Digital currency exchange Coinbase has announced Coinbase Bundle. It allows users to buy all five available cryptocurrencies with just one purchase.

We’re rolling out a suite of new features to help people understand, explore, and buy their first cryptocurrency. Learn more about Coinbase Bundle, Coinbase Asset Pages, and Coinbase Learn here: https://t.co/djQbqGkDKI

— Coinbase (@coinbase) September 27, 2018

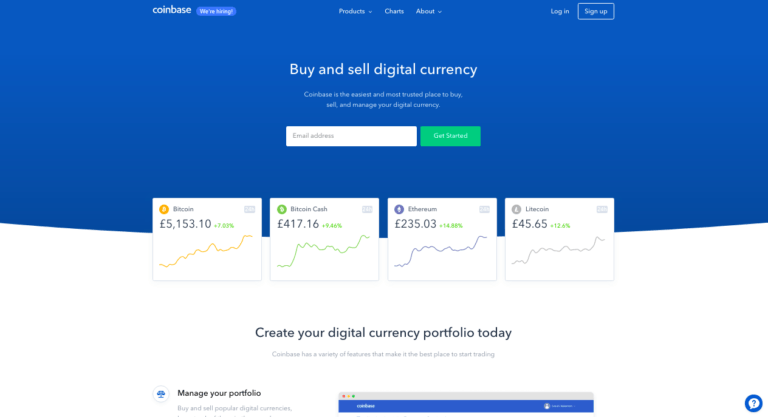

Those who choose to buy the Bundle will be buying a mixture of each currency in proportion to their USD market capitalization at purchase time. A Bundle is made up of Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ethereum Classic.

The call to learn more about Coinbase Bundle came in the same Twitter thread where the company introduced a “suite of new features,” including Coinbase Asset Pages and Coinbase Learn.

A Convenient Way To Buy Cryptocurrency

According to Coinbase, the breakdowns of Bundles are calculated by multiplying the price of each cryptocurrency by the circulating supply at transaction time.

The exchange says buying fees will not be any different than if a user purchased each cryptocurrency separately. Coinbase charges a 1.5% commission rate on purchases.

The ability to purchase Bundles is only available to customers in the United States, United Kingdom, and across the European Union who have a verified identity.

There is no cap on the maximum purchase size for a Bundle, but the smallest one can be purchased for $25 (£25, or €25).

The digital currency exchange wrote in a FAQ page how customers are able to sell off portions of Bundles, but are not able to send or sell them altogether in a single transaction. Additionally, Coinbase is not able to provide tracking information about a Bundle’s specific aggregate performance.

Big Changes Coming To Coinbase

Aside from Bundles, Coinbase also wrote on Twitter today about launching asset pages so people can explore and become educated about cryptocurrencies. They said this resource would be available to anyone, not just customers.

For those totally new to the industry, Coinbase decided to build Coinbase Learn so interested people can get the basics about blockchain and receive other “simple answers to your top cryptocurrency questions.”

More information about the asset pages, Coinbase Learn, and Coinbase Bundle were spelled out in a September 27th blog post from the company.

Additionally, CryproGlobe reported yesterday on a new assets framework for Coinbase that will increase the frequency and number of listed assets.

This new process is designed to make it possible to list digital assets on a per-location basis, assuming they are in compliance with legal requirements in the specific jurisdiction.