On 16 April 2024, during an appearance on CNBC’s “Squawk Box,” Mike Novogratz, CEO of Galaxy Digital, shared his thoughts on the recent volatility in Bitcoin, the cryptocurrency’s role as a safe haven, and how investors should approach the upcoming Bitcoin halving event.

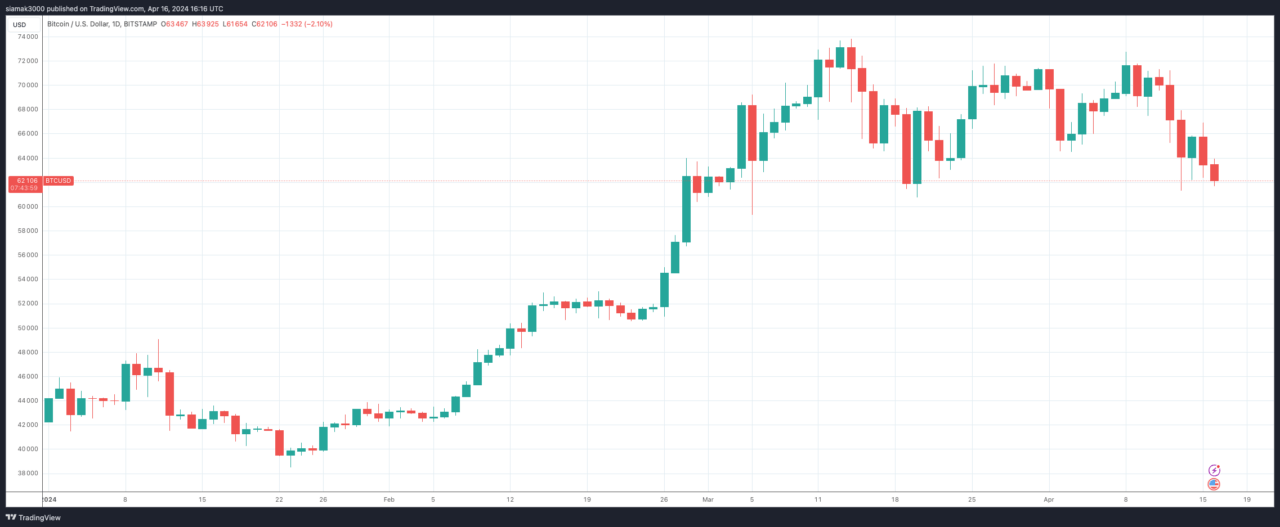

Novogratz started by addressing the recent drop in Bitcoin’s price, which coincided with geopolitical tensions following Iran’s attack on Israel. Despite the dip, he highlighted that Bitcoin started the year strong, rising from $42,000 to $62,000, making it one of the best-performing assets of the year. He emphasized that Bitcoin is still in a very strong position, even with the recent price fluctuations.

One of the key topics discussed was Bitcoin’s role as a safe haven asset. Novogratz elaborated on the natural market reactions where investors tend to revert to what is globally considered safe—usually U.S. dollars and Treasury bills—especially in times of crisis. This reaction often leads to selling off riskier assets like stocks and cryptocurrencies.

He countered the common narrative that Bitcoin should be a replacement for traditional safe havens, explaining that in moments of extreme fear, even seasoned investors revert to traditional safety assets:

“Iran attacks Israel; the only asset that’s open is Bitcoin. People are very long risk assets in general—stocks, crypto, other things—and so the natural reaction is to go to the safe, and safe is still globally dollars and T-bills.“

Novogratz noted that when markets are down, people with leveraged positions tend to reduce their risk, leading to selling pressure in various asset classes, including Bitcoin. He pointed out that Bitcoin’s rise from $40,000 to $70,000 had built a lot of leverage into the market, which needs to be periodically corrected when the market sentiment changes. He added that this is a natural part of market cycles and does not invalidate Bitcoin’s long-term value proposition.

He also discussed the impact of the US-listed spot Bitcoin ETFs on the market. Novogratz believes that most of the ETF investors are new to Bitcoin and are likely to hold their investments long-term, contributing to overall market stability. He contrasted this with the high leverage available in the crypto markets that can lead to significant liquidations and volatility, as seen with the over a billion dollars of liquidations on one Saturday night alone.

On approaching the Bitcoin halving (expected around April 20), Novogratz suggested that investors should understand the historical context of such events. He mentioned that halvings reduce the new supply of Bitcoin, which can lead to price increases if demand remains strong. However, he stressed the importance of looking at a broader set of factors, including macroeconomic indicators and market sentiment, to fully understand potential price movements.

Featured Image via Pixabay