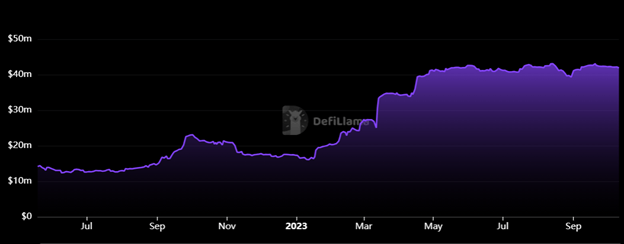

Exchanges have seen the lowest spot and derivatives trading volume in Q3, decreasing over 15% in August. Data suggests a further decline in Q4, according to CCData’s Exchange Review report. If that’s the case for centralized exchanges, then it’s possible decentralized derivative exchanges may experience worse results, although a move on-chain has been seen with the growing adoption of decentralized finance (DeFi) over the last few years.

However, the decentralized derivatives ecosystem is seeing mixed results; protocols like Vertex, MUX, and Hyperliquid have experienced substantial growth in the last six months, and these protocols don’t even have a quarter of the total value locked (TVL) from the top market leaders such as GMX and dYdX. All in all, it seems the market is favoring more risky, exotic trading options and features instead of the typical, narrowed options.

That said, let’s take a look at the top decentralized derivatives exchanges in 2023 in terms of growth volume revenue, and we’ll also compare fees, UI/UX, trading features, and more.

GMX

GMX is a decentralized derivatives and spot exchange launched in 2021, quickly becoming one of the largest protocols. At its peak, GMX reached nearly $700M in TVL.

GMX is currently the market leader in the derivatives space due to its user-friendly UI, amount of assets supported, low fees, and high throughput.

It allows users to trade assets on-chain with leverage and without going through a KYC check.

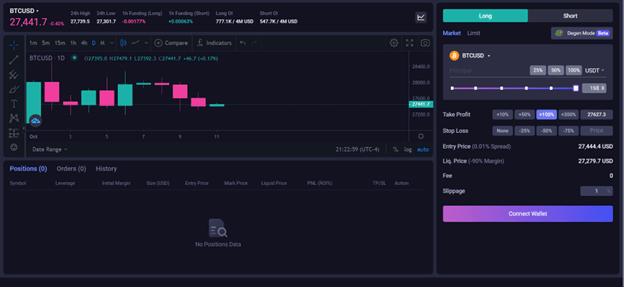

As seen in the image above, its trading dashboard is more simple and spaced out. We can see almost every option on a CEX, like margin, debt, stop loss, market and limit order, and more.

GMX leverages several price oracles to provide accurate, real-time data and, therefore, allow trades to be executed with reduced price slippage, which in turn also reduces the risk of liquidations. On CEXs, this is known as scam or temporary wicks. Another benefit of this is the save on cost allowing users to enter and exit positions with minimal spread and low price impact.

- Fees

There are several types of fees on GMX. Keep in mind gas fees are relatively low as it relies on Arbitrum (L2) or Avalanche (L1). Here’s a quick breakdown of it:

- GMX charges 0.1% per trade, whether for opening or closing a position.

- There’s a fee for staking GMX, GLP, or GM, which can vary depending on the coin and the APR.

- There’s a dynamic borrowing fee, which will vary depending on the asset

- And there’s a swap fee of 0.33%.

Amount of Supported Coins

- GMX V2 allows users to go long or short on a handful of cryptocurrencies, including BTC, ETH, AVAX, DOGE, LINK, and other popular options.

Competitors

GMX’s main competitor is dYdX, which unlike GMX, uses an order book to match orders and a different consensus mechanism. dYdX also offers more coins, but doesn’t have the same level of programmable liquidity as GMX. Currently, GMX has over $620 million in TVL, compared to dYdX’s $350 million.

dYdX

dYdX is a decentralized exchange that offers perpetual trading options for over 35 popular cryptocurrencies and 20x leverage.

While dYdX’s was built on Ethereum smart contracts, it relies on STARK, StarkNet’s cryptographic proof system, which uses zero-knowledge rollups. This allows dYdX to process orders at high throughput while enjoying the benefits of Ethereum’s security system.

As seen in the image above, the UI may be more complicated than GMX or other competitors.

dYdX uses an order book, unlike AMMs in major derivatives protocols. Technically, it leverages a hybrid model in which orders are signed off-chain and settle off-chain, and the liquidity for perpetuals comes from the exchange itself. This hybrid system has allowed dYdX to become one of the most liquid exchanges in DeFi.

dYdX also offers a risk-free test environment on Goerli, allowing developers to test all of the protocol’s features and also trading strategies.

- Supported coins

The advantage over GMX could be the amount of supported cryptocurrencies —35, including major pairs such as BTC, ETH, DOGE, and LINK.

- Fees

When it comes to fees, dYdX has a more simple system; takers pay 0.050% while makers pay 0.020%.

MUX

MUX is a multi-chain decentralized derivatives trading platform that allows users to trade a handful of cryptocurrencies using leverage of up to 100x. It also offers rewards for providing liquidity to the platform through buying and staking MUXLP, the protocol’s liquidity provider (LP) token.

Within its trading dashboard we can find multiple options and features, using a chart powered by TradingView. You can pretty much see the same features as you would see on a CEX; market and limit order, stop loss, leverage, and more. You can also change the network on the top right of the screen.

- Supported coins

MUX v2 offers over 30 cryptocurrencies up for trading, including BTC, AVAX, BNB, FTM, LINK, and UNI.

- Fees

MUX charges a fixed position fee of 0.06% —open and close positions. Here’s the breakdown on fees and trading spreads:

- Fixed trading fee of 0.10%.

- Charges funding payments, which can be seen as borrowing fees from positions.

- Spreads on MUX range from 0% to 0.12% depending on the asset.

ApolloX

ApolloX is an orderbook exchange that allows users to long or short several cryptocurrencies using leverage, up to 150x depending on the asset.

Similar to dYdX, ApolloX uses a hybrid system in which orders in which liquidity is pulled from off-chain orderbooks and settled on-chain. This allows the protocol to run an efficient liquidity and order matching system while preserving privacy and decentralization.

As seen in the image below, ApolloX comes with quite a simple and user-friendly trading dashboard, in which we can see basic options like long, short, market and limit order, leverage and stop loss, and more features you’d normally see on a derivatives exchange.

ApolloX has been one of the fastest growing derivatives protocols in 2023, and we can attribute that to a number of factors, including its new V2 dashboard on BNB Chain, and its launch on zkSync. Additionally, users can trade a wide range of assets with far superior leverage than most protocols.

- Fees

Despite its benefits, fees may not be ApolloX’s strength. The protocol charges takers 0.07% which, as you can see, is way above the industry average of 0.05%. Meanwhile, makers pay 0.02%.

- Supported coins

ApolloX supports around 28 cryptocurrencies, including the most popular in the market. However, leverage will highly depend on which asset you choose to trade, as some will allow you to go up to 150, but others will allow a more conservative range.

Hyperliquid

Hyperliquid is a derivatives trading platform that leverages a fully on-chain order book, unlike most protocols that use a hybrid model. The liquidity is provided through trading vaults, which allow users to create a vault with their own market-making strategies or allow users to deposit into that vault and generate profits with an automated strategy, so it’s a win-win for the maker, the liquidity provider, and the protocol too.

Hyperliquid offers almost all of the features you’d see in a CEX, such as market and limit orders, stop loss, and leverage up to 50x, depending on the coin.

- Fees

0.025% fees for takers and 0.002% maker rebate fees.

- Supported coins

Hyperliquid is currently the protocol with the largest coin offering: up to 51, including popular cryptos such as BTC, ETH and LINK, but also memecoins like PEPE, BANANA, and DOGE

Closing Thoughts

In DeFi, there’s room for everybody. Therefore, the derivatives protocol that you choose will depend on your appetite for risk and your very own style as a trader.

Some protocols are experiencing a massive surge in TVL and trading activity as they’re currently offering more exotic (and risky) trading pairs, a higher leverage, and innovative ways of staking or generating yield through copy trades or vaults.

Other protocols, however, are more conservative and will offer a narrowed list of assets and lower leverage. While the risk is lower, so is the reward, and most of these protocols will offer a more simple and direct dashboard, with an overall user-friendly UX.

Featured image via Unsplash.