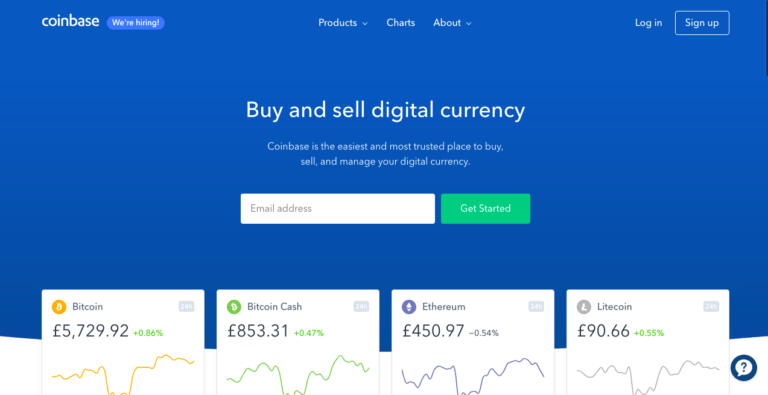

Users attempting to withdraw digital assets from their Coinbase accounts are facing unexplained delays, according to sources in contact with CryptoGlobe. The users in question are U.S.-based, and no reports have surfaced of similar delays for non-U.S. customers.

The withdrawal delays are reportedly affecting all Coinbase assets. Several users reported withdrawal delays of up to a week, and that the delays had been occurring for two weeks.

There are no reports of the delays being mirrored on the Coinbase Pro platform, Coinbase’s institutional trading platform formerly known as GDAX.

Chequered Past

These recent reports are nothing new, as the San Francisco-based tech firm at the center of the crypto industry has faced serious and repeated allegations of holding users’ funds since late 2017, when cryptoasset prices exploded.

CryptoGlobe and many other news outlets reported this summer on the raft of unanswered allegations from angry and distraught customers, which comprised 134 pages worth of complaints filed to the U.S. Securities Exchange Commission (SEC).

A Coinbase representative told CryptoGlobe at the time that the delays had been due to unexpectedly high trading volume, causing downtime during the dramatic runup in cryptoasset prices during late 2017/early 2018.

The company has recently taken steps to rectify this fault, reportedly upgrading its transaction and “surge” capacity by “1000%” earlier this year, as well as hiring hundreds of new employees.

In August, Coinbase’s trading volume was reported to have plummeted up to 83% since the January peak, making overcapacity an unlikely explanation for the present delays.

Coinbase, a U.S. company founded in 2013, also offers services in a total of 30 other countries. The supposedly $8 billion company has apparently had trouble attracting institutional investors, having recently discontinued its high-net-worth index fund product, itself only launched a few months ago.

Former Coinbase VP Adam White, the fifth employee of the company, recently departed his position to join Bakkt, the New York Stock Exchange-backed cryptocurrency venture set to begin offering physically-settled bitcoin products in November.