On Tuesday (July 13), Michael J. Saylor, Co-Founder, Chairman, and CEO of Nasdaq-listed business intelligence company MicroStrategy Inc. (NASDAQ: MSTR), explained why he doesn’t believe that Bitcoin should be treated like a currency.

On 11 August 2020, MicroStrategy announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Michael J. Saylor, Co-Founder, Chairman, and Chief Executive Officer of MicroStrategy, said at the time:

“Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively.”

Since then, MicroStrategy has continued buying Bitcoin and not sold any of the Bitcoin it has bought since it started HODLing last summer.

Saylor’s latest comments about Bitcoin came during an interview with crypto analyst and trader Scott Melker (aka “The Wolf of All Streets”).

According to a report by The Daily Hodl, although Saylor is a huge believer in and advocate for Bitcoin, he thinks that it makes more sense to treat Bitcoin as property such as gold, real estate, or stocks rather than as a currency:

“I don’t really think that Bitcoin’s going to be currency in the US ever. Nor do I think it should be. I really think logically it should be treated as property. It’s like owning a building, or owning a bar of gold, or owning a share of stock. It’s property.

“And what it’s doing is it’s demonetizing other forms of property. If you have a million dollars and you have to choose whether you buy collectibles or a house or a second house or an ETF or a share of Apple stock, or start a business, or buy art, or buy a bar of gold, or buy Bitcoin. That’s the fungible decision you have to make.“

Saylor, who is a Bitcoin maximalist, also said that just like with tech stocks, it only makes sense to buy and hold category leaders such as Apple, Google, and Facebook, with cryptoassets, the obvious “category killer” is Bitcoin:

“If you buy and hold, that’s good, and at any point in the history of technology, if you had sold, you made a mistake, right? With the one caveat, you have to buy the winner. You have to buy the category killer. You have to buy Facebook, Google, Amazon, Apple, Microsoft.

“So the question is – how long do you gotta watch them win before you decide they’re the winner? I think 30 years is a bit late. If you gotta wait 30 years before you pick the winner, you probably won’t get outsized returns. But you could’ve watched them win for 10 years and bought them and still made a lot of money.“

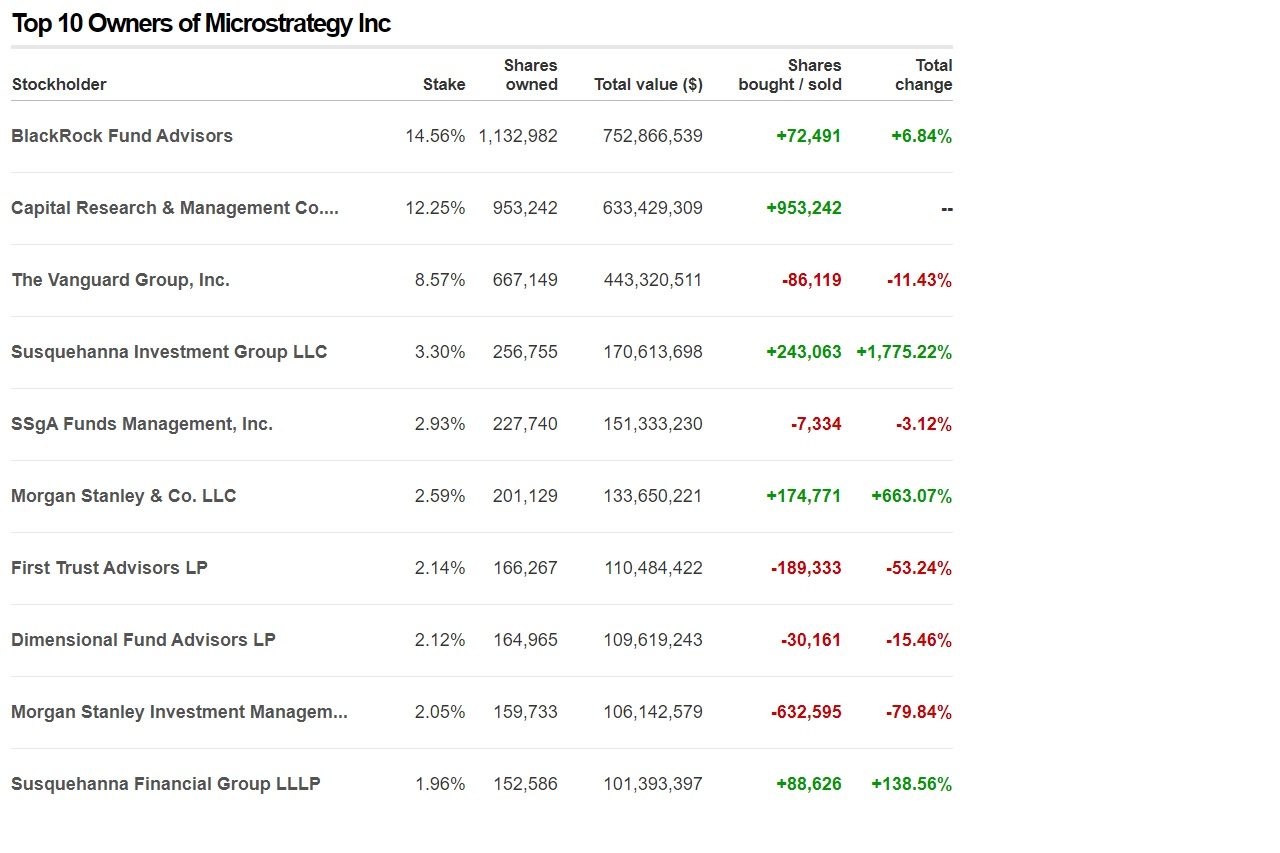

On July 12, Bloomberg reported that Capital Group, “one of the largest and most experienced investment management companies in the world,” had acquired a 12.2% stake in MicroStrategy by purchasing 953,242 shares of the estimated 7,782,658 outstanding MicroStrategy common stock (class A) before 30 June 2021, according to a filing with the U.S. Securities and Exchange Commission (SEC) on July 9.

According to CNN Business, here are the top institutional holders of MSTR (as you can see, Capital Group is #2 in this list):

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.