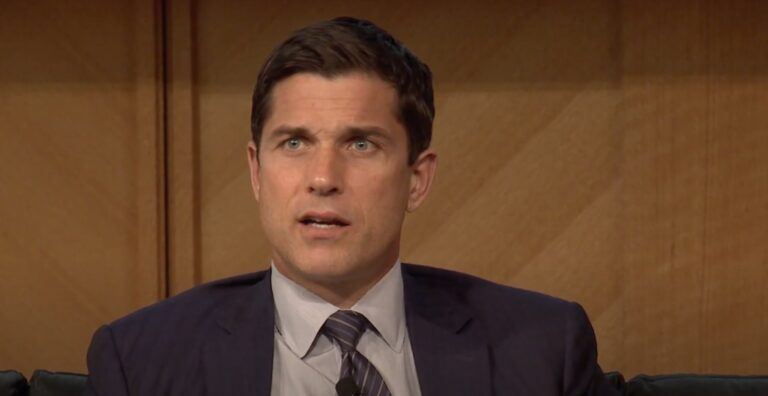

Tom Farley, CEO of Bullish and former President of the New York Stock Exchange, appeared on CNBC’s “Squawk Box” on 21 November 2023. He discussed Bullish’s recent all-cash acquisition of the crypto media platform CoinDesk, the current state and future of the cryptocurrency industry, and the prospects of spot Bitcoin ETFs.

Before joining Bullish as CEO in May 2023, Tom Farley had an impressive tenure as Chairman of Global Blue Group Holding AG, a company listed on the New York Stock Exchange. His rich experience also includes leading roles as CEO and President at Far Peak Acquisition Corporation and Far Point Acquisition Corporation, where he significantly contributed to guiding these companies through the ever-changing fintech industry landscape.

Farley’s notable influence in the financial world was particularly evident during his time as President of the New York Stock Exchange from 2014 to 2018. In this role, he managed the operations of the world’s largest equities listing and securities trading venue, overseeing a period marked by considerable change and technological innovation in the exchange’s operations.

In the earlier stages of his career, Farley held several strategic positions at the Intercontinental Exchange (ICE), including serving as Senior Vice President and later as President, COO, and Board Member of ICE Futures US. These roles involved managing financial products and significantly contributing to the company’s expansion in the derivatives and futures markets.

In yesterday’s interview, Farley emphasized the strategic importance of acquiring CoinDesk, particularly in anticipation of a potential bull run in the cryptocurrency market. He views CoinDesk as a pivotal media arm for Bullish, citing its reputation as a leading source for crypto news and its role in breaking major stories, such as the Sam Bankman-Fried incident.

CoinDesk’s large-scale crypto gathering, Consensus, and its burgeoning index business, which already benchmarks around $20-25 million, were highlighted as key assets. Farley sees these elements as synergistic with Bullish’s operations.

Farley expressed confidence in the crypto market’s recovery, noting that the next wave of success in the industry would likely belong to well-run, trustworthy, and compliant companies. He shared a personal anecdote about the skepticism he faced when initially moving into the crypto space, especially during a period marked by frivolous tokens and questionable practices.

Bullish, despite not being widely known due to minimal marketing, is described as one of the fastest-growing crypto exchanges. Farley mentioned its global presence, with a significant employee base in Hong Kong. The company apparently focuses on compliance and a curated selection of digital assets, offering around 25 coins instead of thousands. Farley hinted at the imminent launch of futures trading on Bullish.

Farley discussed the regulatory challenges facing the crypto industry, emphasizing the need for exchanges to operate within compliant frameworks. He shared insights on the likelihood of a spot Bitcoin ETF approval in the U.S., suggesting that regulatory views on cryptocurrencies as securities, except for Bitcoin and possibly Ethereum, complicate the situation. However, he remains hopeful that a spot Bitcoin ETF could get approved by the U.S. SEC, potentially injecting significant capital into the industry.

According to a report published by The Wall Street Journal (WSJ) on November 8, Bullish is actively participating in an auction to acquire the remnants of FTX.

Per the WSJ report, Bullish is not the only party interested in FTX. It is one of three contenders in the running to purchase the assets of the once-prominent exchange. Initially, the interest in acquiring FTX was quite substantial, with 70 different entities showing intent. This number has since been whittled down to just three firms, with the final decision expected to be made by December.

The WSJ report notes that while a frontrunner is expected to emerge from this process, the possibility of a new suitor entering the fray at any moment remains. It also mentions that FTX’s assets located in the Bahamas are not included in the ongoing sales process.

The other two competitors alongside Bullish are Figure Technologies, a fintech startup, and Proof Group, a venture capital firm. The outcome of this auction could have far-reaching implications for the future landscape of the cryptocurrency exchange market.

Featured Image via YouTube