On 11 April 2024, during a CNBC “Power Lunch” segment, Chris Mancini, associate portfolio manager at Gabelli Gold Fund, offered a detailed examination of the current dynamics in the gold market. Despite noticeable outflows from gold-backed ETFs, a situation that typically leads to lower prices, the price of gold has been moving higher. This intriguing phenomenon was the center of the discussion.

Mancini started by addressing the unusual situation where gold prices are rising despite the outflows from ETFs, which are typically significant players in the gold market, acting as primary buyers and sellers. He proposed that this divergence signals the presence of substantial physical buying by entities that aren’t captured in typical ETF flow metrics.

A notable point Mancini made was regarding the role of central banks in this new trend, particularly highlighting China’s consistent purchase of gold over the past year and a half. According to Mancini, this move could be motivated by the desire to diversify reserves away from U.S. dollars amid geopolitical tensions. Mancini believes that the Russia-Ukraine conflict and subsequent sanctions on Russia, including the freezing of some of its assets that are held in Western countries, have likely spurred other central banks to consider gold as a safer reserve asset that can’t be digitally seized or confiscated.

Mancini also shed light on the behavior of individual investors and high-net-worth individuals who are increasingly turning to physical gold. He says this trend is partly driven by uncertainties in other investment forms, like the faltering real estate market in China. He mentioned that people are looking for tangible assets that offer long-term security, a trend exemplified by significant sales of physical gold bars at major retailers like Costco. Per his comments, such purchases reflect a broader desire among individuals to hold wealth in forms perceived as stable and less vulnerable to market or political upheavals.

Discussing the implications for gold stocks, Mancini noted that shares in gold mining companies have been outperforming the price of gold itself. This indicates a bullish outlook among investors for the sector. He specifically mentioned Agnico Eagle Mines, a company with robust operations in stable regions like Northern Quebec, known for substantial gold production and strong free cash flow. Agnico Eagle represents a significant holding in the Gabelli Gold Fund.

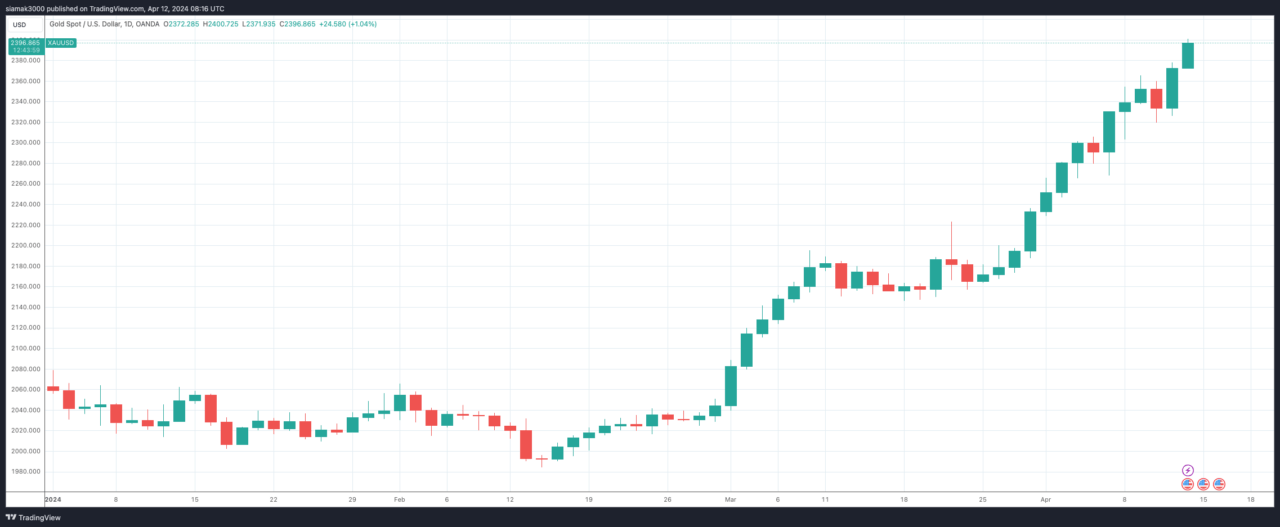

As of 8:15 a.m. UTC on 12 April 2014, gold is trading at $2,396.89, up 1.04% on the day.

Featured Image via Pixabay