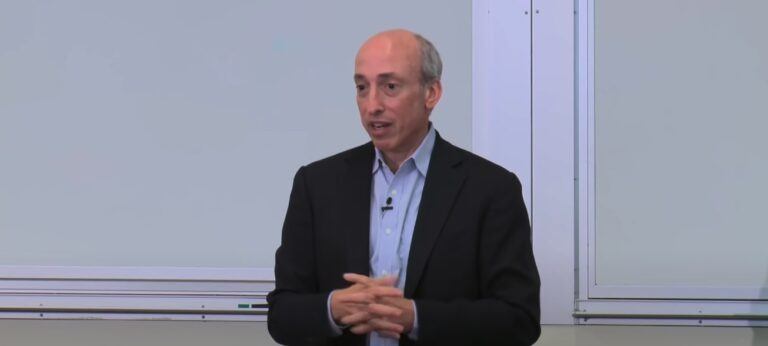

Gensler was nominated (on 3 February 2022) by President Joe Biden to Chair the SEC; this was confirmed by the U.S. Senate on April 14, and he was sworn into office three days later.

Before coming to the SEC, Gensler was the professor of the Practice of Global Economics and Management at the MIT Sloan School of Management. Gensler is also a former Chair of the U.S. Commodity Futures Trading Commission (CFTC).

American lawyer John Deaton said on Twitter yesterday that Gensler “intends to place his regulatory hands around the neck of crypto.” As evidence for this comment, he referred to the response letter that Gensler sent on August 5 to an information request letter that Senator Warren sent to Gensler on July 7.

In her letter to Gensler, Warren said that she was writing to request information regarding the SEC’s “authority to properly regulate cryptocurrency exchanges” and “to determine if Congress needs to act to ensure that the SEC has the proper authority to close existing gaps in regulation that leave investors and consumers vulnerable to dangers in this highly opaque and volatile market.”

In his reply to Warren, Gensler said that currently users of crypto trading and lending platforms “are not adequately protected.”

Gensler then went on to say:

- Many tokens (or cryptoassets) being offered on trading platforms “may be unregistered securities, without required disclosures or market oversight.”

- It is not difficult to determine what cyptoassets are securities. (He is presumably referring to the Howey Test.)

- Out of dozens of enforcement actions against crypto companies, the SEC has not lost even one case.

- Any product that “provides synthetic exposure to underlying securities” is “subject to the securities laws.”

This is how Gensler closed his letter to Warren:

“I believe we need additional authorities to prevent transactions, products, and platforms from falling between regulatory cracks. We also need more resources to protect investors in this growing and volatile sector.

“In my view, the legislative priority should center on crypto trading, lending, and DeFi platforms. Regulators would benefit from additional plenary authority to write rules for and attach guardrails to crypto trading and lending.

“We stand ready to work closely with Congress, the Administration, our fellow regulators, and our partners around the world to close some of these gaps.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.