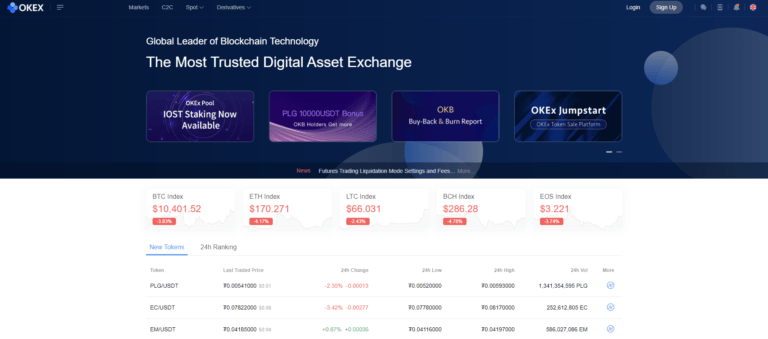

On 29 August 2019, OKEx CEO Jay Hao hosted an “Ask Me Anything” (AMA) live chat session on OKEx’s English Telegram group. This article presents the main highlights of this AMA session.

Crypto Derivatives

- For futures and perpetual swaps, OKEx plans to upgrade the order book to “the full order book depth” in the near future.

- OKEx plans to roll out crypto options “very soon.”

- When asked which is better, regular futures or perpetual swaps, the OKEx CEO says:

They are two different derivative instruments to fulfill different trading needs. Futures has a contract period and delivery date with a larger basis, while perpetual swap has no contract expiry, smaller basis, and includes funding fees. You may choose the one that suits your needs.

Security

Hao says that although they don’t have a well-publicized fund to make users whole in the event of a security breach at the exchange, OKEx takes security of user funds “very seriously”, the exchange has been fortune enough to have never suffered a security breach, and that OKEx has “a more than sufficient reserve to handle any unexpected situations.”

OKB Token

- All OKB holders receive fee discounts when trading on OKEx (“the higher the tier, the larger the discount”). However, with regard to the funding fee, which comes into play with perpetual swaps, this fee is taken by the counterparty of the contract, and so it does not make sense for OKEx to offer a discount on this fee.

- OKEx is not focused on the OKB price, but on ‘#BUIDLing”:

We have been consistently spending enormous efforts in building the OKB ecosystem and empowering the token, making it one of the most valuable digital assets in the market. I see great potential in OKB, and I think everyone should see the same

Crypto Lending

Hao says that OKEx is launching its lending product “very soon.”

Decentralized Exchange OKDEX

According to Hao, OKEx will definitely be launching its own decentralized trading platform (to be called OKDEX) since this is “an inevitable trend”:

As already announced, since our own public chain OKChain is now at the final stage of testing, we will establish our decentralized exchange platform OKDEX upon OKChain and will launch it when our team agrees that the trading experience is great enough.

OKEx first announced plans to launch OKDEX on 22 March 2019

Staking

OKEx Pool launched an EOS Staking Service on 29 August 2019. And Hao says that “more PoS coins will be supported in the future.”

Featured Image Courtesy of OKEx