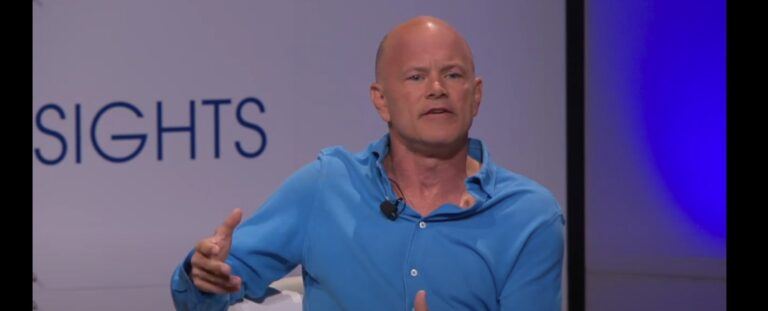

On Tuesday (November 24), billionaire investor Mike Novogratz explained why the two cryptoassets he and the institutional investors he knows are most interested in (for investing as opposed to trading) are Bitcoin and Ethereum.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

Yesterday, during a very interesting interview with Yahoo Finance, he talked at length about the crypto space. In this article, we focus on some highlights from this interview.

How is the Current Bitcoin Rally Different From the One in 2017?

“2017 was a global speculative mania… It was driven by small retail investors. It was kind of the first people’s revolution in lots of ways…

“This rally is being driven by institutions slowly getting into the space, high net worth individuals, hedge funds, real institutions… Bitcoin has become a macro asset to hedge against the debasement of fiat currency both here in the US and abroad and so that story has really taken hold.

“Bitcoin has always been a value as a social construct, very similar to gold: it’s valuable because say it’s valuable, and as more and more credible participants get in… the credibility of the space just keeps growing, and we’ve hit this kind of inflection point where the network effects take over.”

Could Bitcoin’s Price Have Another Huge Correction Like in 2018?

“I think we’re still going to have volatility in Bitcoin… but the maturity process is happening and institutions are longer hold periods, they’re deeper pockets, and so we’re seeing a transfer of coins from a quicker hands.

“Why Bitcoin had so much volatility in the past is that most of the liquidity came on these Asian exchanges like Huobi and BitMEX and Binance that offer fifty, eighty, a hundred to one leverage. And so there was these leverage buyers, almost gamblers/speculators that created a ton of liquidity. A lot of that stuff is being regulated away, and a lot of it is being replaced — a lot of those coins are being replaced by more institutional hands, and so I think we’ll still have volatility. It’s gonna be less.”

Is Crypto Just for Professional Traders?

“Listen, I think Bitcoin is for everyone. Everyone should put 2–3% of their net worth in Bitcoin and look at it in five years and it’s gonna be a whole lot more.

“I think Ethereum is also a coin that you could put into your portfolio. Ethereum will be most likely the protocol that lots and lots of the decentralized finance gets built on top of… So, those are the two, I think, core coins.

“Other than that, it really becomes a trickier. You know, there was a giant rally in the last two days of many altcoins. They’re lower volume, lower market cap, easy to squeeze, and so fun for professionals to trade, but you can lose 60% of your money in a day.

“And so, you know, fair warning, if you’re gonna play in those things, do it with small size and know what you’re doing. For our institutional customers, it’s almost all Bitcoin and Ethereum at this point.”

How Would Bitcoin Be Affected If Janet Yellen Becomes the Next U.S. Treasury Secretary?

“The country’s productivity gap is going to require Janet Yellen to push for more stimulus and more stimulus… You’re gonna have a macro macro environment that’s bullish for gold, bullish for Bitcoin, bullish for hard assets.

“You know, her approach to Bitcoin as a financial asset for payments, eight years ago, wasn’t that constructive, but a lot has changed. So, we’re waiting to see what she says currently about crypto in general, but I think she’s a dove for markets, which is good for Bitcoin…”

The Future of Payment Systems

“We’re gonna go to a stablecoin-based payment system. We’ll see who wins that that race and that’ll be free. You’ll move money around for broadly free in the same way long distance rates went from a dollar a minute to free, you’re gonna see money transfer and the whole banking system get disrupted and so that’s important because it’s gonna shift money back to to consumers.

“It’s not as revolutionary as what crypto can be. What’s more revolutionary is we’re gonna come to systems where the users can participate…