On Monday (5 November 2018), BitMEX Research, the research arm of crypto derivatives exchange BitMEX, announced the launch of a new BTC/BCH soft/hard fork monitoring tool (available at ForkMonitor.info) that it has sponsored.

Here is how BitMEX Research announced this news on Twitter:

We are proud to announce the launch of https://t.co/uT9Of0qctZ, a new website sponsored by BitMEX Research. The site is connected to several nodes, both Bitcoin and Bitcoin Cash. It can be used to monitor the network during softforks or hardforkshttps://t.co/BpvHtwNUUM pic.twitter.com/WiPTZPtiu9

— BitMEX Research (@BitMEXResearch) November 5, 2018

Shortly afterwards, Arthur Hayes, a co-founder and the CEO of BitMEX, tweeted “If you want to get forked up check this out”, referring to the same blog post mentioned in BitMEX Research’s tweet.

The BitMEX Research blog post says it sponsored the website ForkMonitor.info, and that the website was built with the help of Dutch Bitcoin enthusiast and software developer Sjors Provoost (@provoost on Twitter).

BitMEX Research explains why this tool was created:

“While it appears that the economic majority will support Bitcoin ABC’s hardfork, there is significant uncertainty over how each client will behave and which chains they will follow. Therefore, BitMEX Research has sponsored this new website which has launched before the hardfork is due to occur. This will hopefully provide useful information to some stakeholders, as the events get underway next week.”

The tool you will find at this website is called “Fork Monitor”. This connects to ” several different nodes, both Bitcoin and Bitcoin Cash implementations.” It can be used for “monitoring the situation during network upgrades (softforks or hardforks), as well as being potentially useful in helping to detect unintentional consensus bugs.”

Currently, if you go to the “Bitcoin” tab, you will not find a lot of useful information:

However, BitMEX Research says that after the Bitcoin Cash (BCH) upgrade (expected to take place on November 15th) has been completed, this part of the tool will receive more attention:

“After the Bitcoin Cash hardfork is complete, the website’s intention is to move some of the focus over to Bitcoin. The plan is to run more versions of Bitcoin Core (especially older versions), as well as independent implementations such as Bcoin, BTCD and Libbitcoin. This may be helpful in spotting any consensus bugs, such as the inflation bug CVE-2018-17144, which was discovered in September 2018.”

The “Bitcoin Cash” provides quite a bit of information:

BitMEX makes its feelings regarding which variant of Bitcoin Cash (i.e. Bitcoin ABC, Bitcoin SV, or Bitcoin Unlimited) it prefers quite clear with this tweet:

What will happen to Bitcoin ABC, Bitcoin SV and Bitcoin Unlimited during the BCH hardfork on 15th Novemeber?@ProfFaustus 's (AKA “Fake Satoshi”) node, Bitcoin SV, is expected to fork off from the network onto a new chain. Find out what will happen at https://t.co/WKQ8hPDGON pic.twitter.com/C8IZNptZwH

— BitMEX Research (@BitMEXResearch) November 5, 2018

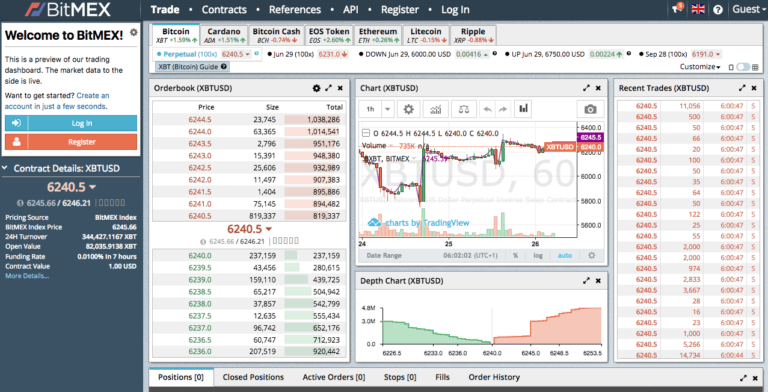

Featured Interface Image Courtesy of BitMEX