Uniswap is a prominent decentralized exchange (DEX) protocol built on the Ethereum blockchain. Unlike traditional centralized cryptocurrency exchanges, it leverages an automated market maker (AMM) model.

This system employs user-provided liquidity pools and a specialized algorithm to facilitate trades without the need for a centralized order book. Any individual with an Ethereum-compatible wallet can interact with the Uniswap protocol, removing barriers to entry often present in traditional exchanges.

Uniswap adopts a decentralized governance model, enabling token holders to participate directly in decisions shaping the platform’s future. By removing intermediaries, Uniswap minimizes counterparty risks such as security breaches or censorship affecting user funds. Smart contracts algorithmically determine exchange rates based on the balance of assets within liquidity pools, promoting automated and transparent price discovery.

The Uniswap Foundation is an entity established to support and facilitate the growth and development of the Uniswap protocol, one of the leading decentralized finance (DeFi) platforms on the Ethereum blockchain. This foundation plays a crucial role in stewarding the protocol towards its decentralized vision by funding grants, supporting community initiatives, and ensuring the protocol remains at the forefront of innovation within the DeFi space.

Founded with the intent to bolster the ecosystem surrounding Uniswap, the foundation aims to enhance the protocol’s accessibility, security, and functionality while promoting decentralized governance practices. It acts as a bridge between the Uniswap community, developers, and other stakeholders, providing resources and guidance to encourage the development of new features, improvements, and applications built on top of the Uniswap protocol.

The Uniswap Foundation is pivotal in managing the community treasury, allocating funds through grants and other financial mechanisms to projects that align with the protocol’s mission and values. This includes funding for software development, research, community building, and educational initiatives that drive the adoption and understanding of decentralized finance principles.

On 23 February 2024, Erin Koen, the Governance Lead at the Uniswap Foundation, introduced a proposal for a comprehensive upgrade to the protocol’s governance system.

This upgrade is designed to enhance the protocol’s fee mechanism, rewarding UNI token holders who actively delegate and stake their tokens. The proposal outlines the motivations behind this initiative, provides a detailed account of the technical adjustments needed, and discusses the logistics of implementation. Additional context is offered through multiple appendices. Subject to the community’s feedback, the proposal is slated for a Snapshot vote on 1 March 2024, followed by an on-chain vote a week later, on 8 March 2024.

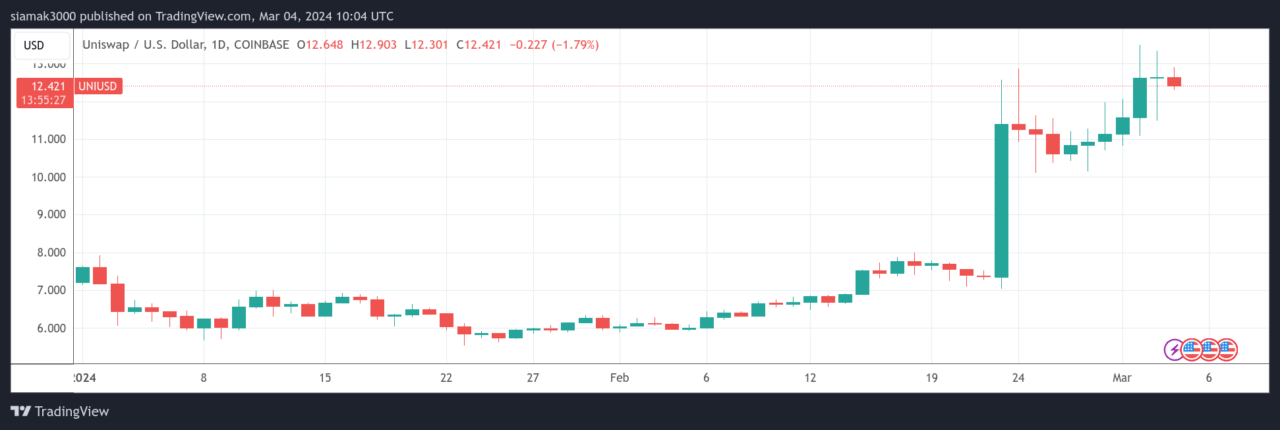

In the wake of this announcement, Jamie Coutts, a freelance blockchain strategist and former crypto market analyst at Bloomberg Intelligence, highlighted the potential impact of the Uniswap “fee switch” on the cryptocurrency sector. Coutts views this development as a landmark moment for crypto assets, underscoring the revenue-generating capabilities of open finance protocols like Uniswap. The proposal has sparked a notable rally in the UNI token, which saw a 50% increase in value following the news.

Coutts further elaborated that Uniswap’s market capitalization (around $10 billion at the time of his analysis), coupled with its anticipated fee revenue of $760 million for the year, places it in league with the revenues of major global exchanges such as ASX and SGX.

He pointed out that despite a 14x price-to-sales (P/S) multiple not being considered ‘cheap’ in traditional markets, Uniswap’s valuation is comparable to that of the CME Group. However, he highlighted a striking contrast in operational efficiency, with Uniswap’s lean team of around 40 developers enabling it to achieve approximately $18.75 million in sales per employee, dwarfing the CME’s $1.45 million per employee ratio.

Coutts also noted the technical analysis of the UNI token’s chart, indicating a clear breakout pattern, signaling a strong bullish sentiment among investors. Nevertheless, he cautioned that despite this positive trend, UNI still needs to demonstrate its ability to outperform Bitcoin over the course of the year, setting a high bar for the token’s performance expectations.

Featured Image via Uniswap