Bitcoin is currently trading at about 2.69 million Argentinean Pesos (ARS) on exchanges supporting BTC/ARS trading pairs. This means the flagship cryptocurrency is trading at about $32,700 on these platforms, far above the cryptocurrency’s current rate of $17,650 across global exchanges.

The flagship cryptocurrency’s price grew steadily against the Argentinean Peso this year as the country is dealing with an inflation rate of 35% and people suffer through the COVID-19 crisis and currency controls.

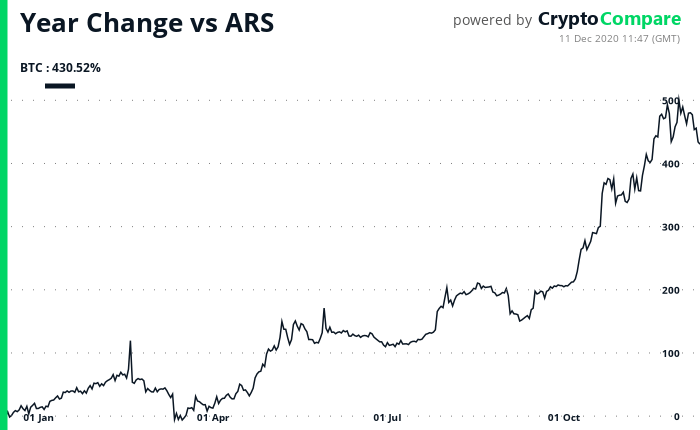

CryptoCompare data shows that while the price of BTC is up 145% against the U.S. dollar so far this year, it’s up over 430% against the ARS.

The price, its worth noting, is based on the so-called blue dollar that circulates in Argentina, and not on the other dollar rates one may find in the country. The blue dollar is said to be governed only by supply and demand in the country.

The cryptocurrency’s premium against the ARS is based on the fiat currency’s plunging value. Experts’ forecasts regarding the Argentinean Peso are bleak. Reports suggest, however, that the gap between the official and market-based dollar exchange rates in the country have narrowed over the government’s adoption of “more orthodox measures to boost exports.”

According to Bloomberg, Argentina’s Senate approved late Friday a proposed one-time wealth tax looking to boost the government’s revenue by targeting millionaires with assets of over 200 million pesos ($2.4 million).

The tax will be between 1% and 3% of their wealth and is looking to boost revenue after strict lockdowns imposed by authorities to fight the COVID-10 pandemic saw government revenue plunge. Senator Carlos Caserio, a member of the committee responsible for the bill, was quoted as saying:

This is a unique, one-time contribution,” said Senator Carlos Caserio, a member of the committee responsible for the bill, according to a statement on the Senate’s website. “We’re coming out of this pandemic like countries come out of world wars, with thousands of dead and devastated economies.

The Director of the Central Bank of Argentina (BCRA) on fiat currency, Carlos Hourbeigt, has reportedly pushed for the use of a national payments network that would replace the use of ARS in cash, called “Tranferencias 3.0,” and would be monitored by the country’s central bank.

The move has faced a backlash from cryptocurrency advocates in the country who believe regulators want to further control the population through Transferencias 3.0. Camilo Jorajuría, a legal consultant in Argentina, tweeted out “only bitcoin fixes this.”

Local crypto news outlets have been questioning whether the move is a “war against privacy,” as presentations on Transferencias 3.0 claim that “the common enemy is cash.”

Featured image via Unsplash.