On Monday (August 24), decentralized finance (DeFi) startup Aave announced that Aave Limited, its UK entity responsible for integrations and support, had been authorized by the Financial Conduct Authority (the UK’s financial regulator) as an electronic money institution (EMI).

What is Aave?

In case you are wondering about the name “Aave”, it is a Finnish word that translates to “ghost” in English, and it is was chosen by the team because they are focused on building an open and transparent DeFi platform.

Aave is being developed by a multi-cultural team, and London was chosen for its headquarters because the city has probably “the largest FinTech community in the world.”

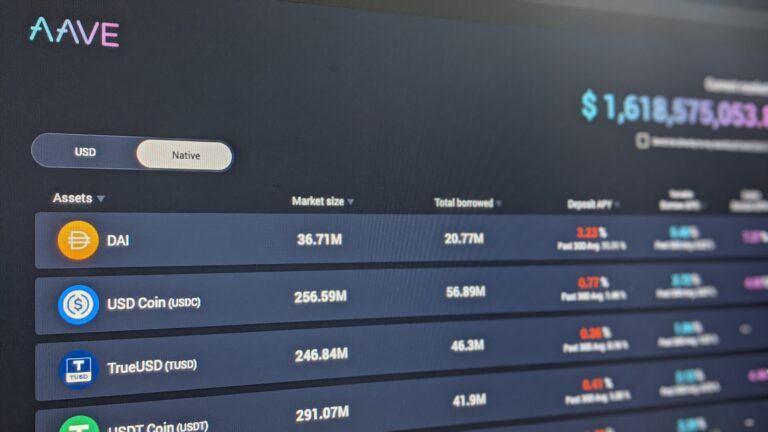

Aave is “a decentralized non-custodial money market protocol where users can participate as depositors or borrowers.” You earn interest on the cryptoassets that you deposit, and those deposited assets can be used as collateral to borrow other cryptoassets.

Three of Aave’s most innovative features are Flash Loans, the ability to choose stable vs variable borrowing rate, and Credit Delegation.

The LEND token is used for protocol governance. LEND is “burnt based on the fees gathered in the protocol, so holders benefit on the reduction of the supply.”

On 29 July 2020, Stani Kulechov, Founder and CEO of Aave, published a blog post in which he introduced a tokenomics upgrade proposal called the “Aavenomics Proposal”, the purpose of which is to transition Aave to a fully decentralized governance model.

Under this proposal, a new governance token called AAVE will replace LEND. “LEND will be migrated to AAVE, via a Gensis Governance vote, at a rate of 100 LEND per 1 AAVE.”

Here is a good introductory video on Aave by Chris Blec:

How Aave (LEND) Has Performed in 2020

According to data from CryptoCompare, LEND is currently trading at 0.7295, which means that it is up over 45.90% against USD in the past 24-hour period, and in the year-to-date (YTD) period, LEND’s return on investment (ROI) vs USD is an incredible +22,625%:

Aave Granted EMI License in the UK

The FCA states that any firm that wishes to “provide payment services as a payment institution in the UK” or to “issue electronic money (e-money)” needs to “register with or become authorised by” the FCA.

Here is the difference between registration and authorization:

“Registration is cheaper and simpler than authorisation, but SPIs are unable to provide payment services into other European Economic Area (EEA) member states.”

Over on Twitter, Aave explained via a tweetstorm the benefits of having this EMI license and how it helps the company with its long-term goal of preparing DeFi services for mainstream adoption:

- “This EMI license allows Aave to facilitate payments and currency conversions, as well as issue electronic money accounts for consumers and businesses.”

- “Financial worlds collide: this authorization is part of Aave’s vision to bring the #DeFi and Fintech spaces closer together by providing access to DeFi directly from electronic money accounts, opening up DeFi services to a wider user base moving toward mainstream adoption.”

- “Current EMI licensed companies range from @RevolutApp to @coinbase, and now Aave Limited will be able to grow the Aave Ecosystem and build innovative products that bridge DeFi and Fintech.”

- “Aave will start the services by offering UK based users the ability to create accounts and hold electronic money, eventually allowing the whole Aave ecosystem to benefit from the new functionalities.”

The Aave CEO told The Block that “Aave will pilot in the U.K., before rolling out to cover the whole EEA and expanding globally,” and then added that this new service will enable users “to go from Fiat to stablecoins and other assets natively in the Aave Ecosystem and then use these assets in the Aave Protocol.”

According to data from Defi Pulse, Aave is now the #1 DeFi project by locked value (USD), taking over from Maker. This fact was confirmed earlier today by Aave Founder and CEO Stani Kulechov:

On August 20, Kyle Samani, a Co-Founder and Managing Partner at blockchain/crypto focused investment firm Multicoin Capital, which is long LEND, explained why Aave is his favorite DeFi project:

Another prominent investor who is bullish on Aave is Spencer Noon, head of DTC Capital, who had this to say:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.