Around 03:00 UTC on Thursday (August 20), the price of the governance token for decentralized finance (DeFi) platform yearn.finance went above $13,350 while Bitcoin was trading around $11,735.

yearn.finance, which was formerly known as iearn.finance, is a hobby project by developer Andre Cronje. It was “semi-launched” in February 2020 as a yield aggregator for DeFi lending platforms to help people find out where to get the highest yield (APR) for lending their crypto:

Then, on July 17, Cronje announced that, over the preceding few months, his team had released the following products under the “yearn.finance” umbrella:

- yearn.finance (“profit switching for lending providers, moving your funds between dydx, Aave, and Compound autonomously”)

- ytrade.finance (once ytrade has launched publicly, it will let you trade $DAI, $USDC, $USDT, $TUSD, and $sUSD “at leverage capped at 1000x with initiation fee pre-paid or 250x without initation fee”)

- yliquidate.finance (“Automated liquidation engine for Aave protocol”)

- yleverage.finance (“Creates 5x leveraged DAI vaults with USDC”)

- ypool.finance (“The first y.curve.fi <> sUSD curve.fi meta pool”)

- yswap.exchange (“a stable automated market maker, allowing single sided liquidity provision while being yield aware and distribution rewards aware”)

Even more interestingly, in this blog post, Cronje announced the release of governance token YFI, which he called “a completely valueless 0 supply token.”

Cronje went on to say:

“We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.”

He then said the best way to get hold of the “0 value” YFI token was not to buy it, but to earn it:

“Earning YFI is simple, provide liquidity to one of the platforms above, stake the output tokens in the distribution contracts (we will provide an interface for this), and you will earn a (governance controlled) amount per day.

“Otherwise, standard voting rules apply, minimum quorum required (>33%) to propose a change, usual veto rights (>25%), and usual agreement thresholds (>50%) required to pass a vote and update a change. All these are configurable, governance can feel free to change as required.

“So if you are an LP to one of the systems (or all of the systems above), the control is in your hands. Good luck.”

On July 24, crypto analyst/investor Andrew Kang sent out the following tweet to summarize the main differences between BTC and YFI:

As Kang pointed out on Tuesday (August 18), just over a month ago, YFI was priced around $3:

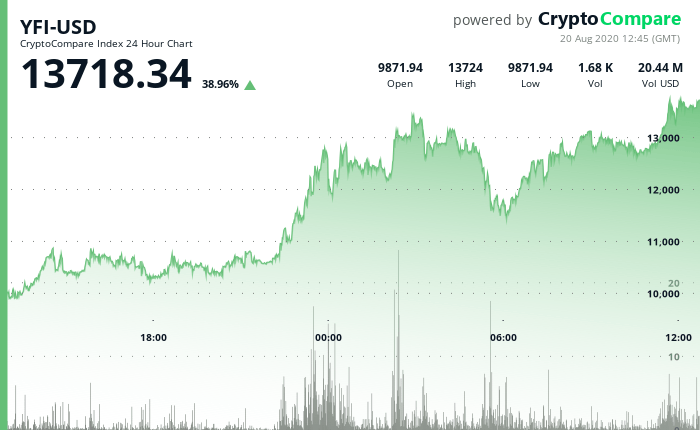

At the time of writing (12:45 UTC on August 20), according to data from CryptoCompare, YFI is trading around $13,718, up 38.96% in the past 24-hour period:

One person who has recently made a decent profit from YFI is Arthur Hayes, Co-Founder and CEO of crypto derivatives exchange BitMEX, who started tweeting about YFI on August 17:

One important thing to point out about YFI is that although currently it costs moe than BTC, YFI’s maximum supply is only 30,000 (vs 21 million for Bitcoin).

On Monday (August 17), Jason Choi, the host of the Blockcrunch podcast, tweeted about yearn.finance’s amazing revenue generation:

And the next day, Larry Cermak, Director of Research at The Block, offered this insight on yearn.finance’s revenues:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.