A HODL Wave chart suggests that the price of bitcoin could keep moving up, as the number of unmoved BTC in the last 12 months recently hit a new all-time high.

The HODL Wave chart was created by Unchained Capital, a financial services firm, and it looks at the number of bitcoin addresses with funds that have not moved within it for a specific time frame. The new 1Y+ HODL Wave chart shows the addresses with BTC that has not moved for the last 12 months, and correlates with the cryptocurrency’s price movements.

As the International Business Times reports, the chart allows us to infer that whenever the price of bitcoin goes up, HODLers who have been holding onto their funds for 12 months or more start moving them, presumably to exchange them for USD or USDT and take profits.

When bitcoin’s price goes down, however, hodlers tend not to move their coins, waiting for a better opportunity. BTC has recently broken through the $10,000 mark after trying to do so for the last two months, but the number of addresses hodling for over one year has kept on rising.

This both means that bitcoiners are expecting the price of the cryptocurrency to keep on going up, and that there will be somewhat diminished selling pressure. BTC is, nevertheless, struggling to maintain the $11,000 mark.

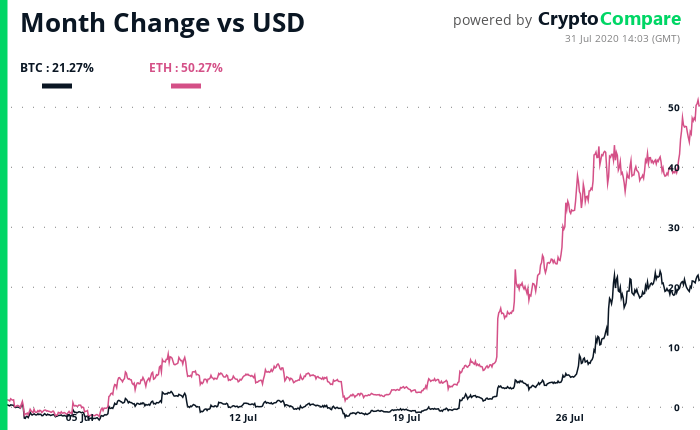

One key indicator suggesting the price of bitcoin will keep going up is the price of the second-largest cryptocurrency by market cap, ether, which started rallying before the flagship cryptocurrency.

On Twitter, analysts Josh Rager, for example, pointed to ether’s price, which has recently broken the $340 mark, as an indicator it could help bitcoin surpass $12,000 in the near future. All eyes are now on the weekly and monthly closing prices of both cryptos.

Analysts believe the cryptocurrency space will keep seeing a positive price action because of a bullish turn discussions have taken on social media, and because bitcoin has now broken past a bearish downtrend it was under since December 2017, when it started dropping from its near $20,000 all-time high.

Featured image by Thought Catalog on Unsplash.