On February 15, in an interview on CNBC’s “Closing Bell: Overtime,” Alesia Haas, CFO of Coinbase Global Inc. (NASDAQ: COIN), shared an in-depth analysis of the company’s financial performance for Q4 2023 and her outlook on the crypto market.

Following the announcement of Coinbase’s financial results, which surpassed expectations with a significant profit and earnings beat, Haas discussed the factors contributing to this success and the evolving landscape of cryptocurrency investments.

Coinbase’s Q4 earnings were notably driven by an uptick in trading volume, attributed to heightened volatility and interest in the crypto space, particularly by the January 11th launch in the U.S. of multiple SEC-approved spot Bitcoin ETFs and by optimism regarding the macroeconomic environment.

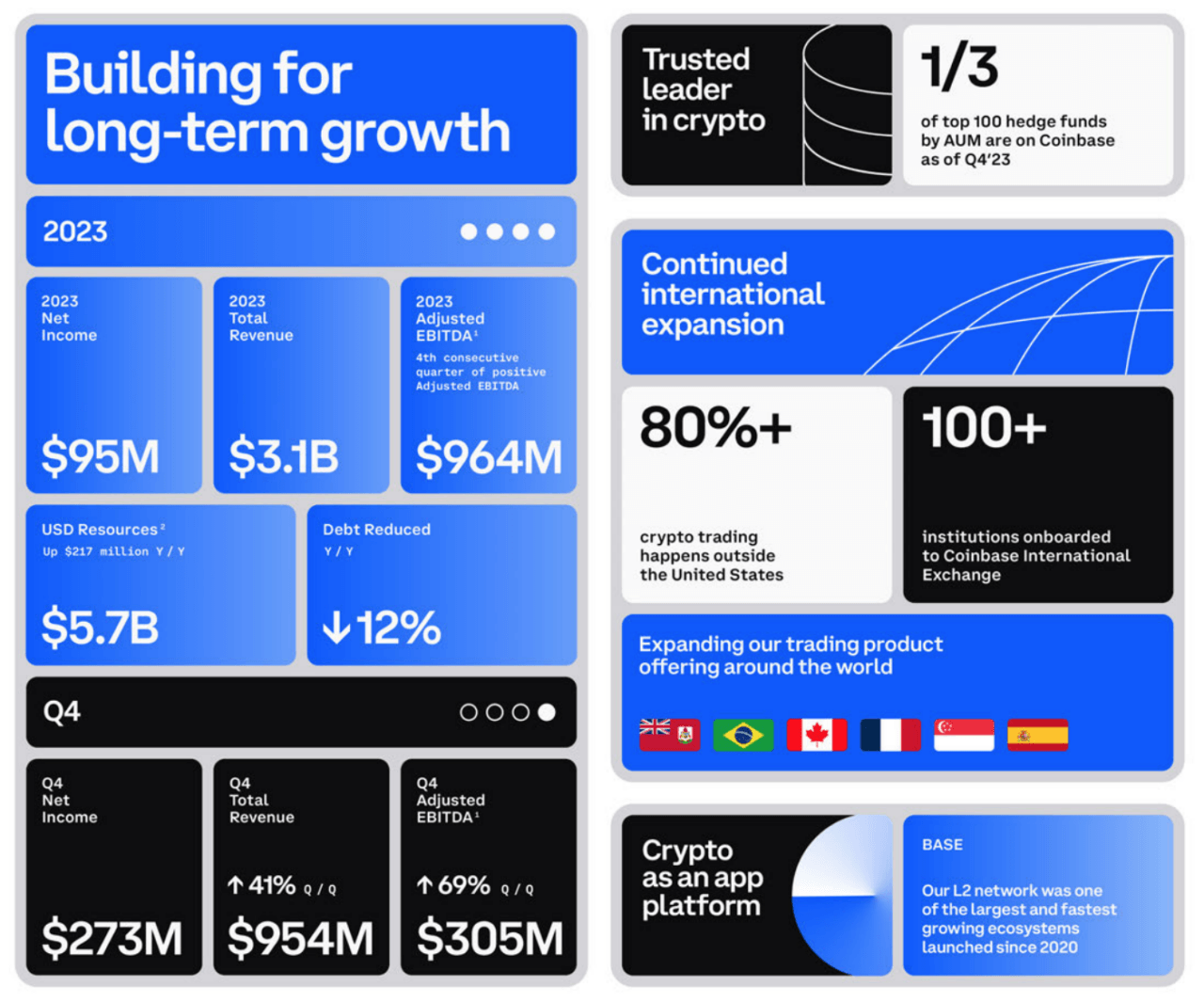

Haas says that this surge in trading activity was not limited to retail investors but was also prominent among institutional participants and users of Coinbase’s Advanced trading platform, leading to a robust $273 million in net income for the quarter. The cumulative effect of these dynamics resulted in nearly a billion dollars in adjusted EBITDA for 2023, achieving the company’s goal of maintaining positive adjusted EBITDA across all market conditions.

Despite the overall success, Haas noted a slight decrease in the take rate, which she attributed to a shift in trading mix rather than fee adjustments.

The introduction of US-listed spot Bitcoin ETFs has been a double-edged sword; while it has introduced competition for investor and trader activity traditionally directed towards Coinbase, it has also significantly increased overall interest and investment in cryptocurrencies. Haas highlighted the unprecedented growth of spot Bitcoin ETFs, with $4 billion in net inflows making it one of the fastest-growing ETF categories and surpassing silver in total size. Haars says Coinbase is proud to serve as the custodian for 90% of total amount of Bitcoin held by these spot ETFs, directly benefiting from this surge.

The momentum generated by the spot Bitcoin ETFs has not only been beneficial for Coinbase but has also contributed to a broader increase in crypto engagement. The industry has witnessed a notable rise in both simple and advanced trading activities, as well as institutional platform use, which supports the Bitcoin ETFs. This trend has continued into the first quarter of 2024, indicating a sustained interest and growth in the crypto market.

Featured Image via Coinbase