The power of Bitcoin to create and obliterate fortunes in record time is unprecedented, claims The Spectator. In a recent article, they pose the question: Could the biggest Bitcoin boom and bust still be on the horizon?

The Spectator, established in 1828, is a prestigious British weekly magazine known for its sharp and insightful commentary on politics, culture, and current affairs. With a conservative editorial stance, the magazine has significantly influenced public discourse and political thought in the UK. Its pages have featured contributions from notable writers, including former editor Boris Johnson and current editor Fraser Nelson, and it regularly publishes articles that spark debate and discussion. The Spectator has been recognized with numerous awards for its journalism and commentary, underscoring its reputation for high-quality and impactful content.

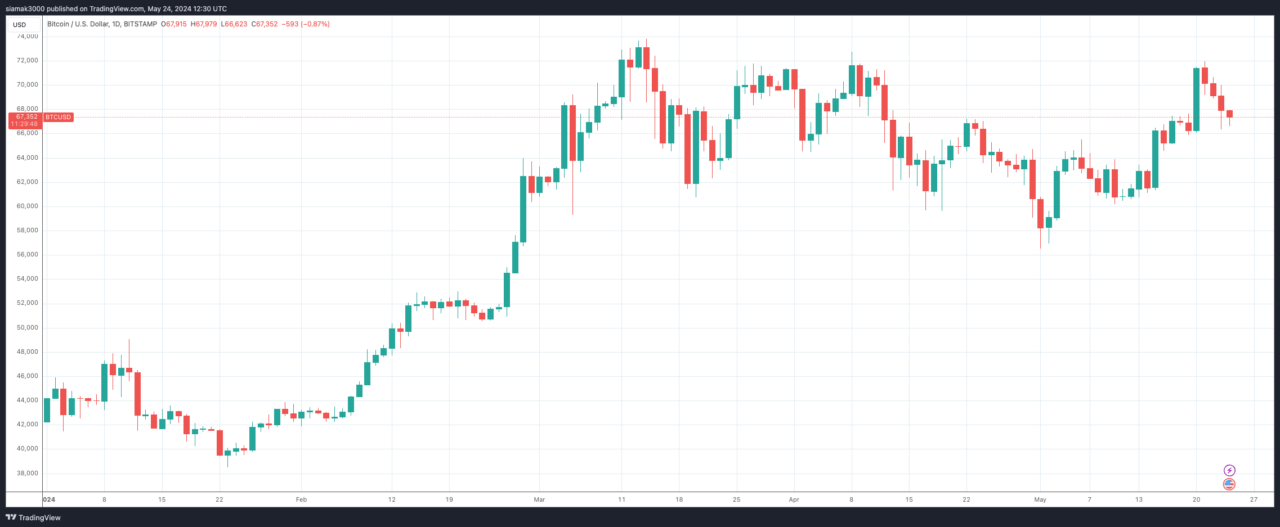

Since January, Bitcoin has seen a remarkable recovery, trading at or even surpassing the highs it reached in 2022. This resurgence occurred despite the trial, conviction, and imprisonment of Sam Bankman-Fried, the founder of the collapsed cryptocurrency exchange FTX.

The article mentions that Bankman-Fried is now reportedly trading grains of rice with fellow inmates at the Brooklyn Metropolitan Detention Center. The article then incorrectly alleges that for many FTX customers, Bitcoin turned into the scam critics had long feared and so it asks the question: why does anyone want to buy it now?

The Spectator suggests the answer lies in the Grayscale Bitcoin Trust, an exchange-traded fund (ETF) that has simplified Bitcoin ownership for retail investors. Grayscale won its lengthy battle with regulators in January, allowing it to offer this fund. Although the article acknowledges that this levels the playing field between ordinary investors and more sophisticated players who might be comfortable with downloading a Bitcoin wallet, it says such spot ETFs raise concerns about the financial stability of millions of households since — allegedly — mainstreaming Bitcoin could lead to widespread financial risk, akin to having a bookmaker in every living room.

The article emphasizes that Bitcoin remains a classic zero-sum game. It says although vast paper fortunes can be made by driving up the price, not everyone can realize these gains and that a mass sell-off could collapse the price to zero. Next, it states that this creates a scenario where quick sellers profit at the expense of slower ones. Bitcoin, the piece argues, earns no income and holds no intrinsic value, likening it to a sophisticated tech-based Ponzi scheme.

The easier it becomes to buy Bitcoin, The Spectator warns, the higher the potential for financial disaster and wealth transfer from the uninformed to the savvy. However, recent Bitcoin price behavior has not mirrored past speculative manias. After soaring from $26,000 last October to $73,000 in March, Bitcoin’s price has stabilized between $60,000 and $70,000 for the past two months. This may suggest a pause in speculative fervor, but The Spectator cautions against ruling out another bubble. It goes on to say that Bitcoin has already defied historical patterns by rebounding multiple times, and the ability to purchase it through an ETF might yet trigger another boom—potentially affecting an even larger number of investors.

Featured Image via Pixabay