CCData, a benchmark administrator sanctioned by the Financial Conduct Authority (FCA), stands at the forefront of digital asset information, delivering top-tier data and indices for settlement purposes. The firm excels in compiling and interpreting tick data from internationally recognized trading platforms, offering a detailed and extensive view of the digital asset market. This view encompasses a wide array of data points, including trading activities, derivatives, order books, historical insights, social media trends, and blockchain analytics.

The company’s Exchange Review is a pivotal resource that sheds light on the evolving landscape of the cryptocurrency exchange sector. This report delves into various aspects of exchange volumes, with a particular emphasis on derivatives trading in the crypto realm, the division of market segments based on exchange fee structures and the comparative analysis of crypto-to-crypto versus fiat-to-crypto transaction volumes. Additionally, the review provides a thorough examination of Bitcoin’s trading patterns with different fiat currencies and stablecoins, a snapshot of leading crypto exchanges ranked by spot trading volume, and a historical perspective on volume trends for prominent trans-fee mining and decentralized trading platforms.

Issued monthly, the Exchange Review serves a diverse audience, from crypto aficionados seeking a comprehensive summary of the exchange market to professional investors, analysts, and regulatory bodies looking for in-depth analytical insights. And the October 2023 edition of CCData’s Exchange Review report certainly did not disappoint.

October’s landscape was characterized by a notable resurgence in trading activity. Centralized exchanges experienced a 53.0% increase in combined spot and derivatives trading volumes, reaching a staggering $2.57 trillion. This peak, the first of its kind in four months, marked the highest volume since June 2023. The surge is attributed to the market’s volatility and positive price movements, sparking renewed interest in digital assets. Speculations around the potential approval of a spot Bitcoin ETF further fueled the market’s momentum.

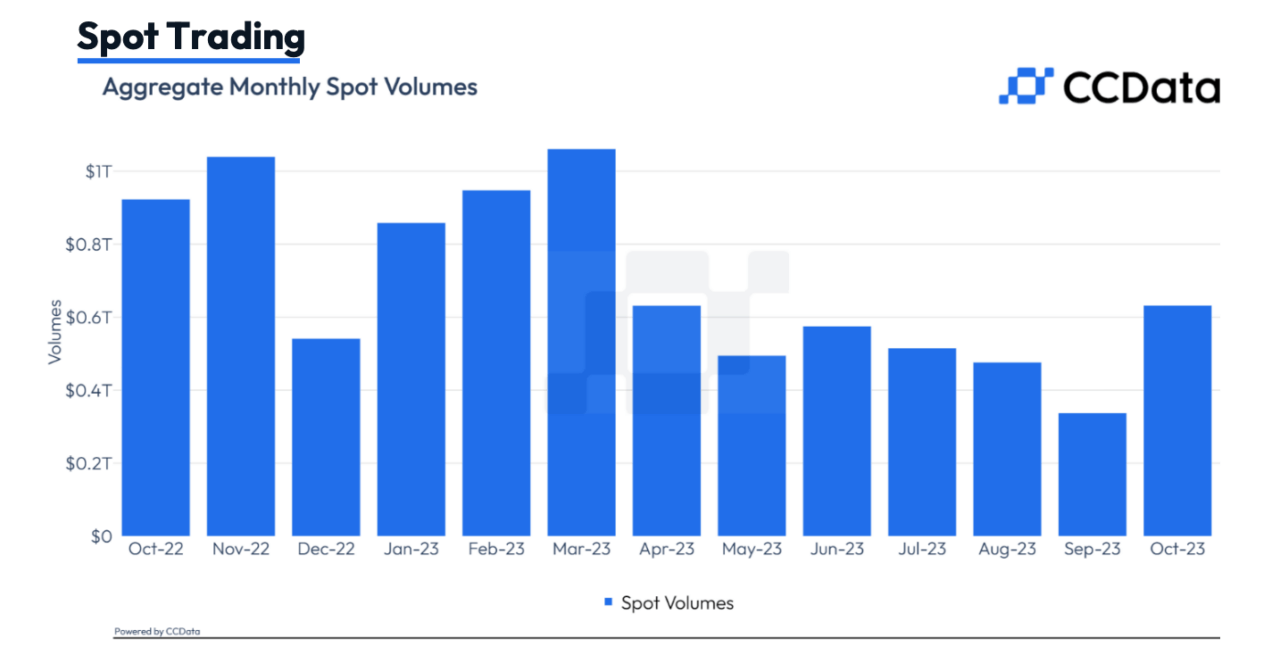

A closer look at spot trading reveals a remarkable 87.2% increase to $632 billion, the highest since March 2023. This leap represents the most significant month-on-month growth since January 2021. Derivatives trading on centralized platforms also saw a substantial rise of 44.4%, culminating in $1.94 trillion, the highest since June 2023. Despite this, the derivatives market share dipped to 75.4%, the lowest recorded since March 2023, suggesting a shift in trader preferences.

The report also sheds light on individual exchange performances. Upbit, a leading exchange, witnessed its spot trading volume skyrocket by 209% to $57.9 billion, the highest since December 2021. This surge propelled Upbit’s market share to an unprecedented 9.16%, positioning it as the second-largest spot exchange by volume. In contrast, Binance saw its market dominance wane for the eighth month in a row, settling at 31.9% despite a 74.9% increase in spot trading volumes to $202 billion.

Institutional engagement, particularly on the CME exchange, experienced a significant uptick. Derivatives trading volume soared by 73.5% to $57.4 billion, the highest since November 2021. BTC futures climbed by 73.4% to $44.1 billion, and ETH futures by 60.6% to $10.2 billion, the most substantial since April 2023. Notably, BTC and ETH options volumes on CME shattered records, rising by 142% and 107%, respectively, signaling a robust institutional interest in the leading cryptocurrencies as the market anticipates a new cycle.