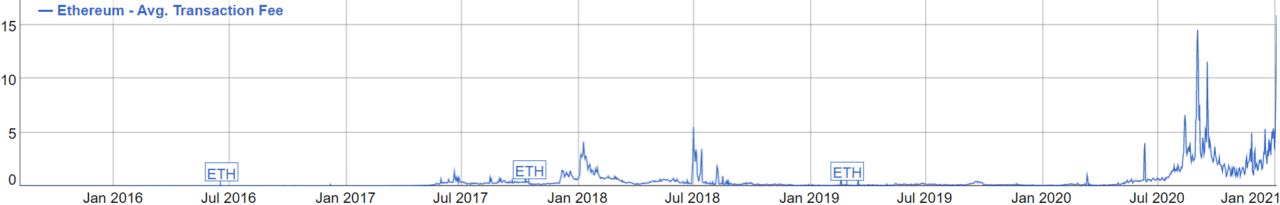

Transaction fees on the Ethereum network have surged since the start of 2020, as demand for blockspace grew along with the decentralized finance (DeFi) space, as more users started interacting with protocols built on top of Ethereum.

Data from BitInfoCharts shows that in January 2020, the average transaction fee on the Ethereum blockchain was less than $0.08. By September, the fees had skyrocketed to $14.5 as DeFi projects like Maker, Uniswap, Aave, and others kept on adding new users.

Similarly, data from DeFiPulse shows that at the start of 2020 there were about $650 million locked in the DeFi space. The figure went up to $8 billion by September, and now stands at $18.35 billion with Aave, Maker, Uniswap, Compound, Synthetix, and SushiSwap having over $1 billion locked in them.

While transaction fees dropped after September’s surge, they have recently climbed back up as demand for ether itself skyrocketed. The cryptocurrency’s price moved up steadily to surpass $1,150 this year, for the first time since January 2018.

Demand for the cryptocurrency rose so much the average transaction fee, as of January 4, is at $15.9. It’s worth noting here that simple transactions on Ethereum are cheaper than transactions interacting with smart contracts, which DeFi projects use.

This has seen some users point out that using DeFi platform like Uniswap became extremely expensive.

Moving onto other blockchains hasn’t been the solution for DeFi users, as most projects are built on top of Ethereum. TheBlock’s Larry Cermak, whose tweet is featured above, responded to Justin Sun’s proposition o trying out TRON’s version of Uniswap with a “no thanks,” as the projects he uses are on Ethereum.

Ethereum’s scaling solutions do not appear to be of much help, at least in the near future.

Ethereum 2.0 and Other Scaling Solutions

Most are confident that Ethereum 2.0 will help the second-largest cryptocurrency network by market capitation scale to handle a higher number of transactions per second and effectively reduce transaction fees.

Ethereum 2.0’s staking contract was launched late last year, and over 2 million ETH are staked on it. The contract launched the Beacon Chain, the first stage in the ETH 2.0 development roadmap. It’s a Proof-of-Stake (PoS) blockchain, and it signals the first step in the plan to change Ethereum’s consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake. It runs alongside the original Ethereum PoW chain, making sure that there is no break in the continuity of the chains.

Phase 1, which is expected to launch this year, will “address finality and consensus on shard chains”, and it will be “more of a ‘test run’ for shard chains than the release of an immediately-scalable solution.”

Ethereum 2.0 is, as such, not expect to help the network process thousands of transactions per second just yet. There are, however, solutions that are now available but are not being used, according to Ethereum co-founder Vitalik Buterin.

Speaking at the opening keynote of CoinDesk’s invest: Ethereum economy conference, Buterin said layer-two scaling solutions such as “rollups,” which essentially keep transaction data on-chain and push computational tasks off the chain, are now available and should be used.

He said:

If you’re listening to this and you are an exchange or you are a wallet or you are a mining pool or you are a major user – even just a regular – then you should be aware of what rollups are and what they do.

Per Buterin, using solutions such as “optimistic rollup solutions” and ZK rollups, which use zero-knowledge-proof technology, could see the Ethereum blockchain move from 15 transactions per second to between 1,000 and 4,000 right away.

These features are more for power users, however, as for most figuring out how to scroll Web 3.0 and move funds in and out of a crypto wallet is hard enough.

Ethereum Virtual Machine Compatibility

Another solution that could help users circumvent Ethereum’s large transaction fees are high-performance blockchains compatible with the Ethereum Virtual Machine (EVM). This compatibility essentially means DeFi projects would not need to write more code to add their projects to another blockchain.

Solutions like Optimism allow ETH smart contracts to be converted to the Optimistic Virtual Machine (OVM) and deployed onto its mainnet. Crypto exchange OKEx, for example, recently launched its OKExChain mainnet, a “high-performance trading chain” compatible with the Ethereum Virtual Machine.

According to OKEx’s page:

OKExChain will support the Ethereum Virtual Machine, including Ethereum developer tools. Once OKExChain supports EVM, developers can use the development tools and languages of Ethereum to develop smart contracts on OKExChain.

OKExChain was reportedly under development for “just under three years” and went through three major phases before launch. It’s an open-source, trading-focused blockchain. Its native OKExChain Token (OKT) gives holders benefits which include staking privileges and voting rights. OKT holders will also be able to become validators to earn block rewards and transaction fees.

Featured image via Pixabay.