This article looks at how Bitcoin has been performing in the past 24-hour period, as well as examine some of the more interesting recent Bitcoin-related news.

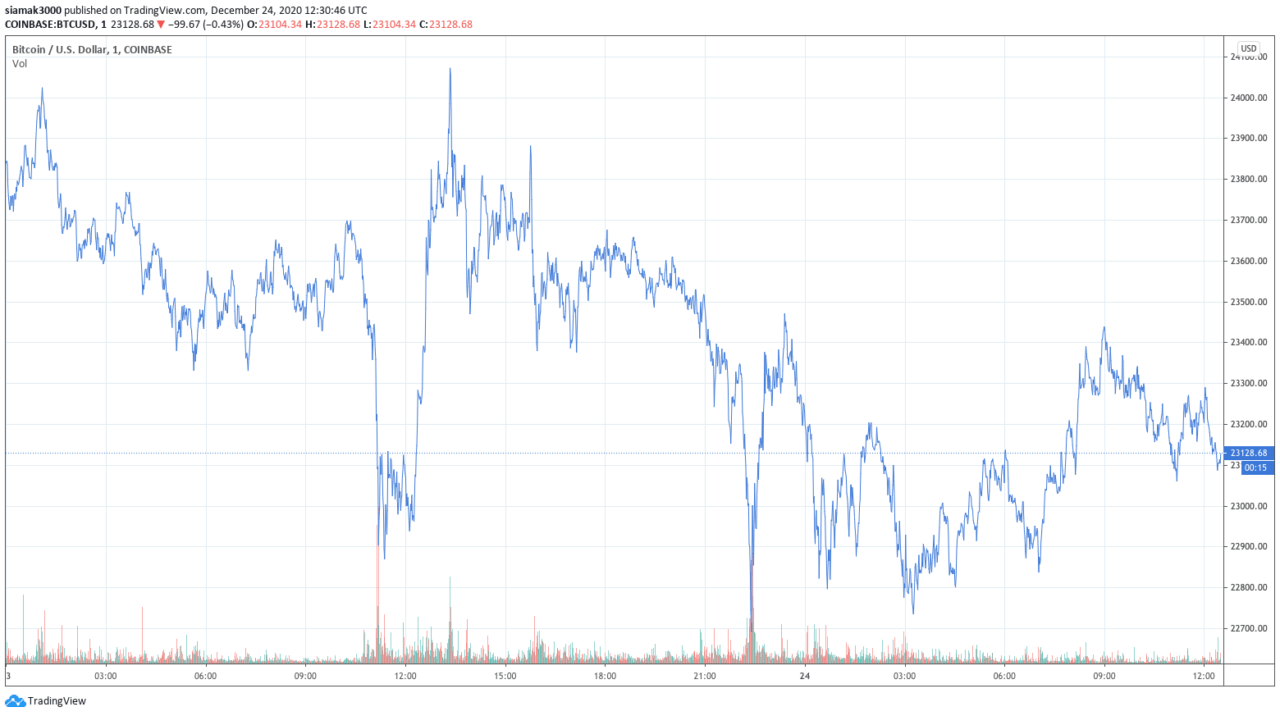

According to data by TradingView, currently (as of 12:30 UTC on December 24), Bitcoin is trading around $23,128 on Coinbase.

Since Bitcoin’s liquid supply is currently 18,581,351, this means that Bitcoin’s market cap is around $430 billion.

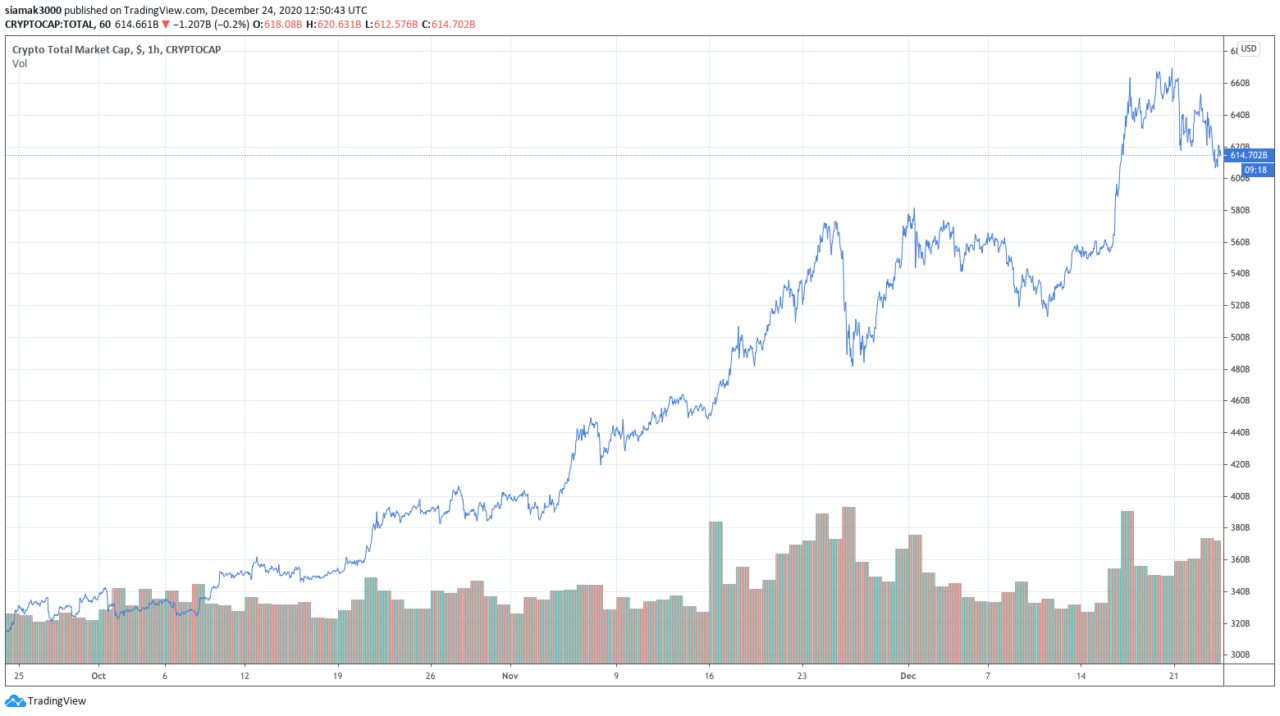

As for the total cryptocurrency market capitalization, the chart below by TradingView shows this has changed ver the past three-month period:

On Wednesday (December 23), the flow of good news about the institutional adoption of Bitcoin as an inflation hedge continued with yet another Nasdaq-listed company announcing that it wants to use some of its cash to invest in Bitcoin.

Canadian FinTech firm Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) announced that it “plans to make an initial corporate investment of up to $1.5 million in bitcoin” and that it “will consider additional investments in 2021 as it monetizes its $17 million investment portfolio.” This initial purchase “would represent approximately 1.5% of Mogo’s total assets as of the end of the third quarter of 2020.”

Mogo’s press release said that was not the first time that Mogo was getting involved with Bitcoin:

“This initial financial investment builds on Mogo’s significant product development related investments in bitcoin over the last several years. MogoCrypto1, launched in 2018, is the easiest way to buy and sell bitcoin in Canada. It enables members to buy and sell bitcoin at real-time prices instantly through the Mogo app, 24/7 from their mobile device, bringing a new level of convenience and accessibility to bitcoin ownership for all Canadians. In addition, the Company recently announced its bitcoin rewards program, a first of its kind in Canada, that provides members with the opportunity to earn bitcoin through engagement with Mogo’s products and enables them to accumulate bitcoin over time.”

Greg Feller, President and CFO of Mogo, had this to say:

“We are strong believers in bitcoin as an asset class and believe this investment is consistent with our goal to make bitcoin investing available to all Canadians. In addition, we believe bitcoin represents an attractive investment for our shareholders with significant long-term potential as its adoption continues to grow globally.

“We plan to initially allocate a modest portion of our capital toward bitcoin investments and will consider additional investments in bitcoin as we monetize some of our existing $17 million portfolio which we expect to begin doing in 2021.”

The CEO of on-chain analytics firm CryptoQuant said earlier tody that on-chain metrics are suggesting that institutional investors are continuing to buy Bitcoin in huge numbers via OTC desks, and that is why he remains very bullish on Bitcoin:

And since today is Christmas Eve, it seems appropriate to close this article with this chart from blockchain data and intelligence provider Glassnode:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.