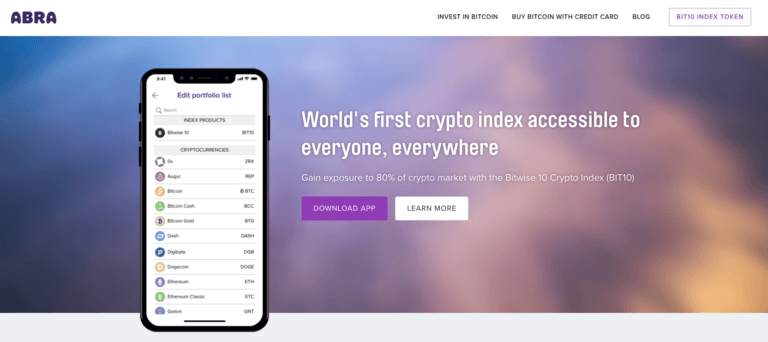

On Wednesday (3 October 2018), FinTech startup Abra, which makes the non-custodial crypto wallet app by the same name that lets you buy/sell/hold 28 cryptocurrencies, announced , via a press release, a new token called BIT10 that “tracks the professionally-managed Bitwise 10 Large Cap Crypto Index through a partnership with San Francisco-based Bitwise Asset Management.”

The Bitwise 10 Crypto Index Token (BIT10), which is only available on Abra, offers investors the following benefits:

- provides exposure to set of the 10 largest assets that currently make up “80% of the crypto market cap with one asset investment, previously only available to accredited investors”

- eliminates worrying about what cryptocurrencies to buy, since instead this lets you “hold the top ten performers in one asset”

- “$5 minimum and no fees”

The set of 10 cryptocurrencies is “rebalanced by Bitwise, adding and removing coins to adjust to the constantly changing market.”

The cost of each BIT10 token is “based on a real-time price feed of the Bitwise 10 Large Cap Crypto Index provided by Bitwise”. BIT10 can be “purchased in fractional amounts, so investors can decide which amount works best for them.”

This is how the press release describes how BIT10 work:

“BIT10 positions are held in multi-signature smart contracts on the Bitcoin or Litecoin blockchain. Once invested, Abra and the user are entering into a smart contract that effectively pegs the asset invested (either fiat currency or cryptocurrency) to the same amount of BIT10 tokens. Abra will get a real-time price feed from Bitwise Asset Management (again according to their published methodology) and the BIT10 investor will see the market movement up or down reflected in the price of their BIT10 tokens.”

Bill Barhydt, Abra Founder and CEO, said:

“We created the BIT10 token to allow greater access to cryptocurrency investing by making the experience simple and accessible. Through partnerships like this one with Bitwise, Abra has created an unprecedented opportunity for the everyday person to start investing in crypto.”

Bitwise Asset Management co-founder and CEO Hunter Horsley stated:

“Index investing is extremely popular in stocks, bonds, and crypto because it gives investors diversified exposure without having to constantly monitor news and try to predict which assets will be most valuable. So far in the crypto space, index investing has only been available to institutions and accredited investors. We're thrilled for that to be changing today with the BIT10 on Abra, which is available to anyone.”

He also explained that the BIT10 index is “smarter than just buying the top ten coins by market cap on a website because it applies rules to weed out some of the risks, and it also rebalances.”

In summary, this is a great partnership between two very innovative companies, and it seems hard to believe that we will see this year anything closer than the BIT10 to a “crypto ETF.”

Featured Image Courtesy of Abra