On Friday, Coinbase (NASDAQ: COIN) shares rose following an upgrade by investment bank Oppenheimer. The firm shifted its rating from “perform” to “outperform,” setting a new price target of $160 per share. This upgrade reflects a positive outlook on Coinbase’s future, despite recent challenges in the crypto market.

According to an article by Helene Braun and Will Canny for CoinDesk, Oppenheimer’s analyst Owen Lau pointed out the resilience of Coinbase during the recent crypto winter. Lau says that unlike many of its peers who struggled or collapsed, Coinbase not only survived but continued to actively defend its business and the broader industry. This resilience, according to Lau, is a testament to the strength and toughness of the company’s management team, qualities that he believes are often underestimated by investors.

A key factor in Oppenheimer’s optimistic assessment is the legal landscape surrounding Coinbase. Lau suggests that there’s a “good chance” Coinbase will emerge victorious in its lawsuit against the Securities and Exchange Commission (SEC), or that the court might dismiss the case. This potential legal triumph is seen as a significant positive for the company’s future.

Coinbase’s involvement in the Bitcoin exchange-traded funds (ETFs) market is another cornerstone of Oppenheimer’s upgrade. The firm serves as a custodian for several issuers of the recently approved ten spot bitcoin ETFs. This role is expected to not only bring in revenue but also benefit from an influx of new investors, increased adoption, and higher trading volumes.

The upgrade comes in contrast to JPMorgan’s downgrade of Coinbase stock to an underweight rating on January 22.

JPMorgan said in a research report Monday, downgrading U.S. exchange Coinbase (COIN) to underweight from neutral, with an unchanged price target of $80.

According to CoinDesk, analysts led by Kenneth Worthington wrote:

“While we continue to see Coinbase as the dominant U.S. exchange in the crypto ecosystem and a leader in cryptocurrency trading and investing globally, we think the catalyst in bitcoin ETFs that pushed the ecosystem out of its winter will disappoint market participants.“

However, Lau disagrees with this assessment. He argues that despite the current low fees for trading spot Bitcoin ETFs, the vast majority of retail traders are likely to continue using platforms like Coinbase. This preference is attributed to the broader blockchain engagement opportunities offered by such platforms.

Lau also highlighted the increase in Coinbase’s trading volume since the start of the year. He predicts that this volume will continue to grow over the next two years, potentially increasing by as much as 66% year-over-year. This growth is expected to be driven by factors such as anticipated Federal Reserve interest rate cuts and the upcoming bitcoin halving in April.

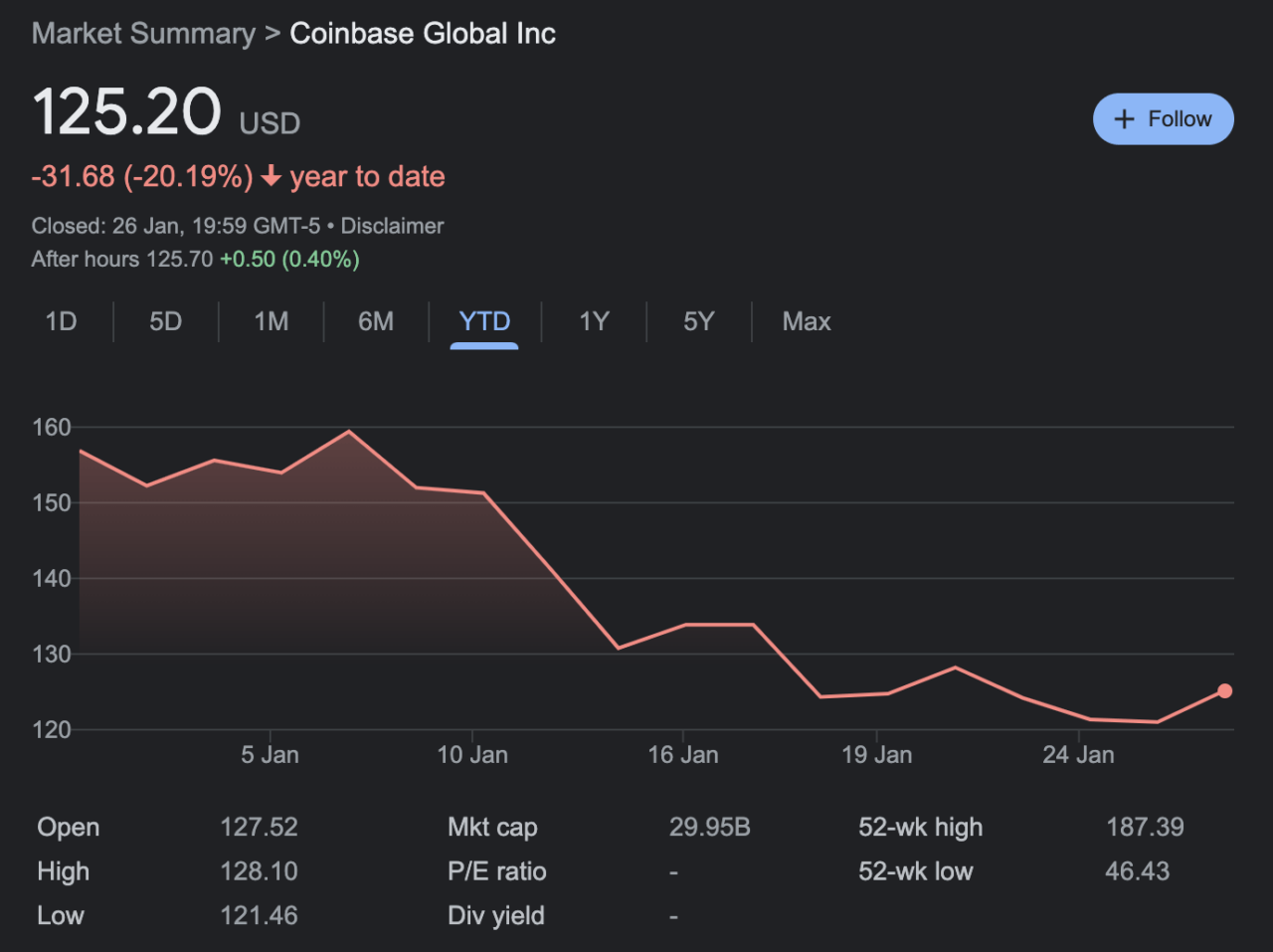

Despite a remarkable 400% rise in share value last year, driven by a recovery in the broader crypto market, Coinbase’s stock has underperformed this year, with a decline of over 20%. On January 26, COIN closed at $125.20, up 3.46% on the day.

Featured Image via Coinbase