Shortly Cardano’s Alonzo Purple testnet went live, IOHK explained what achieving this milestone means and the CTO of blockchain company dcSpark explained how the Cardano ledger is being changed to support smart contracts.

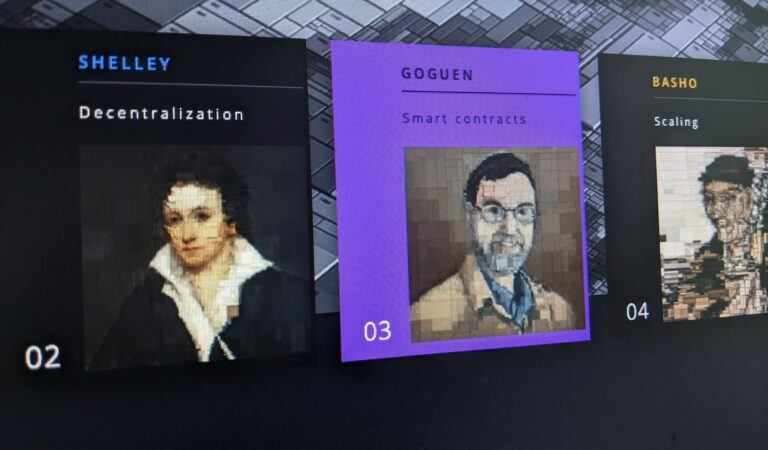

The “Alonzo” hard fork will “bring exciting and highly-anticipated new capabilities to Cardano through the integration of Plutus scripts onto the blockchain.” This will mean support for smart contracts in Cardano, thereby addressing a major criticism of Cardano and opening the door to a whole set of new and exciting decentralized finance (DeFi) apps.

The plan was for the Alonzo functionality to get tested in three phases: Blue, White, and Purple. On Friday (August 6), IOHK, the blockchain infrastructure research and engineering company founded by Charles Hoskinson and Jeremy Wood in 2015, announced that the Alonzo Purple testnet had gone live.

IOHK went on to say that Alonzo Purple will be the first fully public Cardano testnet to support smart contracts.

It also mentioned that:

- The 150+ members of the testing team have been invited to join the Alonzo Purple network.

- 300 graduates from the Plutus Pioneer Program have also been invited to try the Alonzo Purple network.

- IOHK, which has already been helping various exchanges integrate with Alonzo White, plans to talk to more exchanges so that as many crypto exchanges as possible are ready for the Alonzo hard fork combinator event (expected to take place in late August or early September), thereby ensuring that “their customers maintain uninterrupted deposit/withdrawal access to their $ADA and do not have to wait for this to be sorted out afterwards.”

Later that day, Sebastien Guillemot, the CTO of blockchain company dcSpark, published a blog post that summarized what he had said in a YouTube (released on June 24) about the 12 main changes that are being made to the Cardano ledger in order to make it support smart contracts.

Here are five of the most interesting changes that the Alonzo upgrade will deliver:

- Transaction validation has two phases: phase one “ensures Plutus contract execution will be deterministic” and phase two “executes the Plutus contract”. This means that unlike Ethereum smart contracts, Plutus smart contracts “should never fail with out of gas!”

- Transactions that call smart contracts “require collateral” — this needs to cover “at least the cost of contract execution in case contract execution fails (which should not happen thanks to determinism).”

- The “minimum $ADA value in UTXO entries” is being changed from “a constant 1 ADA to a protocol parameter to that it can be changed in the future.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.