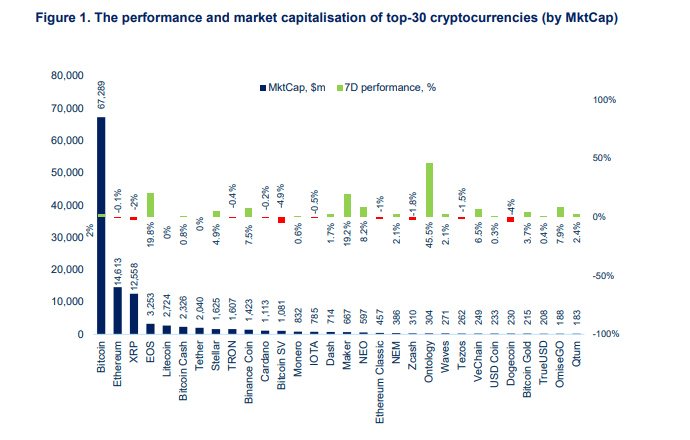

After a bullish week across the crypto markets, where the total market cap spiked by more than 14% from $126bn to $144bn on Saturday, the bears came back on Sunday and virtually wiped out the entire gains within a single hour as a massive red candle dumped it back to the $127bn area. Bitcoin was climbing towards a 2019 high above $4,200 and it only took one hour to destroy its effort and send it back to below $3,800, representing an almost 10% negative change. Ethereum was up by a solid 20% at $165, prior to the anticipated Constantinople hard fork, however yesterday ravaged all gains and Ether is back below $140. The rest of the top-30 assets have been equally affected, with losses ranging from 7% to 16%. The best performing assets over the past week were Ontology (45.5%), EOS (19.8%) and Maker (19.2%).

Crypto Market News

Coinbase Adds XRP to Coinbase Pro

Coinbase announced this week that it was launching XRP trading on Coinbase Pro, its platform for professional investors. The announcement comes after enormous expectation from XRP’s active community, and will initially be available for users in the US (except for NY), the UK, selected EU countries, Canada, Singapore, and Australia.

Pension and Endowment Consulting Firm Advises Institutions to Start Considering Crypto

According to the pension and endowment funds advisor Cambridge Associates, institutional investors should start considering crypto as a long term investment.

University of Michigan Endowment Plans to Invest in Crypto Fund

The endowment fund of the University of Michigan plans to invest an undisclosed amount into a16z crypto fund, managed by Andreessen Horowitz.

BitGo Offers $100m Insurance Protection for AUM

Crypto custodial firm BitGo is offering $100m of insurance cover via Lloyds of London in case of loss or theft of cryptographic keys.

Bitmain Reports Losses of $500m in Q3 2018

Cryptocurrency mining giant Bitmain could have recorded $500m losses in Q3 2018 according to a company document. The document also uncovers Bitmain’s liquidation of almost 500k worth of Bitcoin Cash in order to cover their significant losses.

Samsung Galaxy S10 Offers Crypto-Related Services

Samsung’s flagship phone Galaxy S10 will offer several crypto-related features. Payments to merchants, digital signatures, crypto storage and transfers are just a few of them.

Crypto Funds Q4 2018 Benchmark Report

Vision Hill Advisors released 4Q18 Crypto Hedge Fund returns report, here’s a quick take: 1. Median returns were down almost 20% 2. Active managers outperformed large cap assets by 25% 3. Best performing strategy was Quantitative (down only 3%) 4. Aggregate AUM at $4.5bn (down 25% since 2Q18)

Deutsche Börse to Launch Crypto Futures Contracts

Derivatives exchange Eurex, operated by Deutsche Börse is gearing up to launch futures contracts tied to Bitcoin, Ether and XRP.

Last Week in Funding

Privacy coin Beam received funding; Blockchain analytics start-up CipherTrace raised $15m; Pantera Capital has raised $125m so far for its 3rd fund focused on equity deals in 30-50 start-ups; Market surveillance start-up Solidus Labs raised $3m Seed to fight market manipulation.

Security Token News

Germany’s Securities Regulator Approves Issuing of Digital Bonds

German regulator Bafin has approved online lending platform Bitbond to issue digital bonds on blockchain. Bitbond will also be raising funds via security token BB1.

Major Japanese Securities Brokerage Daiwa Completes Blockchain Pilot

Japan’s second largest securities broker firm Daiwa has completed a blockchain proof- of-concept (where 26 companies are involved) with the goal to increase the efficiency of blockchain tech in the post-trade process. As a result, Daiwa believes that the standardisation will reduce opex, allow for easier development of new products and will also generate considerable benefits for the investors.

Investment Bank BTG Pactual Launches STO

The largest Brazilian investment bank Banco BTG Pactual is raising $15m via an STO. Offered token ReitBZ will be backed by real estate with an expected dividend yield of 15% to 20% annually.

Regulatory News

Germany Opens Consultation Process about Potential of Blockchain

The German government is seeking input on the potential of blockchain technology ahead of developing a national strategy by the summer. Germany’s capital Berlin hosts over 170 blockchain start-ups.

Thailand to Allow Issuance and Trading of Security Tokens

Thailand’s National Legislative Assembly has legalised the issuance of tokenised securities. The country’s financial watchdog (SEC) will reportedly issue detailed guidelines and rules for tokenised and electronic securities in the coming months.

US Chamber of Digital Commerce Calls for National Strategy on Blockchain

Blockchain advocacy group, the Chamber of Digital Commerce, has released its recommendations to implement a national blockchain strategy, urging the government to promote and support blockchain.