As Solana ($SOL) seemingly prepares to break above the $80 level, its price action continues to impress both analysts and investors.

$SOL is the native token of the Solana blockchain. Solana is “an open source project implementing a new, high-performance, permissionless blockchain” that is maintained by the Geneva-based Solana Foundation.

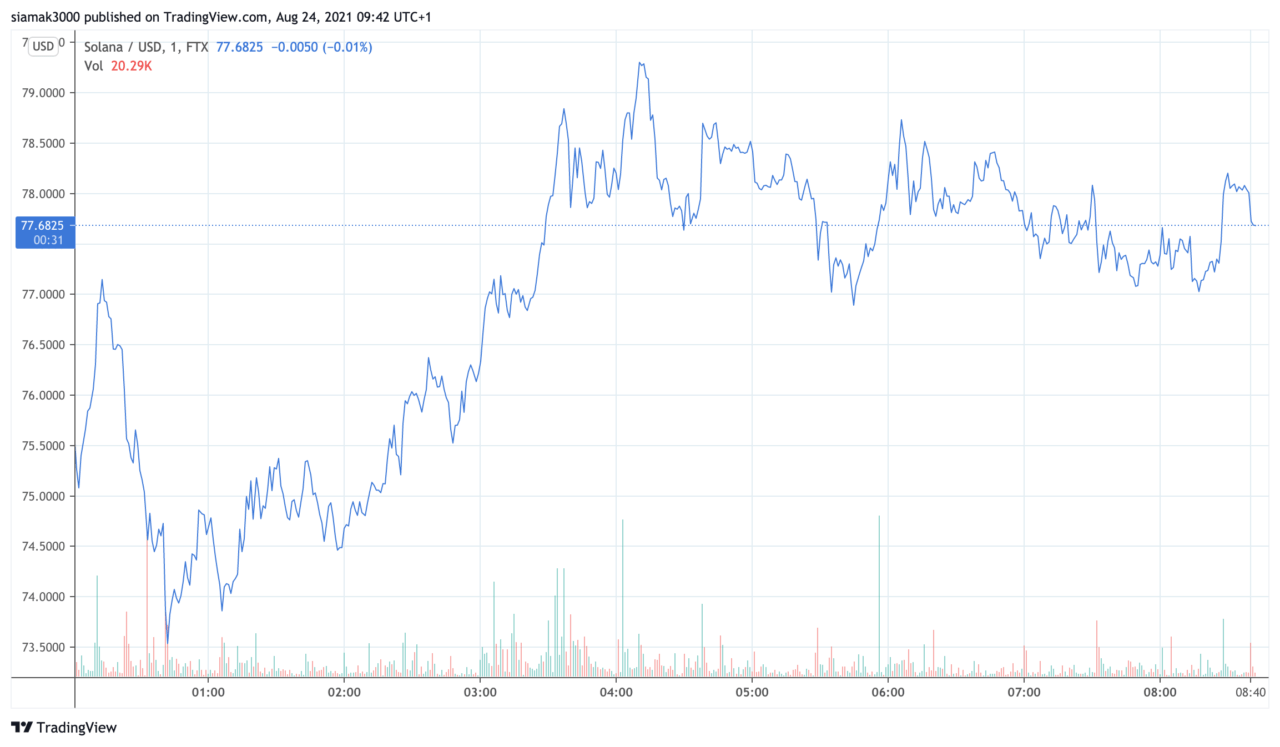

According to data by TradingView, on crypto exchange FTX, the $SOL price set yet another new all-time high at 04:10 UTC today (August 24), hitting $79.3025, which is less than 0.9% from the $80 level. Currently (as 08:50 UTC on August 24), SOL-USD is trading at $77.4625, up 2.90% in the past 24-hour period, which is pretty good considering that $BTC is down 0.71% today.

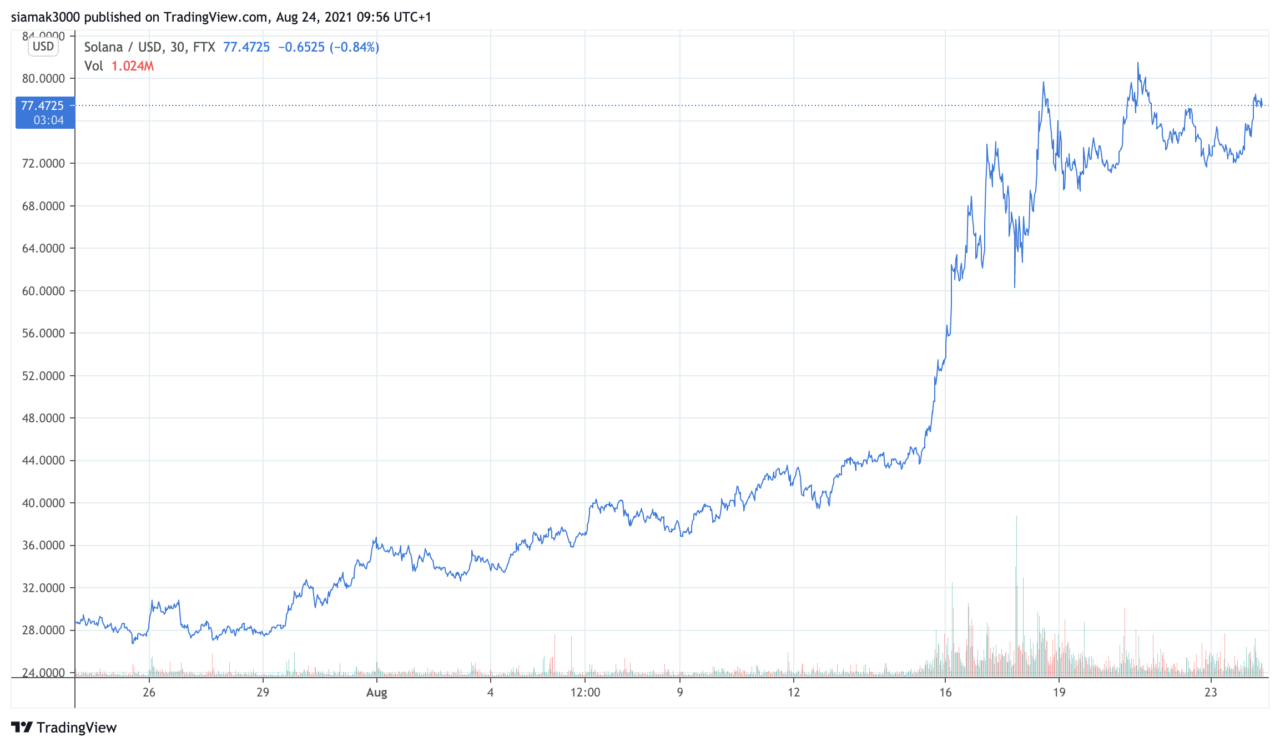

However, if you want to understand why almost everyone in the crypto community is in awe of how $SOL is performing these days, you really should take a look at the one-month SOL-USD and SOL-BTC charts.

As you can see from the above price chart, on FTX, in the past one-month period, $SOL has gone from $28.64 to $77.4625, which is an increase of 170.47%.

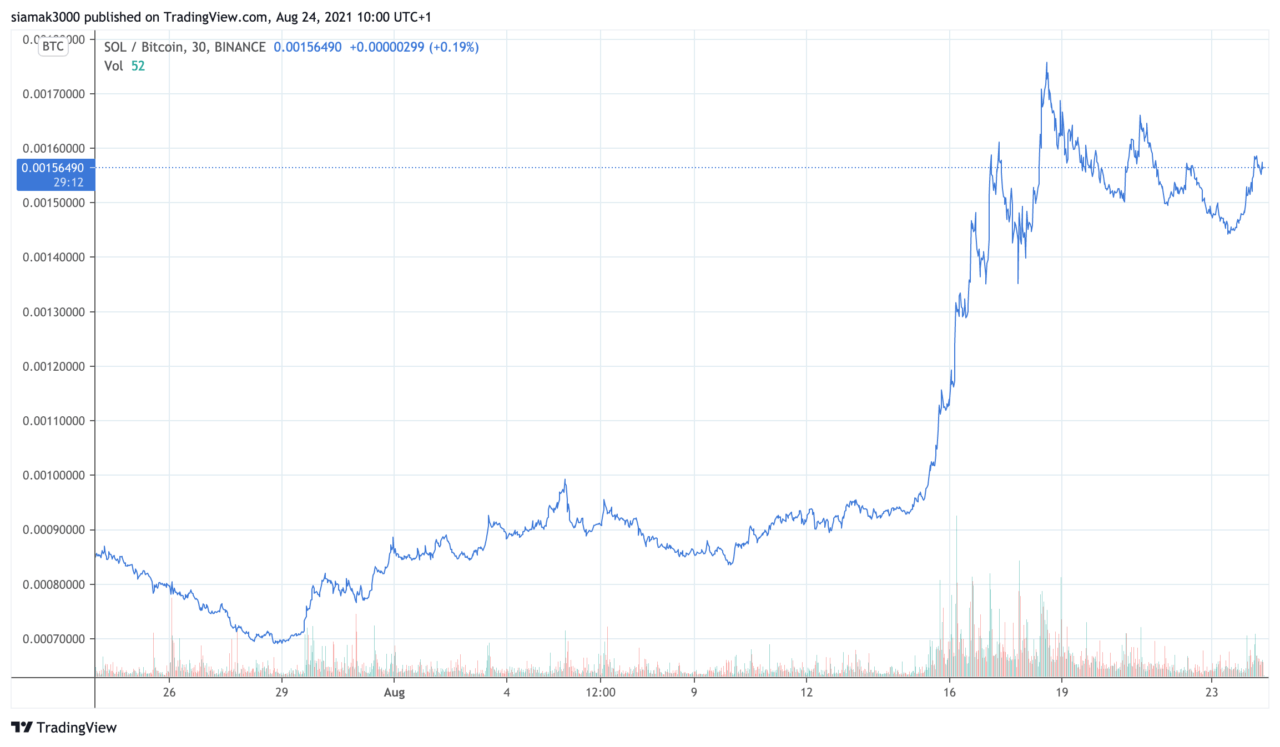

As for the SOL-BTC trading pair, on Binance, during the same one-month period, $SOL has gone 0.00084977 to 0.0015586, i.e. gained 83.41% vs $BTC.

On August 19, macro-economist and crypto analyst Alex Krueger, who is not one prone to exaggeration, said that $SOL’s fast and furious price action is making $BTC look like a stablecoin by comparison.

Another gushing market observer was pseudonymous crypto analyst “Altcoins Sherpa” who told his over 120K Twitter followers that this “speeding train” is headed toward $100 and that those who desperately want to short $SOL for some reason should wait at least until it gets to around $100.

And the next day, he suggested that he feels confident that $100 is coming.

Yesterday (August 23), another pseudonymous crypto analyst — “Altcoins Daily” — mentioned that the current non-fungible token (NFT) craze should not only drive the price of Ethereum ($ETH) to $10,000, but also help competing L1 blockchains, such as Solana, Cardano, Polkadot, Avalanche, and Binance Smart Chain.

Finally, it is worth mentioning that institutional investors appear to be also getting excited by Solana judging by digital asset investment firm CoinShares’ latest “Digital Asset Fund Flows Weekly” report (released yesterday), which said that Solana “saw the largest inflows of any digital asset last week totalling US$7.1m.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Image by mohamed Hassan from Pixabay