Augur, the decentralised platform for prediction markets, has seen a sizeable amount of money flow through the site since its launch last week.

According to data from DappRadar, over 3500 ETH – $1.65 million – has been transacted on the platform in the last 7 days – with an impressive 1,177 ETH in the last 24 hours alone.

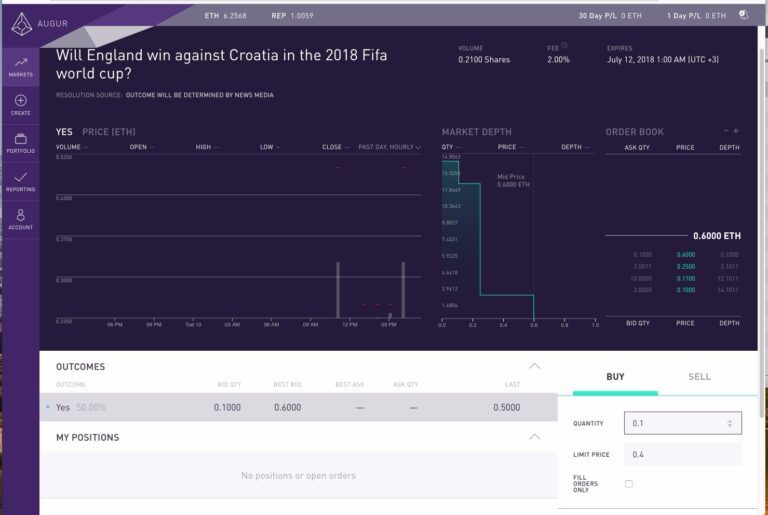

One of the very first Ethereum DApps, Augur allows users to create a prediction market for almost any real-world event and bet on the event by using ETH to buy ‘shares’ in the outcome of an event.

Briefly hitting the top 5 Ethereum DApps list following a spike in interest following the launch, Augur has also seen a significant rise in “open interest” – a measure of how much money is being risked betting on events.

Data from Predictions.Global, a site that allows users to view Augur markets, show the amount exceeding $325,000 over the period:

Using the concept of the “wisdom of crowds” the idea is that the market price of a share at any time will act as an indicator of the likelihood of the outcome occurring – and many have already used the platform to make some interesting bets.

While some have used the site to bet on Ether’s year-end price exceeding $500 (ranked number 1 for the most money staked at $214,00) others have utilised the platform for broader purposes – from betting on a second term for President Donald Trump (ranked number 9) to the winner of the next Super Bowl (number 8).

Refreshingly, in a rare instance of accountability, one ICO has also staked their launch on the platform – with the decentralised healthcare platform Medcredits staking $5,156 on “Will MedCredits release Hippocrates medical app on Ethereum mainnet by October 15, 2018?”

Usability Issues

Although interest in the platform spiked last week, many users reported issues with the platform’s user interface – from problems understanding how to execute bets, to reports of bugs preventing proper functionality.

While user interest has declined more than 50% from its peak of 265 users on its launch day – the trend is actually a feature common to all Ethereum DApps in recent months – with user numbers and transaction volumes dropping sharply.

With fewer than 1600 users active on the top 10 DApps – most of which are exchanges – Augur actually accounts for a reasonable percentage of all DApp users – as this chart from diar illustrates:

The figures are undoubtedly concerning for the health of the Ethereum ecosystem in general, but show that the story is more complicated for Augur as it seeks to gain traction in the current bear market.