Around 05:00 UTC on Friday (October 3), less than 12 hours after the U.S. CFTC announced that it had brought charges against the owners of BitMEX, President Trump reported that he and his wife had tested positive for COVID-19.

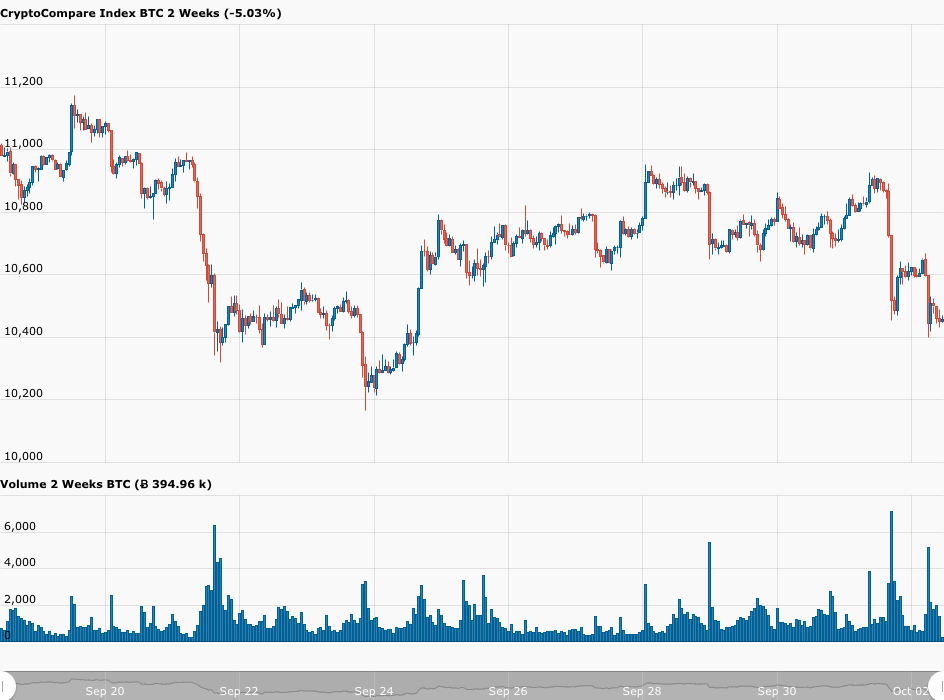

The past seven days have not been kind to Bitcoin and other cryptoassets.

First, last Saturday (September 26), Singapore-based crypto exchange KuCoin announced that it had suffered a security breach, as the result of which some of the cryptoassets in the exchange’s hot wallets—now thought to have been worth around $280 million at the time—were stolen. As Larry Cermak, the Director of Research at The Block pointed out, this was the third largest attack in history on a crypto exchange.

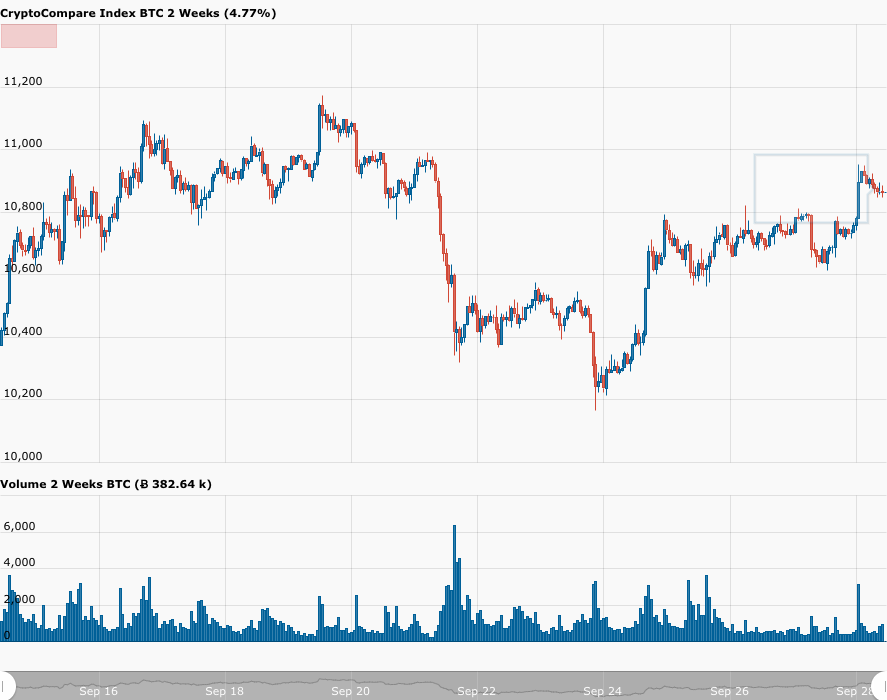

Interestingly and perhaps rather surprisingly, two days later (i.e. on Monday, September 28), BTC-USD and ETH-USD were trading roughly 1% higher than they were shortly before KuCoin got hacked.

Second, on Thursday (October 1), the U.S. Commodity Futures Trading Commission (CFTC) announced that it had brought charges against “five entities and three individuals” that own and operate the crypto derivatives exchange BitMEX.

CFTC’s press release (“Release Number 8270-20”) said that the agency had filed “a civil enforcement action in the U.S. District Court for the Southern District of New York charging five entities and three individuals that own and operate the BitMEX trading platform with operating an unregistered trading platform and violating multiple CFTC regulations, including failing to implement required anti-money laundering procedures.”

It went on to say that the three co-founders of BitMEX—Arthur Hayes, Ben Delo, and Samuel Reed—were among those charged. The entities named as co-defendants are “HDR Global Trading Limited, 100x Holding Limited, ABS Global Trading Limited, Shine Effort Inc Limited,and HDR Global Services (Bermuda) Limited (BitMEX).”

The CFTC said that it is bring these charges because it believes that BitMEX is “conducting significant aspects of its business from the U.S. and accepting orders and funds from U.S. customers.”

Around the same time, the U.S. Department of Justice (DOJ) issued a press release, which announced the indictment of Arthur Hayes, Benjamin Delo, Samuel Reed, and Gregory Dwyer, saying that these four individuals had been charged with “violating the Bank Secrecy Act and conspiring to violate the Bank Secrecy Act, by wilfully failing to establish, implement, and maintain an adequate anti-money laundering (‘AML’) program” at BitMEX.

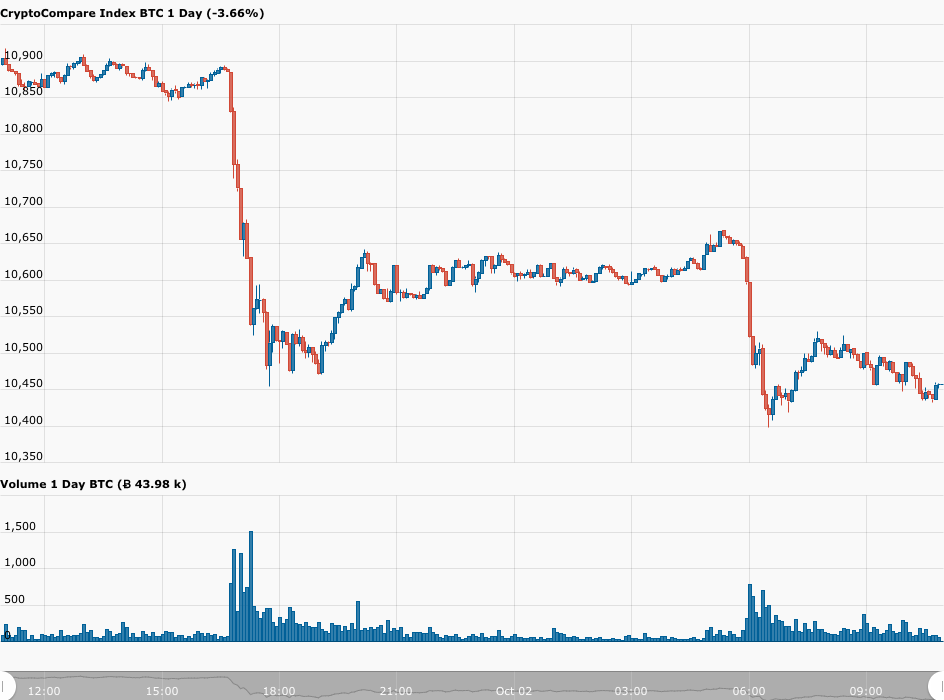

Initially, the Bitcoin price dropped from around $10,893 (where it was just before these two announcements) to $10,454 in roughly one hour, which is a drop of 4.03%. However, by 04:20 UTC on Friday (October 2), the Bitcoin price had recovered to around $10,667, which means that Bitcoin had suffered a drop of around 2.07% as the result of the BitMEX news.

The third below to Bitcoin arrived this morning when we got the even more shocking news that U.S. President Donald Trump and his wife had tested positive for COVID-19.

Currently (as of 09:55 UTC on October 2), Bitcoin is trading around $10,453, down roughly 2% since President Trump’s tweet and down approximately 4% in the past 24-hour period.

Of course, the news about President Trump contracting COVID-19 has also dealt a blow to U.S. equities. At the time of writing (i.e. as of 5:55 DT or 09:55 UTC on October 2), futures on the Dow, the S&P 500, and the Nasdaq 100 are down 1.44%, 1.52%, and 2.14% respectively.

However, as far as crypto is concerned, the main takeaway is that despite these three body blows, Bitcoin has not been knocked out and is still standing (down only 2.3% since just before the attack on KuCoin).

This display of strength and resilience is something that is making some members of the crypto community even more bullish on Bitcoin.

Featured Image by “PublicDomainPictures” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.