For those customers that can’t wait until November 15th for the Bitcoin Cash (BCH) hard fork (“Planned Network Upgrade”), Circle’s crypto exchange Poloniex has announced a solution: it is allowing customers to trade Bitcoin Cash ABC (BCHABC) and Bitcoin Cash SV (BCHSV) tokens right now.

The two main competing implementations in the upcoming hard fork of Bitcoin Cash are “Bitcoin ABC” and “Bitcoin SV”. Poloniex does not want to take sides, and furthermore it wants to allow members of the crypto community to show which variant of BCH they support before the hard fork takes place:

“We believe the responsible thing for an exchange to do is remain neutral, and we want to empower the community to demonstrate their support through trading activity. “

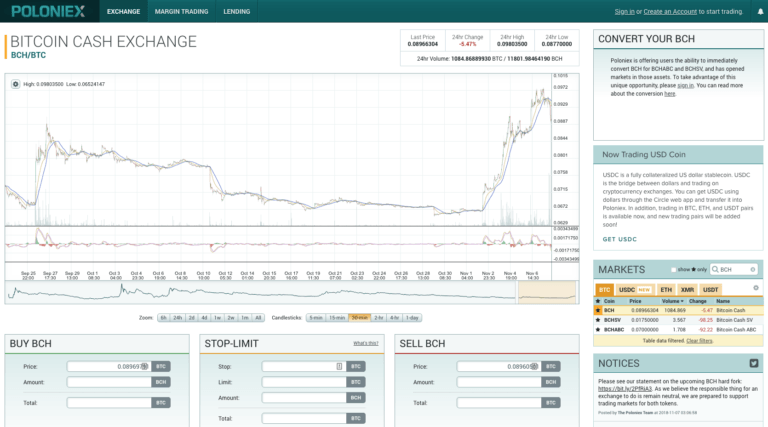

So, on 7 November 2018, it enabled “pre-fork trading” for the first time ever. Customers can trade BCHABC and BCHSV against both Bitcoin (BTC) and Circle’s stablecoin USDC Coin (USDC):

To make this possible, it now provides a conversion tool (you can find this in the upper right corner of the “Exchange” screen on the Poloniex website). This allows BCH to be converted into “equivalent amounts” of BCHABC and BCHSV; it also allows BCHABC and BCHSV to be converted back to BCH in case csutomers wish to withdraw funds:

Poloniex plans to pause BCH deposits and withdrawals at 14:00 UTC on 15 November 2018. At 15:00 UTC, it will “freeze the BCH, BCHABC, and BCHSV markets, cancel all outstanding orders, and take a snapshot.” Any user that still holds BCH at this time will “immediately receive an equivalent amount of BCHABC and BCHSV.” All BCH balances will then be set to zero. Once both chains have stabilized, withdrawals will be enabled.

Poloniex offers this important warning:

“You do not have to engage in pre-fork trading. If you choose to engage in pre-fork trading, please note that, as with all trading on the platform, trading in these assets can be extremely risky, and you trade at your own risk. It is possible that one of these chains will not be economically or technically viable after the fork, and its value will drop to zero.”

At press time, according to data from CryptoCompare, BCH is trading at $589.34, down 4.55% in the past 24-hour period.

Featured Image Courtesy of Poloniex LLC