On Friday (7 December 2018), cryptocurrency exchange Coinbase announced that it is considering adding support for up to 31 additional digital assets.

If you own XRP, NEO, ADA, XLM, EOS, and/or any of the 26 other cryptocurrencies shown in the diagram below, you have cause to feel a bit more cheerful during this holiday season because Coinbase is considering listing these in the future:

The last time that Coinbase announced that it was exploring adding support for several new assets was 15 July 2018, when it said that it was looking at Cardano, Basic Attention Token, Stellar Lumens, Zcash, and 0x. (And before that, on 26 March 2018, Coinbase announced its “intention to support the Ethereum ERC20 technical standard for Coinbase in the coming months.”)

In the blog post published earlier today, Coinbase says that from the five assets it mentioned on 15 July 2018, it has already added support forthree of these—BAT, ZEC, and ZRX—and that is continuing to “evaluate the others, along with a number of ERC-20 tokens.”

Coinbase wants people to note the following:

- “Adding new assets requires significant exploratory work from both a technical and compliance standpoint, and we cannot guarantee that all the assets we are evaluating will ultimately be listed for trading.”

- “… our listing process may result in some of these assets being listed solely for customers to buy and sell, without the ability to send or receive using a local wallet.”

- “… we will add new assets on a jurisdiction-by-jurisdiction basis, which allows us to add assets efficiently and responsibly.”

- “As part of the exploratory process, customers may see public-facing APIs and other signs that we are conducting engineering work to potentially support these assets. We cannot commit to when or whether these assets will become available…”

One more thing worth noting is that just because a certain digital asset may be considered a security in one jurisdiction, say the United States, it does not mean that Coinbase cannot offer the same digital asset in other jurisdictions where there are no regulatory issues with offering that asset for trading on an exchange.

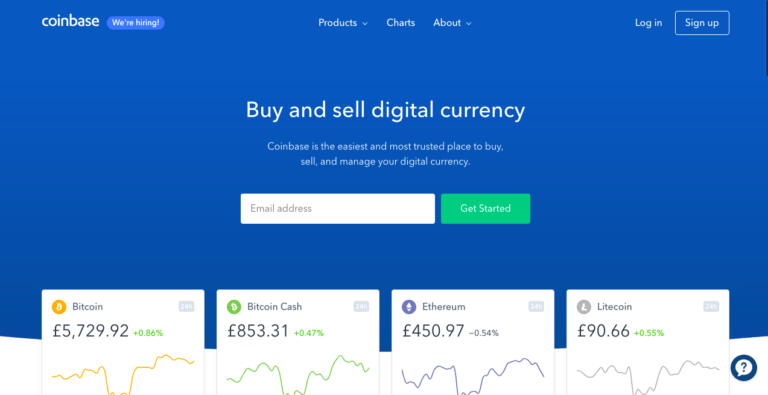

All Images Courtesy of Coinbase