Introduction

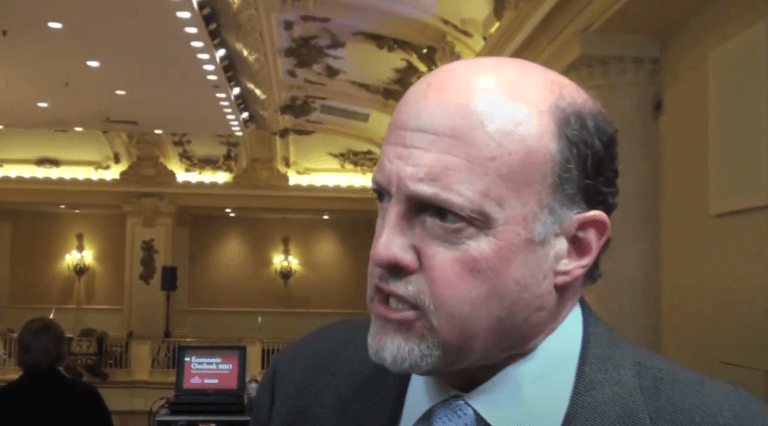

In yesterday’s episode of CNBC’s “Mad Money,” host Jim Cramer outlined his market themes for 2024, offering investors a roadmap for navigating a year he anticipates to be tumultuous yet potentially rewarding. This analysis explores Cramer’s insights, juxtaposing them against the backdrop of current economic indicators and market sentiments.

The ‘Magnificent 7’ and the Fate of High-Performers

Cramer’s discourse began with an examination of the ‘Magnificent 7’ – a term he uses for the top-performing stocks. He speculated on their continued success in 2024, with a pointed focus on Tesla. Drawing parallels with characters from classic films like “The Magnificent Seven” and “The Princess Bride,” Cramer expressed concerns over Elon Musk’s leadership approach and hinted at potential vulnerabilities in Tesla’s stock performance.

Election Year Dynamics

Cramer’s analysis then shifted to the potential impact of the 2024 election on the stock market. Noting the unique nature of this election, he discussed former President Trump’s market-friendly policies and speculated on the possible economic implications of Trump’s campaign strategies and potential policy announcements. Cramer seemed to lean towards a bullish outlook for the stock market in the context of the election year, though he advised caution given the unpredictable nature of political events.

Healthcare Sector: The Promise of GLP-1 Drugs

A significant portion of Cramer’s discussion was dedicated to the healthcare sector, particularly GLP-1 drugs. He emphasized the importance of these drugs in treating a range of conditions, from diabetes to obesity, and advised investors to consider exposure to this promising area. Cramer’s confidence in GLP-1 drugs was underpinned by insights from the JP Morgan Healthcare Conference.

China’s Economic Prospects

Cramer expressed skepticism about China’s economic trajectory under its current leadership. He questioned the sustainability of China’s growth model, which heavily relies on real estate and manufacturing. Cramer warned investors to be cautious about the long-term prospects of Chinese investments.

Mergers and Acquisitions: A Revival

Turning to mergers and acquisitions, Cramer predicted a resurgence in 2024. He referenced recent regulatory changes and market conditions that could encourage more M&A activities. This optimism was, however, tempered by his critique of some recent failed deals, suggesting a selective approach to investing in companies involved in M&A.

Interest Rate Speculations and Economic Outlook

Cramer was critical of the forward yield curve predictions, particularly the expectation of multiple rate cuts. He described these predictions as overly optimistic, advising investors to remain grounded in their economic expectations.

Stock Recommendations and Viewer Engagement

Cramer answered viewer queries, providing insights into specific stocks. He recommended Snowflake, citing its potential in AI and cloud computing. He also expressed confidence in Etsy’s management, suggesting its potential attractiveness for M&A if the stock remains undervalued.