In the cryptocurrency space, Bitcoin has long been the king of the hill. As the demand for exposure to this digital asset has grown, Wall Street has answered the call by offering various investment vehicles, including spot Bitcoin exchange-traded funds (ETFs), 11 of which got approved by the U.S. SEC on January 10. However, the tides seem to be turning, as these once-popular ETFs have recently experienced an unprecedented streak of net outflows.

BitMEX Research revealed on March 23 that spot Bitcoin ETFs have seen better days. In the past week alone, a staggering $888 million bid farewell to these funds, marking the longest run of net outflows to date. This new record surpasses the previous four-day streak set just a couple of months ago in January. Monday, March 18th, stood out as a particularly grim day, with Grayscale’s GBTC bearing the brunt of the outflow onslaught.

As if the substantial outflows weren’t enough, spot Bitcoin ETFs also had to contend with meager inflows. Industry giants like Blackrock’s IBIT and Fidelity’s FBTC, which usually lead the pack, saw record-low inflows that barely made a dent in offsetting the exodus of funds. It’s clear that the enthusiasm for these investment vehicles has taken a significant hit.

While it’s easy to point fingers at Bitcoin’s recent price slump as the culprit behind the outflows, there may be more to the story. Speculation is rife that the unusually large outflows from Grayscale’s GBTC could be tied to the trading activities of digital financial firm Genesis, which recently found itself in hot water.

Last Friday, Coinbase Research shed light on a potential source of selling pressure that could be influencing the spot Bitcoin ETF market. The bankruptcy estate of Genesis Global is reportedly gearing up to sell a substantial chunk of GBTC shares, separate from the shares pledged as collateral for a loan from Gemini Earn users. While the dots have yet to be officially connected, the timing of the significant changes in GBTC shares outstanding is certainly raising eyebrows.

In their most recent weekly market commentary, Coinbase Research’s David Doung and David Han wrote:

“One known source of potential selling pressure that we’ve been anticipating since mid-February has been Genesis Global Holdco LLC’s sale of 35.9M GBTC shares (worth $2.1B). Recall that Genesis received permission on February 14 from the US Bankruptcy Court for the Southern District of NY to sell its GBTC shares. Of those shares, around 31.2M were linked by Gemini Trust Company to the Gemini Earn Program. However, the court ruled that these shares were never properly pledged as collateral by Genesis to borrow from Earn users, so Genesis could sell these shares at market value to pay back creditors – in either cash or bitcoin. The Wall Street Journal reported on March 18 that there’s an outstanding creditor-backed proposal that could return up to 77% of customer holdings in-kind.

“Note that this is separate from the 30.9M in GBTC shares that Genesis did pledge as collateral to borrow $1.2B from 232k Earn users back in 3Q22. Gemini recently settled with Genesis to return all of those assets in-kind with 97% to be paid within a few weeks, pending court approval.

“It’s not clear whether the recent GBTC outflows are linked to these sales, as there are no direct public filings that immediately announce when they happen. For now, we can only infer that the size and scope of the change in GBTC shares outstanding coincide with recent developments on Genesis’ payment obligations. More importantly, given that the majority of creditor payments will be made in crypto and not cash, the market effect on bitcoin performance should eventually be net neutral, in our view.“

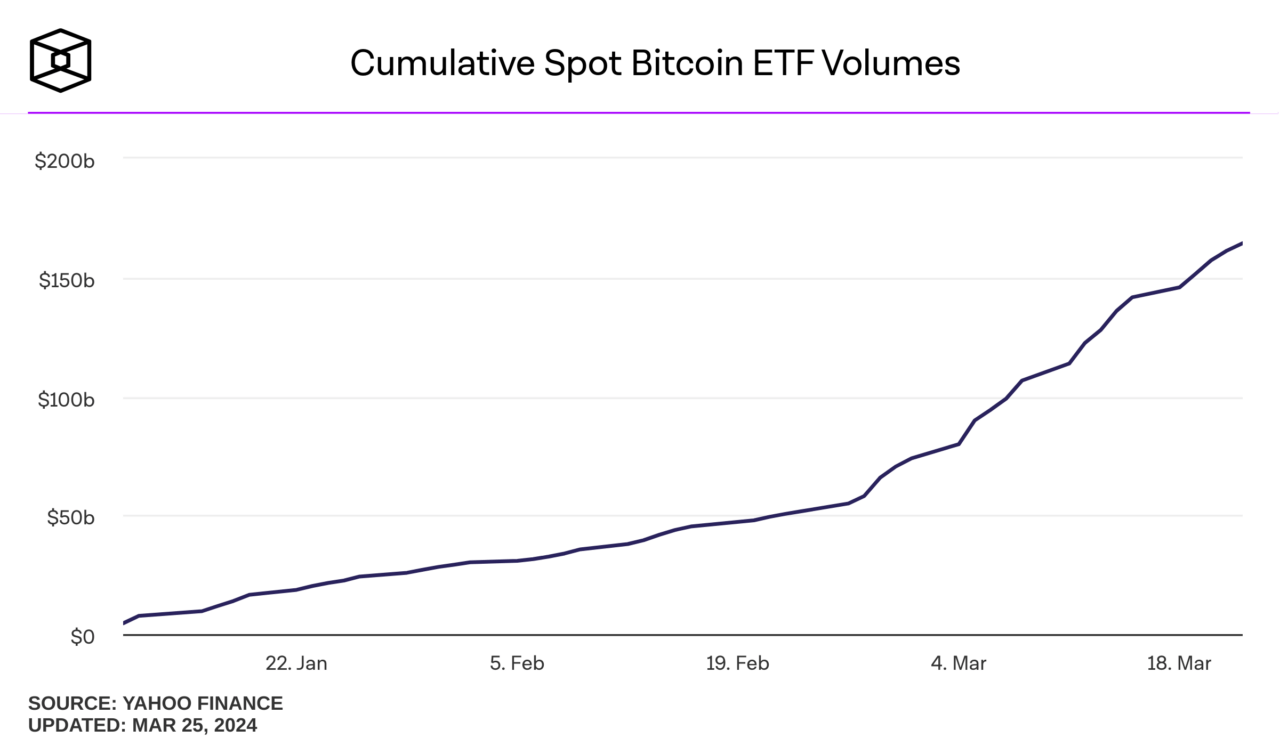

Despite the gloomy outflow numbers, it’s not all doom and gloom for spot Bitcoin ETFs. Trading volumes, while slightly lower than in previous weeks, still managed to put up a fight. The Block’s data dashboard reveals that these ETFs saw their cumulative volumes grow by a respectable $22 billion over the past week, bringing the total to a hefty $164 billion. This suggests that while some investors may be jumping ship, others are still willing to test the waters.

Featured Image via Pixabay