In a recent interview, Kyle Davies, Co-Founder of Singapore-based hedge fund management firm Three Arrows Capital talked about why he is so bullish on Bitcoin right now.

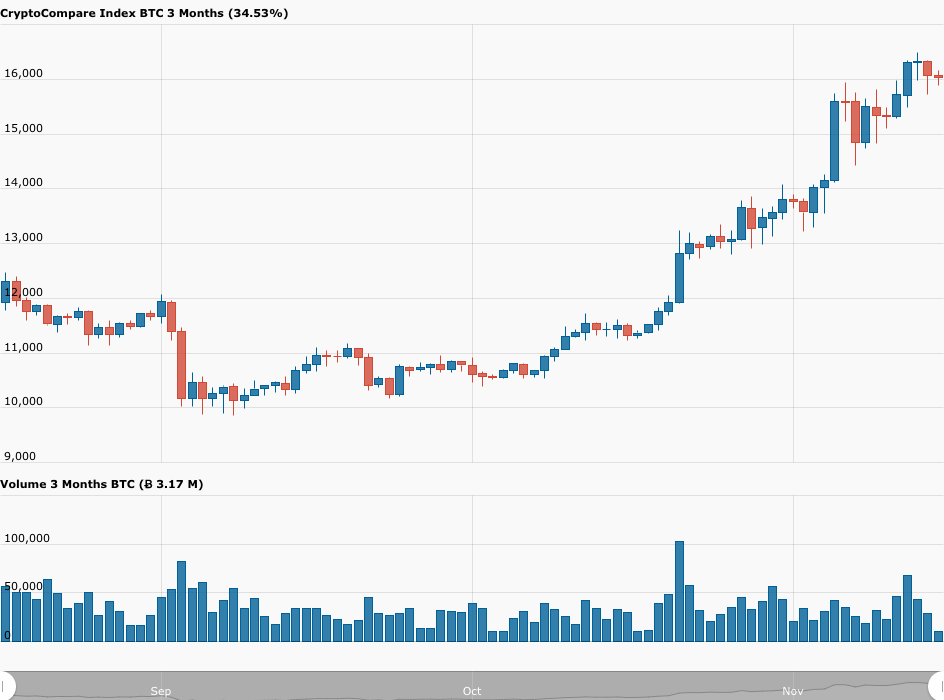

In the episode of “The Coinist” podcast released on Friday (November 13), crypto analyst/trader Luke Martin interviewed Davies to find out how the latter feels about Bitcoin’s current bull run, which has taken the Bitcoin price to above $16,000.

Davies replied:

“It’s moving. This is just the beginning though. I was calling for all-time highs, and I think we’re going to see them; so, [it] feels good.”

The next question related to Bitcoin was why Three Arrows Capital decided to go long on Bitcoin before the U.S. presidential election.

Davies answered:

“A lot of this year has been ‘buy the rumor, sell the news’, and like going into halving, [the] great trade was long Bitcoin, on the halving, dump Bitcoin, straight into alts. And then, we went straight into a DeFi bull run, which was very much driven by yield farming.

“Ethereum did extremely well, but then all of the yield farming was incentivized, and it was very clear to us that these incentives were going to come off and when that did, there would be a pullback. And so when we saw that, we thought ‘you know, we’re still extremely bullish crypto, we should be going big into Bitcoin — like over a hundred percent basically — that and short some other stuff and we did… I think this [i.e. Bitcoin Dominance] goes over 70%…

“I think that there’s no clear catalyst for anything outside of Bitcoin right now. I think DeFi can always do well — there’s a lot of innovation happening there, we’ve seen it in a lot of projects, we’ve continued to, and all of that is long-term for us by desire and not by chance. We’re like locked up for one year plus. We have a whole team dedicated to it, we work with teams, we do it well, a lot community work, but basically for me, as a macro manager, I kind of like have my small book which is my DeFi book that is a long-only community book and then I create on the top of that…

“For us…pre-election… I just thought cash on the sidelines, and I thought the narrative was strong. This was going be a clear BTC Dominance run, and that’s what we did.”

Davies also explained why he thinks that for now Bitcoin seems destined to do much better than Ethereum or other altcoins:

“One of the important things to remember is that liquidity is important and if if people believe that alts can move more than Bitcoin, then they will start to move away from it. Even irrationally so sometimes, but if Bitcoin starts to run, this really becomes a liquidity vacuum, and you have to remember that large investors don’t really want to hold lots of illiquid things — they want to hold the most liquid thing because it allows them to manoeuvre and not get liquidity-trapped…

“When Bitcoin starts to run, it really runs, and it sucks liquidity out of everything, and that especially as we get close to all-time highs, that’s the alt risk: the alt risk is Bitcoin hits all-time highs, every media outlet talks about Bitcoin, and Bitcoin then goes on a tear through $25,000 to whatever … and when that happens, what happens to alts? They don’t need to go up, they can go down… then once we peak, yes, money can flow back into alts, but large investors don’t want to hold alts — they want to hold Bitcoin.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.