On Monday (25 June 2018), or TRON Independence Day, cryptocurrency derivatives exchange BitMEX announced that it is soon launching a TRON (TRX) futures contract.

Here is the announcement on BitMEX’s blog by BitMEX co-founder and CEO Arthur Hayes:

Due to popular demand, we will be listing the BitMEX TRON / Bitcoin 28 September 2018 futures contract, TRXU18, on or before 26 June 2018 08:30 UTC.

However, on Tuesday (26 June 2018), BitMEX sent out the following tweet to explain why it was unable to go ahead with the launch on June 26th and instead postponing this to June 27th:

Binance is back online. We will list TRXU18 at 08:30 UTC tomorrow, June 27. https://t.co/1qAAsr86To

— BitMEX (@BitMEXdotcom) June 26, 2018

A TRX futures contract is an agreement to buy or sell TRX at a predetermined price at a specified time in the future. In this case, BitMEX is initially offering one future contract product, i.e. one with an expiration date of 28 September 2018.

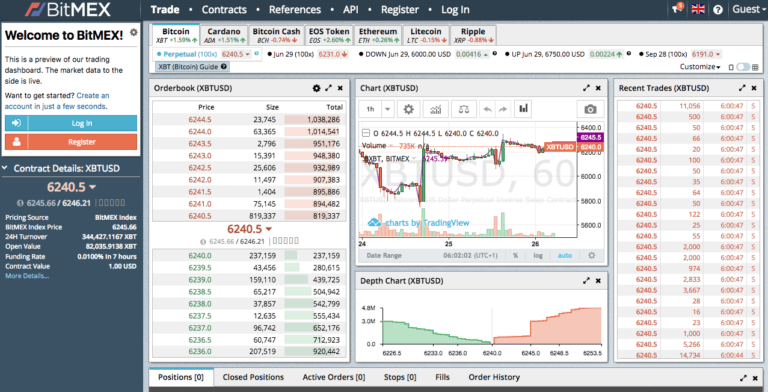

As well as futures contracts, BitMEX offers a type of derivative called a “perpetual contract” that is similar to a standard futures contract in how it trades, but it has no expiration date, and so you can hold a position for as long as you wish. Perpetual contracts trade track the underlying index price quite closely.

Here are a few things you should note about BitMEX:

- It is a P2P trading platforms that offers leveraged contracts that are bought and sold exclusively in Bitcoin.

- It does not handle fiat currency.

- It allows trading with a high degree of leverage.

As well as the TRX futures contract, BitMEX offers futures contracts for Bitcoin, Bitcoin Cash, Ada, EOS, Ether, Litecoin, and XRP.

For TRX trades and investors, the advantage of using futures contracts is that they can be used for hedging/managing risk or for making higher profits (since they are highly leveraged) for speculation purposes (even in a bear market). We should not forget what early Bitcoin investor Tyler Winklevoss tweeted on 7 May 2018 after hearing that Bill Gates had said that he would short Bitcoin if he could:

Dear @BillGates there is an easy way to short bitcoin. You can short #XBT, the @CBOE Bitcoin (USD) Futures contract, and put your money where your mouth is! cc @CNBC @WarrenBuffett https://t.co/4JIhF5vWsZ

— Tyler Winklevoss (@tylerwinklevoss) May 7, 2018