Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice. Tax rules can change and the value of any benefits depends on individual circumstances.

Bitcoin once again became the talk of the town. Only this time, it is not its impressive bull run that drew people’s attention, but its recent crash.

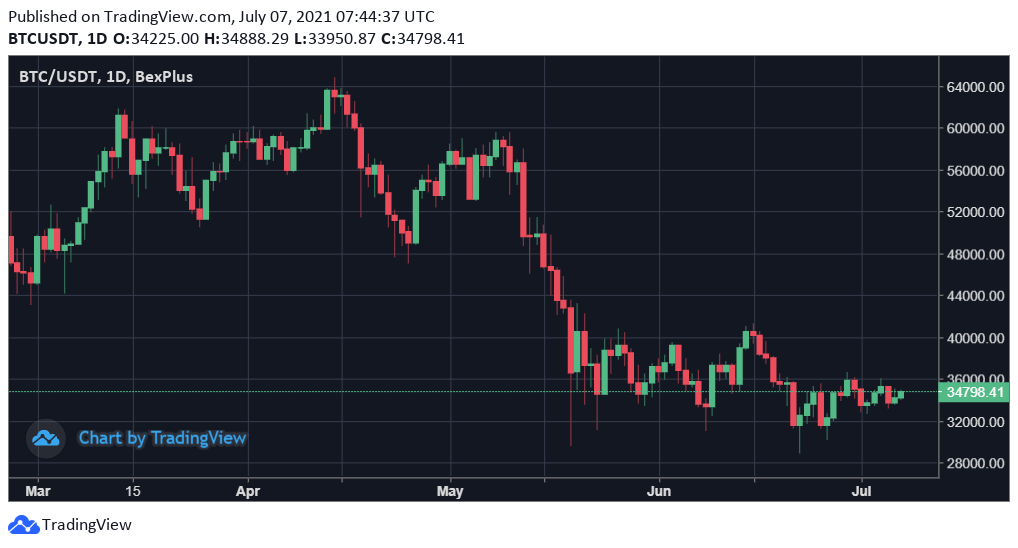

Bitcoin has lost almost 50% of its value since it hit an all-time high of $64,000, falling back to $34,000. Most altcoins have fallen by two-thirds or more. The cryptocurrency market is undoubtedly being shaken, but opportunities are arising. Just imagine how much you could make if you short crypto when it’s overvalued.

Although bitcoin is a very volatile asset, its high volatility means that traders can multiply their funds in a couple of months or even weeks and lose everything in the same amount of time. If you are looking for ways to enter the crypto world, ask yourself these questions before putting your money in Bitcoin.

Do you have a diversified portfolio?

It’s crucial to have clear investing strategies when you are dealing with an asset as volatile as Bitcoin. Always divide your investments into two parts: one is what you can afford to lose and one is what you can’t.

There are numerous ways of investing in Bitcoin. The most popular ones are futures trading and hodling. In futures trading, traders can earn Bitcoin by speculating on the cryptocurrency’s future price directions using leverage from exchanges.

For instance, with 100x leverage, a trader can open a position worth 10 BTC with just 0.1 BTC. When the price goes up 1%, the trader can earn 0.1 BTC. When the market trend is strong, futures trading is one way to earn Bitcoin quickly and easily.

Traders can also get easily liquidated when the trend reverses. Only invest what you can afford to lose when dealing with futures contracts. HODLing is much safer and you can earn interest on your holdings while incurring a much smaller risk.

Can you devote time and energy to learn to trade?

This question will set those who want to earn because they’re lucky and those who want to make a name for themselves in the trading world apart.

There’s a learning curve to learn something new. For Bitcoin futures trading, it takes about10 minutes to understand the mechanism, but it can take a a lot longer to build your principles and strategies before you can make it trading in the real world.

It’s common for beginners to get lost in a variety of new concepts, and learning the ins and outs of an exchange and its trading engine could be difficult. So if you are new to crypto trading, it is recommended that you practice first in a trading simulator. Don’t hesitate to consult help centers when you trade on exchanges.

Are you able to control your emotions while trading?

Losing a trade will stick with you for a while, and every successful trader has a long list of losses they wish they did not have. Those who feel angry and confused end up missing out on potential trading opportunities because they can’t move on fast enough.

Practice makes perfect, and keeping track of your strategy and using stop-loss orders can help. A smartphone can also be used to monitor your trades on the go. Take the Bexplus app as an example, its 24/7 notification helps you better manage positions during huge price swings.

Bexplus is a recommended leverage trading platform that doesn’t require any KYC. Bexplus provides a demo account with 10 BTC for traders to get familiar with leverage trading. Bexplus provides users with a 100% bonus on every deposit, an affiliate program with up to 50% commission reward, and 24/7 customer support.

The application is available on Apple App Store and Google Play.

Featured image via Pixabay.