According to Bloomberg, the Financial Conduct Authority (FCA), the UK’s financial regulator, has approved the first cryptocurrency exchange-traded products (ETPs), marking a milestone in the UK’s approach to digital asset investment.

An ETP is a type of security traded on stock exchanges, similar to individual stocks. ETPs are designed to track the performance of a specific index, commodity, currency, or other benchmark, allowing investors to gain exposure to various asset classes without directly owning the underlying assets. ETPs can include different structures, such as exchange-traded funds (ETFs), exchange-traded notes (ETNs), and exchange-traded commodities (ETCs).

An ETF is a specific type of ETP that pools together various assets, such as stocks, bonds, or commodities, into a single fund. ETFs aim to replicate the performance of a specific index or benchmark and are structured as investment funds. When you invest in an ETF, you own shares of the fund, which, in turn, owns the underlying assets. ETFs are typically regulated under investment company laws, which provide certain protections and requirements for investors. Additionally, ETFs can distribute dividends to investors if the underlying assets generate income.

The main difference between ETPs and ETFs lies in their structure and scope. ETPs is a broad category that includes various types of exchange-traded securities, not limited to funds. They can encompass notes and commodities as well. While ETFs are a subset of ETPs and are specifically structured as investment funds, other types of ETPs, like ETNs, are debt instruments issued by banks. ETFs are regulated under specific investment fund regulations, while other types of ETPs, such as ETNs, may have different regulatory frameworks. Moreover, ETNs carry the credit risk of the issuer as they are debt securities, whereas ETFs do not have this risk since they own the underlying assets directly. Another distinction is that ETFs can distribute dividends to investors, whereas ETNs do not because they do not directly own the underlying assets.

Per Bloomberg’s article, WisdomTree Inc. announced today that it has received FCA approval to list two physically-backed crypto ETPs, which will track Bitcoin and Ether, on the London Stock Exchange. These products are expected to begin trading as early as 28 May 2024.

Several other issuers, including ETC Group, 21Shares, and CoinShares, have also applied to list their crypto products in the UK. As of midday on Wednesday, the FCA’s approval list included entries from WisdomTree, 21Shares, and Invesco Digital Markets Plc, all set to be part of the first batch of trading on the approval date.

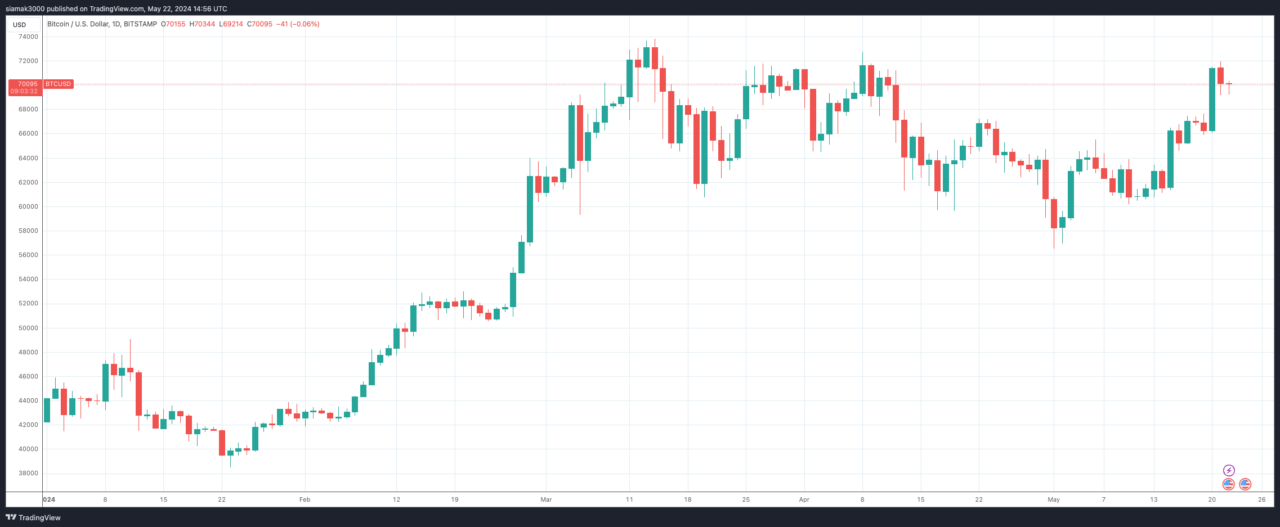

Despite this advancement, the FCA has implemented stringent rules surrounding these products. WisdomTree’s Bitcoin and Ether ETPs, although physically-backed, are only available to professional investors. This restriction is stricter compared to the United States, where the approval of spot Bitcoin ETFs in January has led to significant market growth. Bloomberg says that in the US, these ETFs now manage a combined $59 billion, which is nearly five times the total for similar crypto vehicles traded in Europe.

ETPs linked to cryptocurrencies have been trading on other European stock exchanges for years. The approval of such products by the US Securities and Exchange Commission (SEC) earlier this year played a crucial role in propelling Bitcoin to a record high in March and has facilitated broader adoption among retail and institutional investors.

However, not all global markets have seen the same enthusiasm. In Hong Kong, despite the approval of Bitcoin and Ether ETFs, investor response has been lukewarm. This contrast highlights the varying degrees of market maturity and investor interest in different regions.

ETC Group confirmed that its application is still under review, while 21Shares has already secured approval. CoinShares and the FCA declined to comment on their status, and Invesco had no immediate response.