In the cryptocurrency space, certain trends and movements offer valuable insights into market sentiment and potential future shifts. One such development, highlighted by crypto analyst Ali Martinez on February 26, has caught the attention of the crypto community: a significant increase in the number of “Bitcoin whales.”

According to Martinez, over 150 new Bitcoin addresses, each holding more than 1,000 BTC, have emerged in just the last month:

In the cryptocurrency ecosystem, the term “whale” refers to individuals or entities that hold a large amount of cryptocurrency. Specifically, a Bitcoin whale is someone who owns a Bitcoin address with a balance of 1,000 BTC or more. Given the value of Bitcoin, these whales have significant financial resources and, as a result, the potential to influence market movements. Their large transactions can lead to noticeable changes in Bitcoin’s price, making their activities of keen interest to investors and analysts alike.

A Bitcoin address is akin to an email address or a bank account number, but for Bitcoin transactions. It’s a unique string of letters and numbers that represents a destination for Bitcoin payments. Each address is associated with a private key, which is required to access and send the Bitcoins held at that address. Bitcoin addresses allow for anonymity, as they do not directly reveal the identity of their owner, making them a fundamental part of the cryptocurrency’s appeal.

The creation of over 150 new Bitcoin addresses holding more than 1,000 BTC each is noteworthy for several reasons:

- Market Confidence: The influx of new whales could signal growing confidence in Bitcoin’s long-term value. Investors making such substantial commitments are likely bullish on Bitcoin’s future, suggesting a positive outlook among some of the market’s most influential players.

- Potential Market Impact: With the ability to move large volumes of Bitcoin, whales can significantly impact the market. Their buying or selling activities can lead to price fluctuations, making the market more volatile in the short term. However, an increase in the number of whales might also lead to greater liquidity and potentially more stability in the long run.

- Increased Institutional Interest: The emergence of new whales could indicate growing institutional interest in Bitcoin. As more companies and financial institutions explore cryptocurrency as an investment or hedge against inflation, the number of high-value Bitcoin addresses is likely to rise.

Earlier today, Ki Young Ju, the Founder and CEO of the South Korean blockchain analytics startup CryptoQuant, pointed out that on-chain data—a term referring to the publicly available transaction records on the blockchain—indicates a significant accumulation of Bitcoin by new whales. According to Ju, these whales are currently sitting on a 38% unrealized profit, suggesting that despite the substantial gains, these investors might be aiming for even higher returns before cashing in.

The term “on-chain data” refers to all transactions and information recorded on the blockchain, which is the underlying technology of cryptocurrencies like Bitcoin. This data is transparent and accessible to anyone, making it a goldmine for analysts looking to gauge market sentiment and investor behavior.

“Unrealized profit” refers to the gain in value of an investment that hasn’t been sold yet. For instance, if an investor buys Bitcoin at $10,000 and the price rises to $13,800, they have an unrealized profit of 38%. This profit remains “unrealized” until the investor sells their Bitcoin, at which point it becomes a “realized” profit.

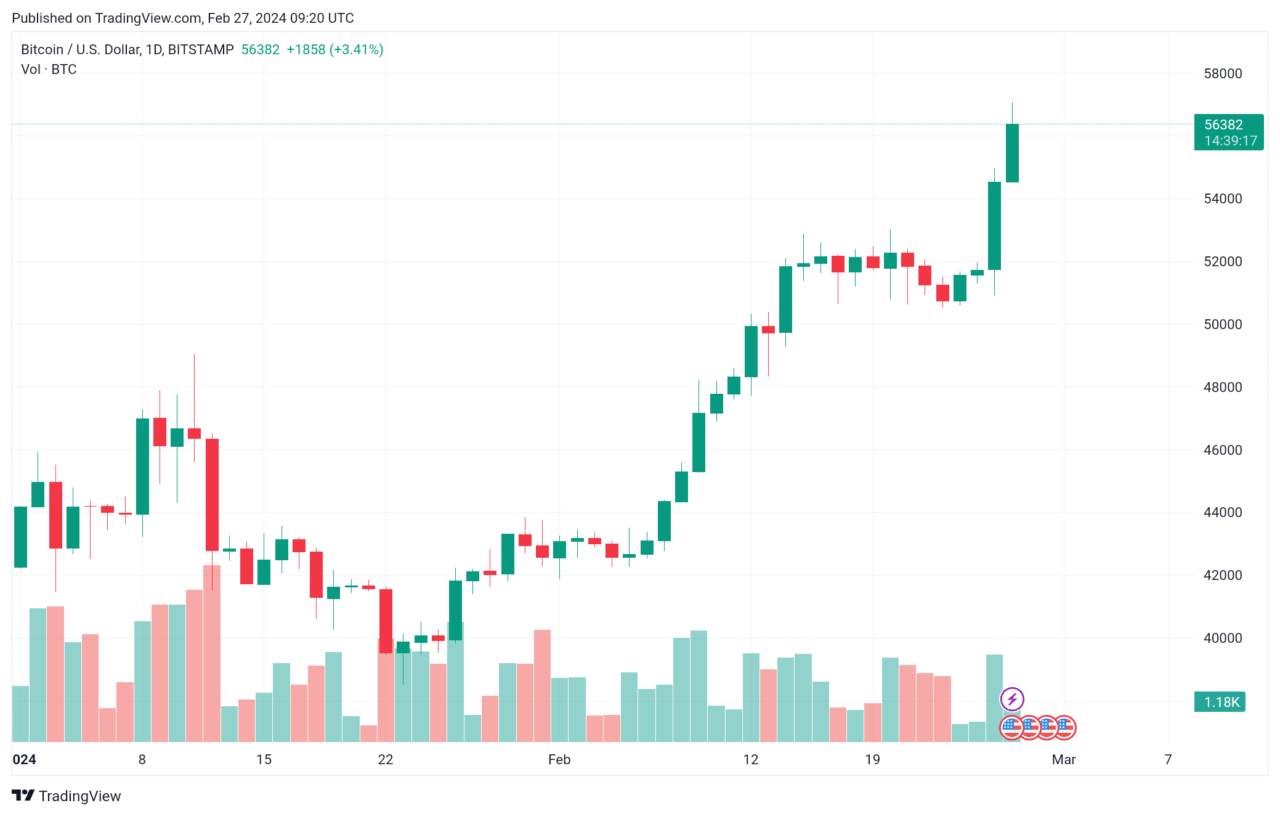

At the time of writing, Bitcoin is trading at around $56,537, up 10.9% in the past 24-hour period.

Featured Image via Pixabay