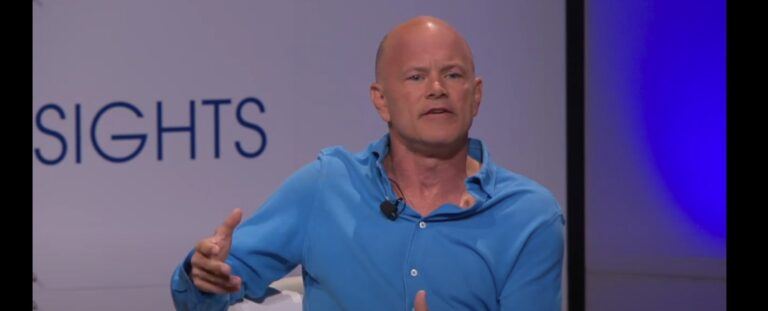

During an interview on Thursday (July 8), billionaire investor Mike Novogratz talked about the crypto space in general and Bitcoin in particular.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

Novogratz’s comments about Bitcoin were made during an interview with Joe Kernen on CNBC’s “Squawk Box” at a time when Bitcoin was trading around the $32,800 level.

On Bitcoin’s Recent Price Action

Novogratz seems to think that Bitcoin could be in consolidation mode for some time while the market is absorbing the impact of the recent FUD surrounding Bitcoin mining’s energy consumption and the crypto crackdown in China:

“We’re consolidating here between 30 and 35. What we’re seeing is Asia sells it off and then the U.S. buys it back. We’re seeing new money flowing to crypto funds, to venture funds, to hedge funds. And so there was lots of buying at the beginning of the month, and you saw altcoins — Ethereum a bunch of the other coins besides Bitcoin — have really good moves.

“And then, the Asians continue to sell, right? I mean, China’s declared war on crypto as part of this broader cold war that we’re getting into. And so, I think that we’re still digesting that.“

On Crypto Regulation

Novogratz believes that regulatory clarity will be good for the crypto space as a whole, but of course the U.S. Securities and Exchange Commission (SEC) cannot create its own crypto laws since that is something that only the U.S. Congress can do.

“When Gary finally addresses it will be good. Listen, he would love to regulate all the crypto. He doesn’t have the mandate, right? He needs Congress to give them the mandate, and it’s a pretty tight Congress. We’ll see what they end up doing.

“But I think even when even you have the mandate, once you have the rules, I think that would be relief for the market… Our politicians, as smart as they are, know very very little about crypto and, you know, shame on our industry. We need to do a better job educating them.“

As for a Bitcoin ETF getting approved by the SEC, he thinks that the current SEC Chairman — Gary Gensler — is more crypto friendly and that Gensler would like the SEC to approve crypto ETFs but as the new SEC Chairman he has quite a few more higher priority issues on his plate.

“I think it’s probably first quarter of next year. Just my intuition — it could be fourth quarter of this year, but it feels a little further along… You get a new job like Gensler — there’s a whole lot on your plate and how do you prioritize things? I’m guessing a Bitcoin ETF wasn’t at the top of his list.

“I know they’re working on it — there are 13 or 14 applications. They’ve got to get to it. I do know Gary wants to be smart and be seen as be smart and so he will get to this stuff, whereas… Chairman Clayton just didn’t want to deal with crypto.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.