This article takes a closer look at recent reports coming out of China about potential upcoming regulations that could result in a a partial or total ban on Bitcoin mining in that country.

Tuesday’s Announcement by Three Chinese Self-Regulatory Organizations

Last Tuesday (May 18), Shanghai Securities News (SSN), “China’s leading financial newspaper and the China Securities Regulatory Commission’s government designated channel for disclosure of Chinese-listed companies”, reported that three Chinese self-regulatory organisations — the National Internet Finance Association of China (NIFA), the China Banking Association (CBA), and the Payment & Clearing Association of China (PCAC) — had announced that “the price of virtual currency has soared and plummeted, and virtual currency trading speculation has rebounded, which has seriously violated the safety of the people’s property and disrupted the normal economic and financial order.”

SSN’s report went on to say that “in order to further implement the requirements of the ‘Notice on Preventing Bitcoin Risks‘ and ‘Announcement on Preventing Token Issuance Financing Risks’ issued by the People’s Bank of China and other departments, to prevent the risks of virtual currency transaction speculation,” member organizations “must earnestly strengthen their social responsibilities.” Below is a list of those responsibilities:

“They must not use virtual currency to price products and services, underwrite insurance businesses related to virtual currencies or include virtual currencies in the scope of insurance liability, and must not directly or indirectly provide customers with other services. Services related to virtual currency, including but not limited to: providing customers with virtual currency registration, trading, clearing, settlement and other services; accepting virtual currency or using virtual currency as a payment and settlement tool; developing virtual currency exchange services with RMB and foreign currencies; Develop virtual currency storage, custody, mortgage, etc.; issue financial products related to virtual currency; use virtual currency as investment targets for trusts, funds, etc.

“Financial institutions, payment institutions and other member units should effectively strengthen the monitoring of virtual currency transaction funds, rely on industry self-discipline mechanisms, strengthen risk information sharing, and improve the level of industry risk joint prevention and control; if clues of violations of laws and regulations are found, they must promptly adopt restrictions, suspensions or procedures in accordance with procedures. Terminate relevant transactions, services, and other measures, and report to relevant departments; at the same time, actively use multi-channel and diversified access methods to strengthen customer publicity and warning education, and take the initiative to make warnings about risks related to virtual currencies.

“Internet platform enterprise member units shall not provide services such as online business premises, commercial display, marketing promotion, paid diversion, etc. for virtual currency-related business activities. If clues of related problems are found, they shall promptly report to relevant departments and provide technical support for related investigations and investigations. And assistance.“

Friday’s Meeting of the Financial Stability Development Committee of China’s State Council

Last Friday (May 21), the Financial Stability and Development Committee (FSDC), which is a financial regulatory body under the State Council of the People’s Republic of China (PRC), held a meeting chaired by Vice-Premier Liu He. The State Council is the chief administrative authority of the PRC. Currently, it has 35 members: “the premier, one executive vice premier, three other vice premiers, five state councillors (of whom three are also ministers and one is also the secretary-general), and 26 in charge of the Council’s constituent departments.”

The next day, South China Morning Post (SCMP) reported that according to a statement b the FSDC, the Chinese government will “crack down on bitcoin mining and trading behaviour, and resolutely prevent the transfer of individual risks to the society.”

According to SCMP’s report, this statement “stopped short of an outright ban on cryptocurrency mining” and “did not elaborate on the measures involved or scale of this crackdown.”

Li Yi, chief research fellow at the Shanghai Academy of Social Sciences, told SCMP:

“The wording of the statement did not leave much leeway for cryptocurrency mining… We should expect the relevant departments, including law enforcement, to come up with detailed measures to ban bitcoin mining in the near future.“

The SCMP’s report also mentioned that “various local and regional governments in China have already been cracking down on cryptocurrency mining facilities.” One example is Inner Mongolia, which started suspending cryptocurrency mining operations in March. As SCMP reported on May 20, earlier this week, Inner Mongolia called for “more comprehensive reporting of cryptocurrency mining, signalling a strong determination to weed out power-consuming activities in the region.”

It is worth pointing out that on 12 December 2020, Chinese President Xi Jinping said during his address to the Climate Ambition Summit 2020:

“China has made important contributions to adopting the Paris Agreement and has made active efforts toward implementing it. I announced in September that China would scale up its nationally determined contributions and adopt more vigorous policies and measures. We aim to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060.

“Today, I wish to announce some further commitments for 2030: China will lower its carbon dioxide emissions per unit of GDP by over 65 percent from the 2005 level, increase the share of non-fossil fuels in primary energy consumption to around 25 percent, increase the forest stock volume by 6 billion cubic meters from the 2005 level, and bring its total installed capacity of wind and solar power to over 1.2 billion kilowatts.“

Reactions From the Crypto Community

Dovey Wan, a Founding Partner at crypto investment firm Primitive Ventures, had this to say shortly after the statement from the FSDC was released:

She went on to say:

She also tweeted on May 21 that discounts on Tether (USDT/CNY) suggested that “Chinese investors are exiting the market, selling tether into RMB to avoid collateral damages.”

Wan also says that Chinese Bitcoin miners are preparing to relocate their rigs to Africa and other adjacent countries in Central Asia, which she believes will mean that in a few months the total Bitcoin hash rate based in China will drop from around 70% to somewhere in the 20-30% range (even though Chinese entities will still be controlling over 50% of the hash rate).

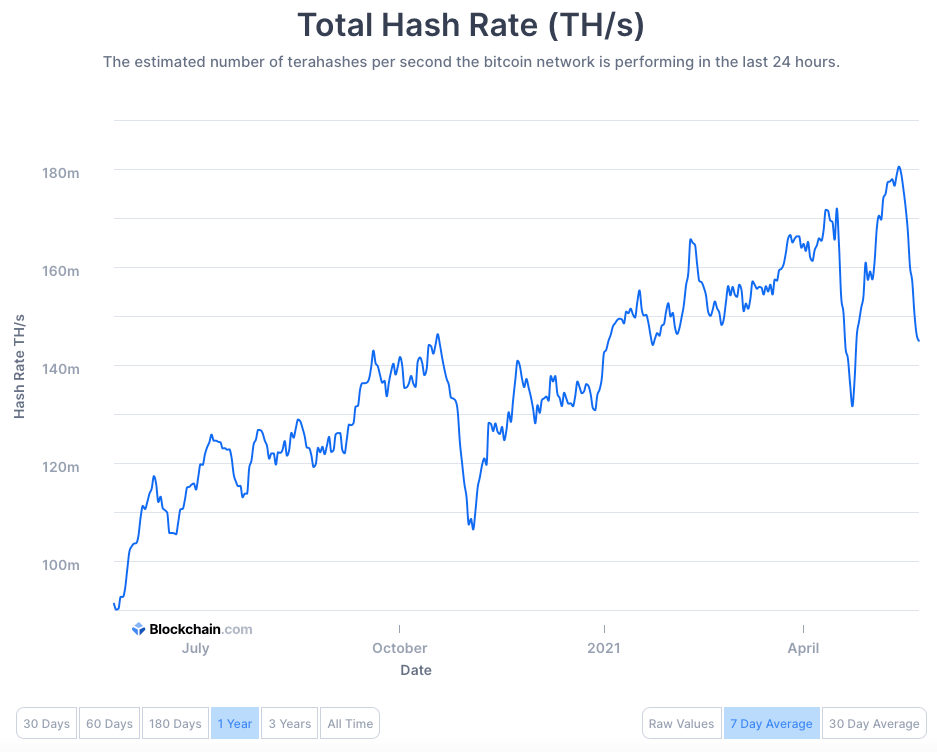

As you can see in the chart below, Bitcoin’s 7-day average total hash rate (TH/s) has been falling since May 14, when it hit 180.66 EH/s. Wan expects this to drop further “as enforcement is gradually deployed” in China.

Yesterday (May 23), Nic Carter, a Partner at Castle Island Ventures and a co-founder of Coin Metrics, said that he was seeing on-chain evidence of selling by Bitcoin miners (presumably in China) and also mentioned that “buying from forced or panicked sellers, sellers in unusual circumstances, or sellers in the midst of a capitulation is usually a good idea.”

Carter talked in detail in a video released on his YouTube channel why he is even more bullish than usual on Bitcoin now that it seems the Chinese government seems intent on shutting down Bitcoin miners (at least all of those using electricity from coal power plants).

Also, yesterday, Mustafa Yilham, VP of Global Business Development at Bixin, took to Twitter to offer his take on China’s crackdown on Bitcoin mining:

- “In past 48 hours, Chinese miners already started to accelerate migrating process to other countries. There will also be large quantities of Bitcoin mining machines available for sales.“

- “Were miners selling Bitcoin? Some already panic sold, others had no choice. Not everyone have access to western hosting sites. There are also added level of uncertainty on current RMB OTC trading channels. Need fiat to cover operational costs at end of the day.“

- “Under this current crisis, there will be a massive opportunity – redistribution of entire Bitcoin mining network around the globe. We need to make sure: majority of the mining machines are not going to single country. This is best time to work on further decentralization.“

- “We also need to work together and ensure this new wave of mining operators outside of China are using renewable energy as much as possible.“

- “We have already began doing this work with our friends & partners around the globe. It’s going to be painful short term as we see price & hashrate effected, but we will come out stronger than ever.“

Early Reactions From Mining Pool Operators

Earlier today, Jiang Zhuoer, the CEO of major BTC mining pool BTC.Top, shared his thoughts about the impact of China’s policy on the Bitcoin mining industry:

Here are some of the main highlights:

- “Large datacenter and major veteran miners may suffer a significant loss this time, while the whole Bitcoin network will be as resilient as always…“

- “Small miners install several miners at home; Medium miners set dozens of miners in a warehouse or a few hundred miners in a factory; Veteran miners find a small remote hydroelectric power plant and locate there a couple thousand miners.“

- “Although home miners pay higher electricity costs, the whole industry becomes less efficient , the number of running machines will decline, making the output per unit rise and counterbalancing the impact of rising power costs.“

- “But in the long run, if China takes regulatory actions against crypto mining, then major Chinese manufactures #bitmain will probably sell most of their machines abroad: Selling domestic = violation of regulation Selling aboard = earn foreign currency“

- “In the end, Chinese hashpower will flow abroad just like the Exchanges did in 2017, China will play a less significant role in the global hashpower distribution.“

- “During the process, there will not be obvious changes in the entire Bitcoin network, except that European and North American mining pools will rank higher than the Chinese pools.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Photo by “enriquelopezgarre” via Pixabay