Markus Thielen, the founder of 10x Research, the analyst renowned for accurately predicting Bitcoin’s (BTC) bottom in November 2022 and its subsequent surge to record highs prior to the halving event, has now adopted a bearish stance on risk assets, including technology stocks and cryptocurrencies. This shift in outlook comes amid rising concerns over sustained inflation and its impact on the financial markets.

According to a report by CoinDesk published earlier today, in a recent note to clients, Thielen highlighted that risk assets are currently on the brink of a significant correction. “Our growing concern is that risk assets (stocks and crypto) are teetering on the edge of a significant price correction. The primary trigger is the unexpected and persistent inflation,” he stated. With the bond market adjusting its expectations to fewer interest rate cuts—now anticipating less than three as opposed to six earlier this year—the landscape appears increasingly precarious for risk-sensitive investments.

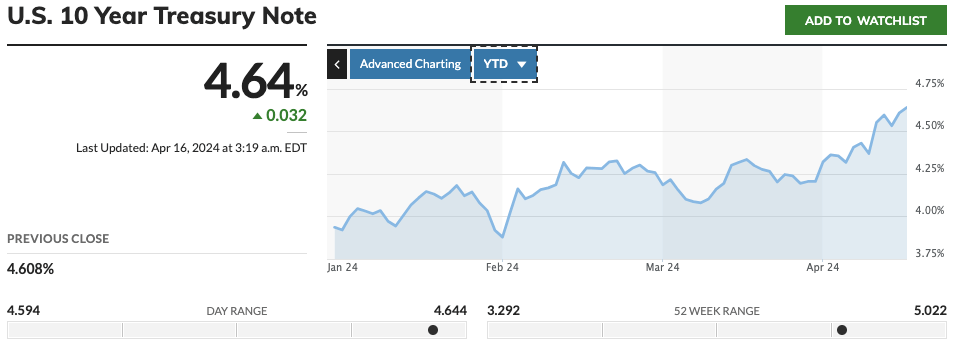

The bond market adjustments have seen the yields on the U.S. 10-year Treasury notes climb to 4.642% this month, marking the highest level since November 2023.

This rise in what is often considered the risk-free rate makes higher-risk investments, such as technology stocks and cryptocurrencies, less attractive. Thielen noted that this hawkish repricing in the bond market, driven by persistent U.S. inflation alongside a resilient U.S. labor market and economy, has significantly dulled the appeal of these high-risk assets.

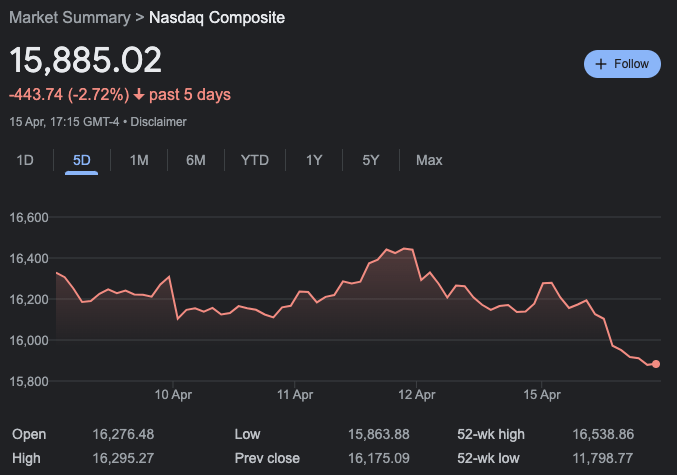

Reflecting his cautious stance, Thielen mentioned, “We sold all our tech stocks last night as the Nasdaq is trading very poorly and reacting to the higher bond yield. We only hold a few high-conviction crypto coins.”

Thielen further elaborated that much of the Bitcoin rally seen through 2023 and into 2024 was fueled by expectations of rate cuts, a narrative now being seriously challenged. According to a recent Wall Street Journal article by Nick Timiaros, Blake Gwinn, an interest rate strategist at RBC Capital Markets, has said, “Our initial prediction included three rate cuts, with a June reduction being crucial. Should we move past June without a cut, our expectations adjust towards a potential first reduction in December.”

The U.S. SEC’s approval of eleven spot Bitcoin ETFs on January 10 initially drove nearly $12 billion into these funds, supporting a robust price rally. However, inflows have tapered off significantly, with the 5-day average net inflows to these spot ETFs dropping to zero.

As the excitement of the Bitcoin network’s upcoming quadrennial halving—which is set to reduce the reward for mining new blocks, thus slowing the pace of new Bitcoin entering the market—begins to wane, some market observers, including Thielen, anticipate that the correction might accelerate. He points out, “After an initial novelty hype, ETF flows tend to run out unless prices continue increasing—which they have not done since early March. With two to 17% drawdowns, those investors might stay on the sidelines.”

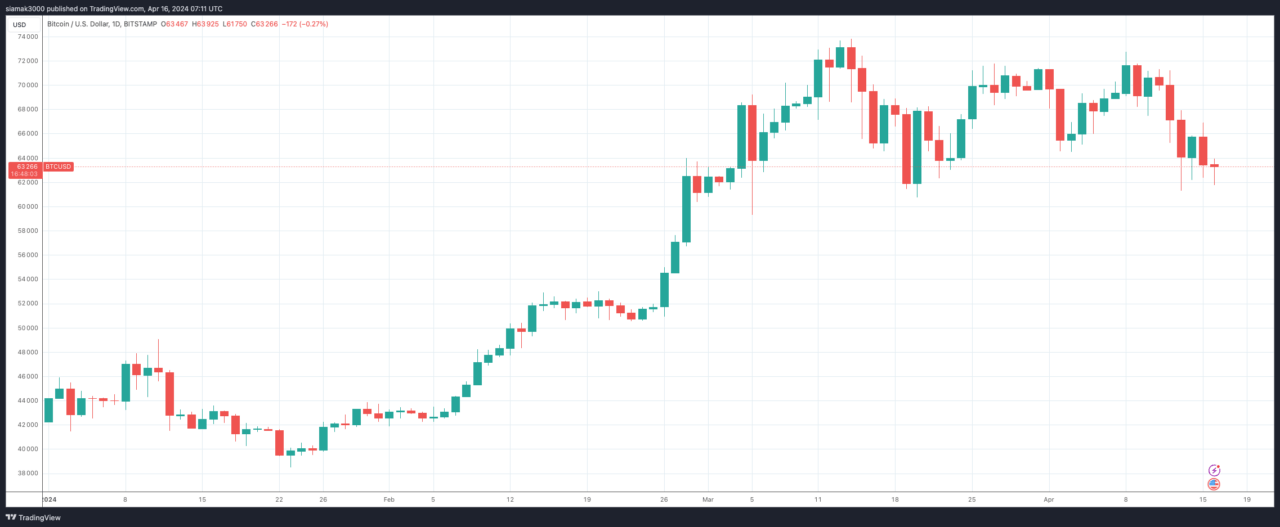

At the time of writing, Bitcoin is trading at around $63,410, down 4.7% in the past 24-hour period.

In the past five-day period, the tech-heavy NASDAQ Composite Index is down 2.72%.

Featured Image via Pixabay