Everyone was waiting for the Bitcoin price to blow past $20,000 on all crypto changes in order to establish an undisputed new all-time high (ATH) price. Well, today, Bitcoin finally did it — and in style!

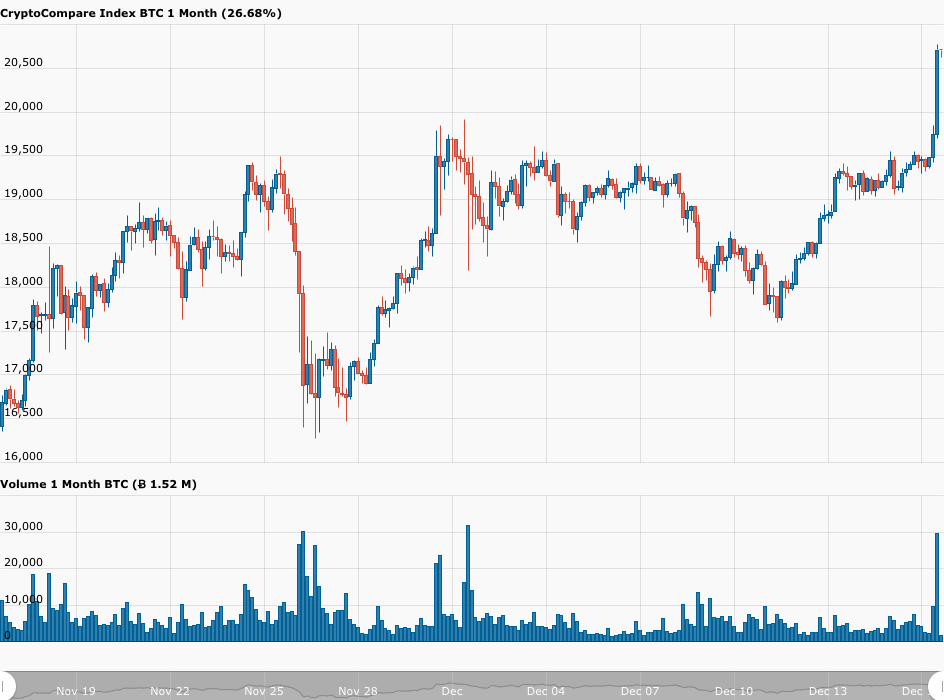

On November 30, on several crypto exchanges, the Bitcoin price did get tantalisingly close to the psychologically important $20,000 level (and it may have even just barely surpassed it on a couple of exchanges) . However, the consensus in the crypto community back seemed to be that it is not a new ATH until the Bitcoin price easily breaks this level at all centralized crypto exchanges.

This sentiment was perhaps best expressed by Sam Bankman-Fried, the CEO of crypto derivatives exchange FTX, who said:

Since then, Bitcoin had — until today — been mostly trading sideways in the range $18,000 to $19,000.

On December 8, Tyler Winklevoss, co-founder and CEO of digital asset exchange Gemini, said that Bitcoin seemed like a “tiger ready to pounce.”

And just yesterday (December 15), popular crypto analyst and trader Alex Krüger made the following prediction:

Although many crypto influencers had predicted that the Bitcoin would reach reach or surpass $20,000 before the end of this year, the ferocity of Bitcoin price’s surge past the $20K level still managed to surprise more than a few people.

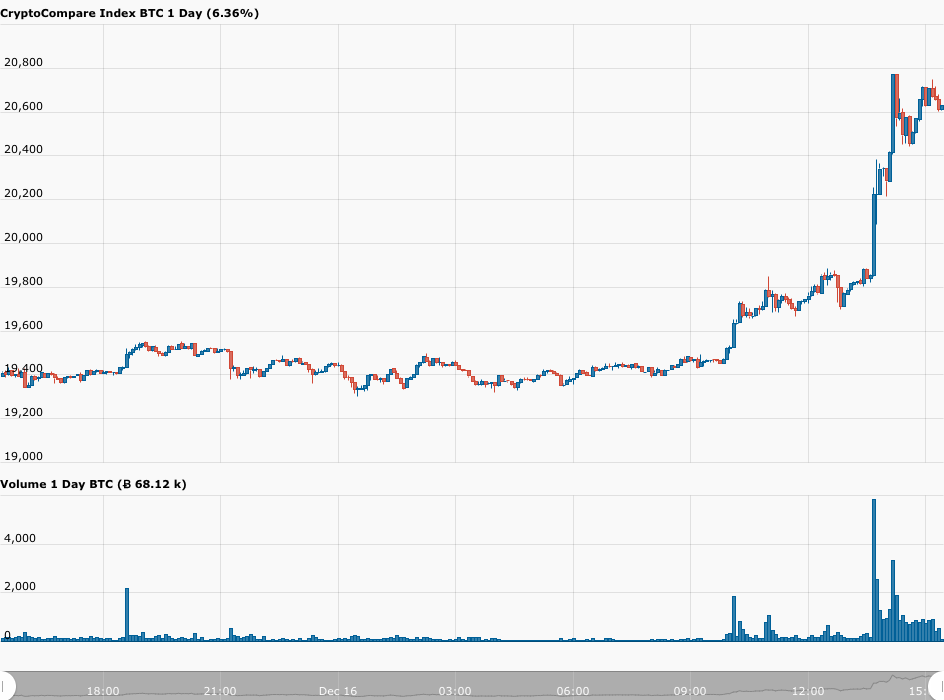

According to data from CryptoCompare, on Wednesday (December 16), between 13:35 UTC and 13:40 UTC, the Bitcoin price broke the $20,000 level, going as high as $20,257. Just 30 minutes later, the Bitcoin price reached $20,771, the highest price it has ever been.

Charles Hayter, Co-Founder and CEO of leading cryptoasset market data provider CryptoCompare, had this to say about the catalysts behind this year’s Bitcoin bull run:

“The corporate investments in Bitcoin from the likes of Square, MicroStrategy, and more recently MassMutual and Ruffer, have caught the attention of the investing world. This growing demand is simply outstripping Bitcoin’s low and fixed supply. I expect more corporations to follow suit in 2021.

“With the macroeconomic backdrop of unprecedented monetary expansion and negative real interest rates spurred on by COVID-19, it is no wonder that investors of all types are looking at hard assets like Bitcoin as an alternative to gold. Unlike the retail-driven bull run in 2017, institutional investors can allocate capital effectively and with considerably lower risk as the markets are more mature, efficient and regulated.”

The CryptoCompare CEO told CNBC a short time ago:

“This is the domino effect as asset managers tumble their portfolios into bitcoin.”

Andy Byrant, Co-Head of European Business / Chief Operating Officer (COO) at crypto exchange bitFlyer, noted that the news about Bitcoin going over $20K today had even edged out a story about a potential upcoming Brexit deal on the CNBC home page:

While Bitcoin is trading at a new all-time high, high several companies still offer small amounts to users so they can test the flagship cryptocurrency before diving in. Cryptocurrency exchange OKEx, for example, rewards users with small amounts of BTC for learning about crypto and its own platform.

Offering free BTC has long been a way for the cryptocurrency space to attract new users, through so-called faucets. Some of the early faucets were created when bitcoin was essentially worthless, and rewarded users with up to 5 BTC per claim. That amount is nowadays worth over $100,000.

Of course, faucets offering large amounts disappeared as the price of BTC went up. A better way to earn free bitcoin would now be to take advantage of savings programs offered by crypto exchanges like OKEx, or via blockchain startups, such as BlockFi, that help users earn interest in BTC on their Bitcoin holdings.

As for what is the most likely reason for today’s highly impressive price action, as CryptoGlobe reported earlier today, one reason is renewed optimism over the next COVID-19 relief package (which will cost around $900 billion) getting passed by the U.S. Congress this week following recent constructive talks between the White House (as represented by U.S. Treasury Secretary Steven Mnuchin) and congressional leaders.

According to a report by NBC News, following a meeting on Tuesday with House Speaker Nancy Pelosi, Senate Majority Leader Mitch McConnell, Senate Minority Leader Chuck Schumer, and House Minority Leader Kevin McCarthy, Senate Majority Leader Mitch McConnell had this to say:

“We’re making significant progress and I’m optimistic that we’re gonna be able to complete an understanding sometime soon.”

NBC’s report says that the “lawmakers are trying to hammer out an agreement by Friday, when Congress hits the deadline to pass legislation to keep the government funded.”

And the second (and perhaps more important) reason is asset manager Ruffer Investment confirming to Coindesk today that they had around a $742 million exposure to Bitcoin.

Around 13:31 UTC, journalist Zack Voell wrote in a report for Coindesk that a spokesperson for Ruffer Investment had clarified (via email) an important statement in the company’s portfolio update memo to shareholders.

More specifically, this person told Coindesk that the 2.5% figure mentioned in that memo was referring to the percentage of the firm’s AUM that represented Bitcoin exposure. In fact, he/she said that currently Ruffer’s Bitcoin exposure “totals around £550m, equivalent to around 2.7% of the firm’s assets under management.”

At today’s GBP-USD exchange rate, this means that Ruffer’s Bitcoin’s exposure currently totals around $742 million. Of course, what we still do not know is what they mean by “exposure to Bitcoin.” They could have simply bought “physical Bitcoin”, but it is also possible that they have invested in Bitcoin futures/options.”

What is highly interesting is that the Coindesk report came out at 13:31 UTC, which is around when the Bitcoin price started surging from $19,839 to $20,770 just 40 min later.

Another piece of bullish news that came out today (around 14:18 UTC on December 16) is CME Group, “the world’s leading and most diverse derivatives marketplace”, announcing that “it intends to launch Ether futures starting February 8, 2021, pending regulatory review.” According to the press release, the new contract will be “cash-settled, based on the CME CF Ether-Dollar Reference Rate, which serves as a once-a-day reference rate of the U.S. dollar price of Ether. Ether futures will be listed on and subject to the rules of CME.”

Crypto analyst Alex Krüger tweeted that CME Group’s Ether futures product would “make it easier for institutional investors to get $ETH long exposure” and that Ether would “have a spectacular 2021.”

Later, he added:

As of 16:17 UTC on December 16, Bitcoin is trading around $20,701, up 6.98% in the past 24-hour period. In the year-to-date (YTD) period, the Bitcoin price is up 188%. As for Ether (ETH), it is currently trading around $622.83, up 6.28% in the past 24 hours and up 383% in the YTD period.