Comment of the Day @brakmic

Graffiti in Paris “R.I.P Banking System” pic.twitter.com/Y3fgZ5FQH9

— Harris Brakmić (@brakmic) February 14, 2018

Lightning Network Grows

The future of Bitcoin is looking bright once again and it seems as though the enormous fees that we saw only weeks ago are starting to dissipate. The price taking a huge dive certainly helped reduce the $ cost of fees as well as reducing the trading volumes and general velocity of bitcoin. However SegWit has also helped to reduce fees and the first ‘organic’ 2MB block was mined recently. Even Coinbase has said they will be implementing SegWit shortly as well as batching transactions, all of which will put less stress on the network.

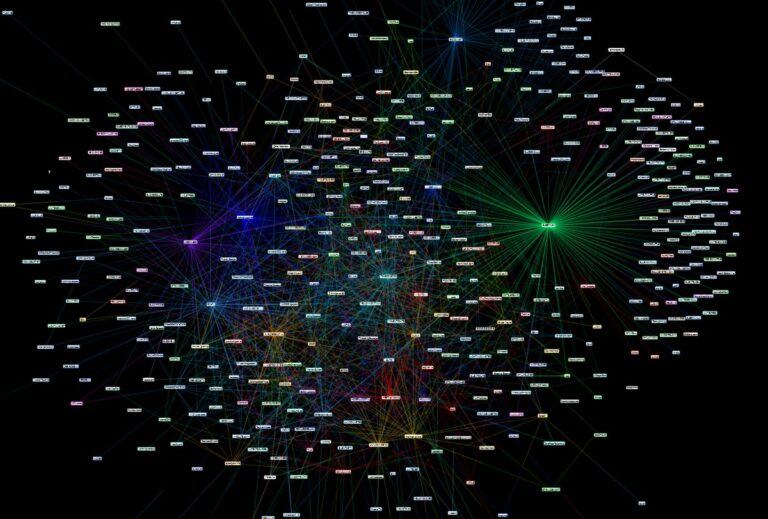

We just passed 700 lightning nodes on mainnet serving 1,700 open channels. 👏 Instant, free and trust-less transactions are here and it is just the beginning. The resemblance this has with our universe is mind-blowing . 🤯👇⚡️🚀🌌 #LightningNetwork #bitcoin #segwit pic.twitter.com/AM8z7geyNR

— Armin van Bitcoin ⚡ (@ArminVanBitcoin) February 14, 2018

However, ‘Satoshi’s vision’ and many early bitcoin adopters’ vision was to provide cheap and fast transactions that would allow you to buy your cup of coffee and send $1 Billion. Unfortunately this vision had been lost as security and censorship resistance come at a cost but the much hyped and long awaited layer two scaling solution is here – lighting.

The testnet launched late 2017 and I even had the pleasure of taking part as the 2657 node. I managed to pay for my ‘Starblocks’ coffee with fake bitcoin and the fee was less than a cent and the payment instant. It gave me a warm fuzzy feeling but I dared not hope that we could truly revive ‘Satoshi’s vision’ from the grave. For one it was very buggy and not that easy to set up and secondly there are the issues with having to lock your money in a channel until you settle your balance, which means part of your wealth is trapped and if the other side of the channel doesn’t pay up, your BTC stake can remain frozen for some time.

Looking at the beautiful map of the 1,700 channels setup on the mainnet its exciting to imagine the potential retail adoption of Bitcoin with cheap and instant transactions. I dare to hope that Bitcoin will really be used as a common medium of exchange one day.

In the meantime, help get this lonely node a payment channel!

There is one lightning node no one wants to connect with. Zooming in reveals why. 😂👇 #bitcoin #LightningNetwork @rogerkver pic.twitter.com/v1piLyxo9i

— Armin van Bitcoin ⚡ (@ArminVanBitcoin) February 14, 2018

Steve Hanke On Crypto

Cryptocurrency seems to encourage a hasty and often stupid response from some of the world’s most intelligent people. Professor Steve Hanke has joined the long list of these high profile remarks, behind Nobel laureate Joseph Stiglitz who said Bitcoin ‘Ought to be outlawed’ and Jamie Dimon who garnered the most publicity for calling bitcoin ‘a fraud’.

Professor Steve Hanke is an American applied economist at the Johns Hopkins University in Baltimore and he recently tweeted:

Cryptocurrencies can never be considered true currencies due to the anonymous nature of digital wallets. Law enforcement is struggling to return funds to victims of last week's theft from the Coincheck exchange due to this reason. https://t.co/scwA6kq7NK

— Prof. Steve Hanke (@steve_hanke) February 4, 2018

Its clear that the anonymity of cryptocurrencies scares some people and governments but as many were quite to respond it kind of the point… Seeing as bitcoin emerged from the ‘Cypherpunk’ group who were activists advocating widespread use of strong cryptography and privacy-enhancing technologies as a route to social and political change.

I suggest you stop tweeting on the topic. One ridiculous uneducated tweet after the other. I think we have making of a Professor Bitcorn #2 folks

— George Kikvadze ⚡⚡⚡ (@BitfuryGeorge) February 5, 2018

Regardless of whether Bitcoin and cryptocurrencies succeed they are without doubt one of the most disruptive innovations as they allow wealth to be stored outside of the control of governments for the first time since fiat money was invented. It is also the first form of money thats supply is controlled by math. Unlike fiat supply which is controlled by centralized groups of power who enjoy the freshly minted currency before generously ‘spreading the wealth’ to everyone. This debases the currency by the time it reaches the average citizen and their dollar is worth less than the same dollar printed, this is called inflation.

Hopefully as time passes the great thinkers of our time will take a bit more consideration when weighing up the good and bad of cryptocurrenices to elevate the debate from – is it a Fraud, Yes of No?