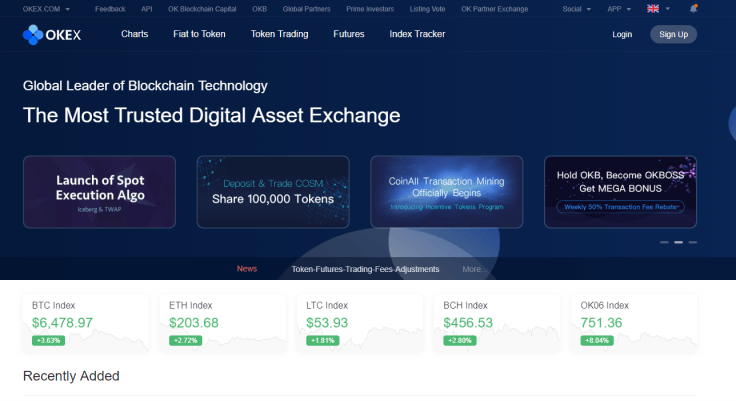

Continuing the whirlwind of news for stablecoins, OKEx announced today that it will list four new stablecoins on its platform, just as the largest and most controversial stablecoin, Tether (USDT), experiences huge price volatility.

The Malta-based exchange will list Paxos Standard Token (PAX), USDC//Coin (USDC), True USD (TUSD), and the Gemini Dollar (GUSD), all to begin trading within the next couple of days. The announcement comes only hours after Kucoin, another well known crypto-asset exchange based in Hong Kong, temporarily suspended and then resumed transfers of Tether tokens on its platform, citing “wallet system maintenance”.

Tether Action

The price of USDT fluctuated wildly today, and caused BTC/USDT pairings to trade at record-high premia, owing to the divergence in price between USDT and genuine fiat U.S. dollars. The difference in bitcoin price on USDT exchanges versus the Coinbase exchange, which does not use USDT, exhibits the effect of Tether price premia.

Due to the outsized role Tether plays in underpinning the crypto-asset industry, today’s market turmoil has been cautiously attributed by some to issues surrounding Bitfinex and Tether, which are closely linked through common management and investors and based together in Hong Kong.

Specifically, Bitfinex and Tether have been moving from bank to bank to bank over the past year, after being “dumped” by the Wells Fargo & Co bank, following subpoenas by the U.S. Commodity Futures Trading Commission over accusations that Tether could not back up its virtual currency with the equivalent amount of fiat.

As CryptoGlobe recently explored, Tether has been generally controversial in the crypto-asset industry for some time, serving as a linchpin for liquidity on many exchanges while never actually accomplishing a legal audit, and thus never proving its tethers are backed by real dollars.

All four of the new stablecoins listed today by OKEx differ from Tether in that they have to date experienced no banking problems, while three of them – GUSD, PAX and USDC – are regulated.

The Gemini exchange’s GUSD has been criticized, however, for having the ability to completely halt or reverse transactions of its ERC-20 stablecoin if Gemini so chooses, or is obliged by law enforcement to do so.