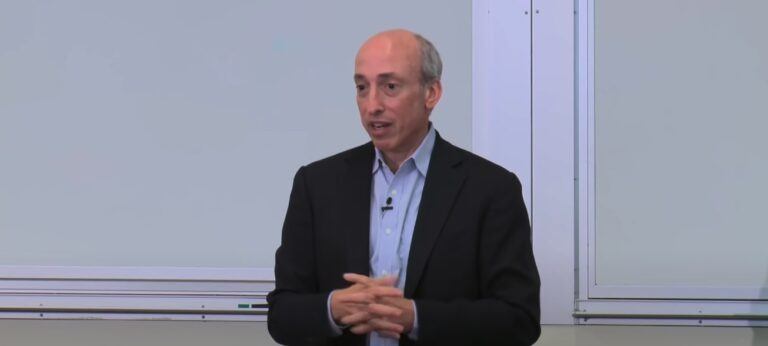

Yesterday, during a conversation with Bloomberg Television reporter Kailey Leinz, U.S. SEC Chair Gary Gensler discussed the implementation of new mandates for hedge funds aimed at reducing risks in the broader financial system. He also touched upon the challenges in the crypto market, highlighting the issue of noncompliance affecting many investors.

Here are the key points from the interview:

- New Mandate for Hedge Funds

- Gensler emphasized the importance of the new rule in lowering systemic risk, particularly in the U.S. Treasury markets.

- The rule focuses on central clearing, which facilitates multi-party netting and ensures the collection of collateral against transactions.

- Addressing Systemic Risks

- The SEC is aware of various risks, including those from cyber attacks, as evidenced by a recent ransomware attack disrupting a treasury clearing broker-dealer.

- Gensler refrained from commenting on interest rate policies, leaving that to the Federal Reserve, but acknowledged the increased volatility in the markets.

- Wall Street’s Response to SEC Rules

- Gensler discussed the legal challenges faced by the SEC, particularly regarding rules around securities lending and short selling.

- He expressed confidence in the SEC’s work and its adherence to legal authorities and public feedback.

- Political Landscape and SEC’s Work

- Gensler focused on serving the American public, emphasizing the importance of maximizing benefits during his tenure, regardless of potential political shifts.

- Crypto Market and Non-Compliance Issues

- He highlighted the harm to investors in the crypto market due to widespread non-compliance, not just with securities laws but also other regulations.

- Gensler pointed out the smaller scale of crypto securities compared to the U.S. Treasury Market, emphasizing the latter’s significance in funding government and monetary policy.

- Engagement with Crypto ETF Filings

- The SEC is currently reviewing several filings related to Bitcoin exchange-traded products.

- Gensler mentioned a recent court case relevant to this area, reiterating the SEC’s commitment to operating within its legal authorities.

- Climate Risk Disclosures

- The SEC is considering a rule on climate risk disclosures, with over a thousand companies already making such disclosures.

- Gensler highlighted the extensive public feedback received on this proposal and the SEC’s commitment to legal compliance in moving forward.