Alesia Haas, Coinbase’s CFO and a veteran of the finance industry, recently spoke with Fortune. Haas has been with Coinbase since April 2018 and has an impressive background that includes senior roles at Sculptor Capital Management, OneWest Bank, Merrill Lynch, and General Electric.

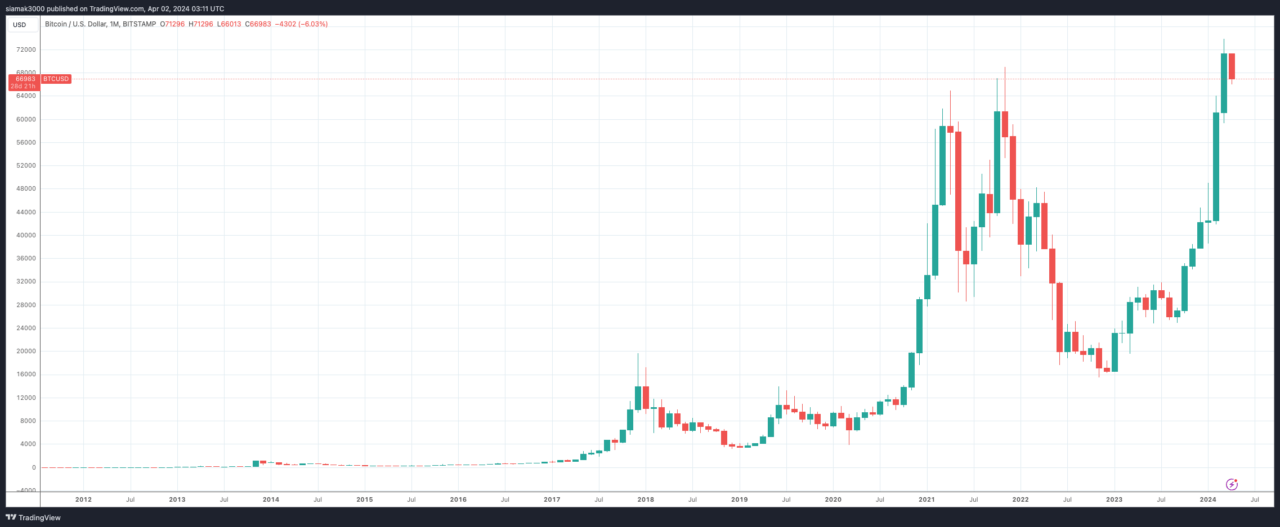

During her interview, Haas reflected on the significance of Bitcoin reaching a new high of over $72,000, advising a broader perspective to appreciate the asset’s growth across four price cycles, each demonstrating a pattern of ascending peaks and troughs. She linked the latest price rally to the advent of US-listed spot Bitcoin ETFs, which broadened the asset’s appeal by integrating it into investment advisory portfolios.

Addressing the dynamics between Bitcoin and Ethereum, Haas outlined the distinct roles each plays, with Bitcoin serving as a value reserve and Ethereum emerging as a preferred platform for decentralized application development. She revisited the SEC’s stance on Ethereum not being classified as a security, advocating for clear federal regulations in the U.S. to safeguard consumers, stabilize markets, and provide clear guidance for entities like Coinbase.

She said:

“Ethereum is not a security. Historically, the SEC has repeatedly said that Ether isn’t a security. The CFTC [Commodity Futures Trading Commission] has said that Ether isn’t a security. The core problem here is that we still do not have comprehensive crypto regulation at the federal level in the United States. And this is something that we feel passionately about. It’s so critical to get regulatory clarity so we can have a clear, equitable, applied regulatory framework that will protect consumers and ensure responsible markets—and also protect businesses like Coinbase, so we know how we can bring compliant products to the market and continue innovation here in America.“

Haas shared observations on the recent crypto bull market’s characteristics, including enhanced participation, influx from both retail and institutional investors, and increased trade volumes, pushing the crypto market cap beyond $2.5 trillion and reigniting mainstream and household interest.

Regarding the fallout from the FTX collapse and the legal consequences faced by Sam Bankman-Fried, Haas noted the resilience of the market and Coinbase’s emphasis on regulatory adherence, highlighting a general trend towards reputable firms within the industry.

Her move from conventional finance to Coinbase was driven by a belief in blockchain’s potential to democratize, expedite, and economize financial transactions. Haas expressed enthusiasm about applying her extensive finance background to foster trust in Coinbase’s crypto products.

Looking ahead, Haas is optimistic about the ongoing and future integration of cryptocurrencies, citing the 52 million Americans currently holding crypto and the incorporation of spot Bitcoin ETFs into US retirement plans. She also underscored the promise of stablecoins and asset tokenization for revolutionizing global transactions and accessibility, using BlackRock’s tokenized money-market fund as a case in point. Haas envisions these innovations uniting the global community, minimizing middlemen, and extending asset access to wider audiences and markets.

Featured Image via Coinbase