A relatively new cryptocurrency project called Ethena is reportedly capturing attention by adopting a hedge-fund trade approach, drawing significant investments and generating buzz. Despite the promising start with yields around 37%, skepticism regarding their sustainability is surfacing, reflecting the volatile history of the crypto market.

Per an article published by Bloomberg News yesterday, Ethena introduces the USDe (USDE) token, which exploits price differentials between spot and futures markets using a strategy known as cash-and-carry in crypto circles. This method has become increasingly profitable amidst rising token prices and funding rates.

The Bloomberg report also mentioned the inherent risks that come with high yields, drawing parallels to past market upheavals, like the TerraUSD incident in 2022. This comparison raises concerns about the potential pitfalls in Ethena’s strategy in the notoriously unpredictable crypto market.

According to Bloomberg, Ethena operates by allowing traders to generate USDe tokens through an automated process, using deposits of stETH among other tokens. Ethena Labs strategically opens short positions across various exchanges to capitalize on high funding rates, illustrating a lucrative tactic in the current bullish market environment.

Bloomberg highlights Ethena’s ambition to create a decentralized cryptocurrency that offers stability and attractive yields, diverging from the traditional stablecoin market dominated by asset-backed tokens.

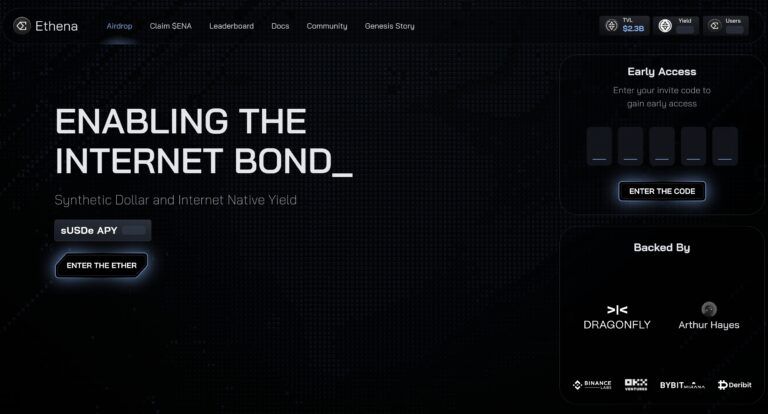

The Bloomberg piece also sheds light on Ethena’s rapid growth, with over $2 billion in cryptocurrency deposits, setting it apart from previous attempts to stabilize token value through basis trades. This surge reflects a strong market demand for high-yield opportunities in the wake of the 2022 lender collapses.

Ethena’s profitability, with more than $25 million in revenue for March alone as mentioned by Bloomberg, showcases its success. However, questions about the strategy’s viability in less favorable market conditions remain, underscoring the potential risks from funding rate fluctuations and the volatility of its collateral, stETH.

Bloomberg notes that Ethena aims to democratize basis trades, providing retail investors access to sophisticated strategies typically reserved for professional trading firms. This effort seeks to enhance transparency and reduce dependency on non-transparent intermediaries.

Despite its achievements, Bloomberg mentions Ethena’s transparency about the risks involved, from funding and exchange risks to the reliance on third-party custodians. This candid approach contrasts sharply with previous projects, indicating a mature stance towards risk management.

Featured Image via Ethena