On October 6, Greg Cipolaro, Global Head of Research at NYDIG, a subsidiary of Stone Ridge that “delivers Bitcoin products across industries, from banking and insurance to fintech and nonprofits,” published NYDIG’s latest weekly research report.

Bitcoin’s Resilient Performance: NYDIG’s Observations

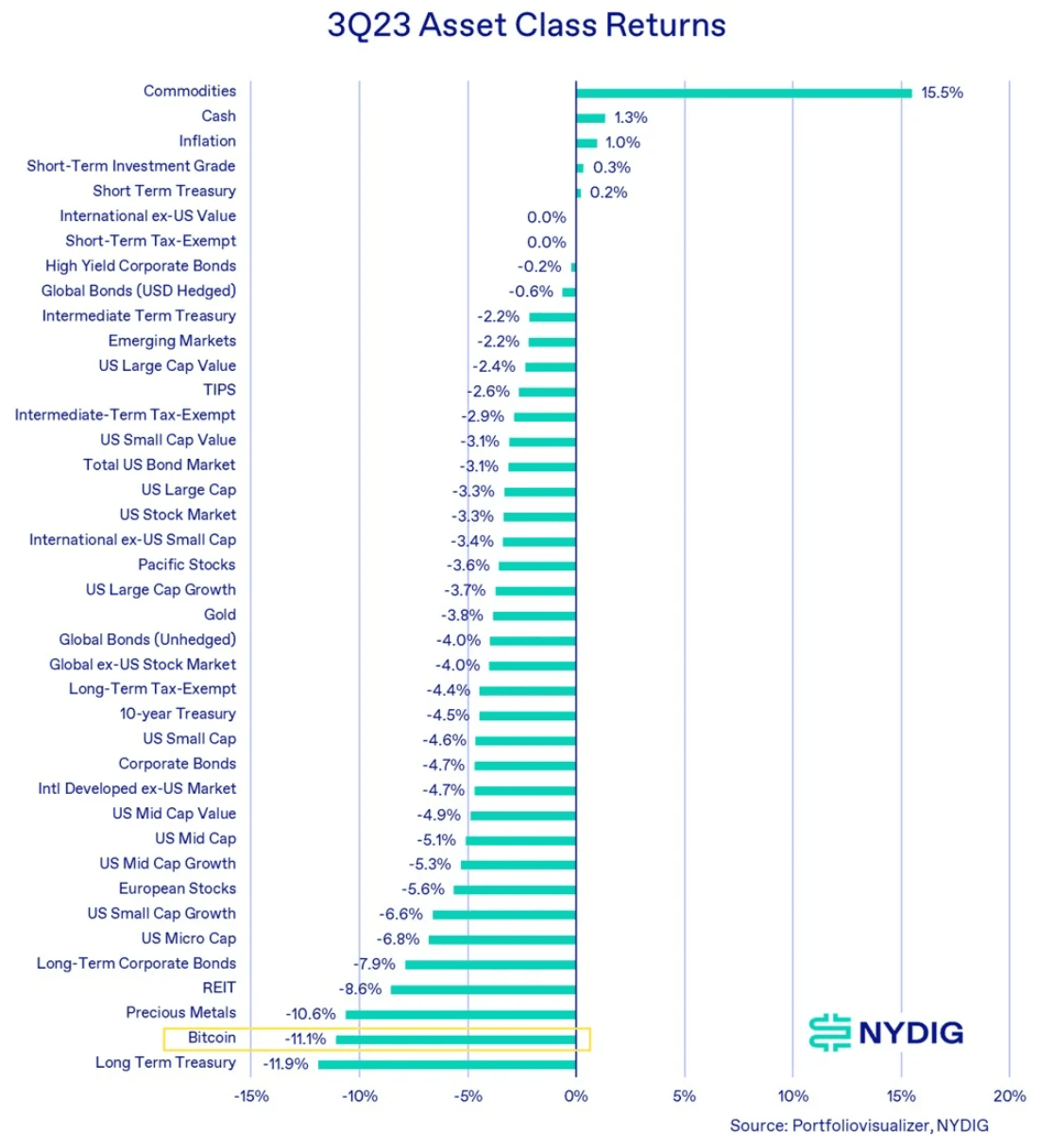

Cipolaro reports that Bitcoin’s price fell by 11.1% during the quarter.

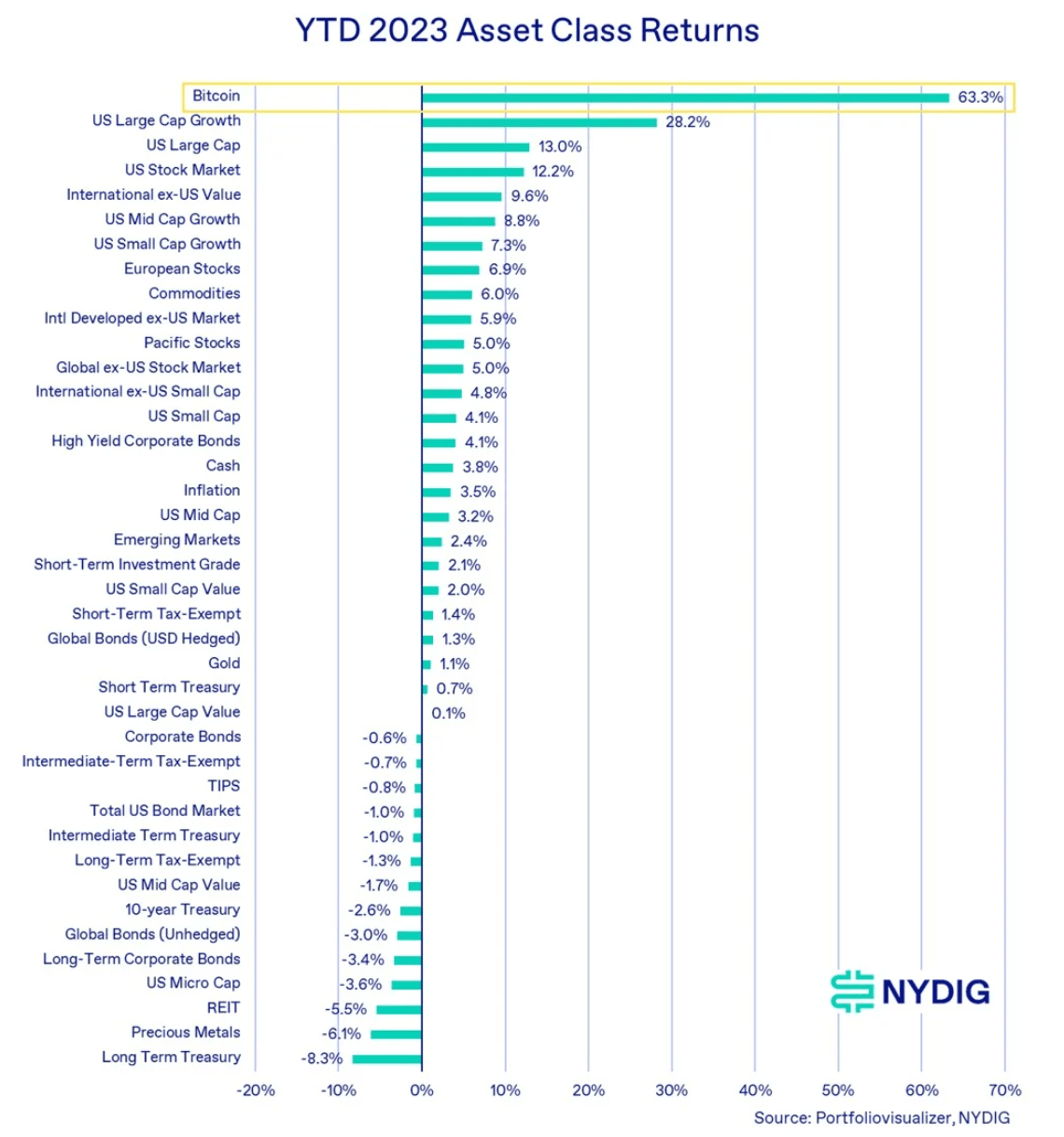

Despite this decline, it has managed to maintain its status as the top-performing asset for the year, with a 63.3% year-to-date increase.

Cipolaro notes that Bitcoin has been trading within a narrow range of $25K to $31K, resisting any significant price movements even amid various macroeconomic changes and legal developments.

The Broader Asset Landscape: NYDIG’s Take

Cipolaro points out that Bitcoin wasn’t the only asset to experience a downturn in Q3. Nearly every other asset class, including stocks, bonds, gold, and real estate, also declined. Factors such as high inflation, rising rates, and recession worries contributed to these trends. However, commodities were an exception, with oil prices rising due to production cuts by OPEC+ countries.

Year-to-Date Asset Performance: NYDIG’s Analysis

Despite the quarterly performance, Cipolaro emphasizes that Bitcoin continues to outperform other asset classes year-to-date. While stock market indices have dipped from their July highs, they are still up for the year. Bonds have faced challenges due to higher interest rates and inflation, with some gaining and most losing. Long-term US Treasuries have been the poorest performers, impacted by duration risk and credit warnings.

The SEC and Bitcoin ETFs: NYDIG’s Perspective

Cipolaro observes that the SEC has been delaying decisions on Bitcoin ETFs, even fast-tracking some postponements. This has occurred despite the legal win for Grayscale, which has put the SEC’s stance on spot ETFs under scrutiny.

Legal Battles: Grayscale vs. SEC Through NYDIG’s Lens

Cipolaro highlights the legal confrontation between Grayscale and the SEC, noting that the DC Circuit Court of Appeals ruled in favor of Grayscale. The SEC has until 13 October to appeal, and their next move is uncertain.

Ethereum-Backed ETFs: A NYDIG Viewpoint

Cipolaro reports that Ethereum futures-backed ETFs have been approved but have performed poorly, accumulating only $16.8 million in AUM. This performance raises questions about the viability of futures-based crypto ETFs.

SEC’s Legal Challenges with Ripple and Others: NYDIG’s Insights

Cipolaro discusses the SEC’s setbacks in its case against Ripple and notes that the outcome remains uncertain. He also mentions that the SEC’s legal actions against Binance and Coinbase are still in their early stages.

Crypto-Related Equities: NYDIG’s Market Analysis

Cipolaro states that crypto-related public equities struggled during the quarter. Crypto companies saw a 1.6% increase, primarily driven by Coinbase’s quarterly performance, while Bitcoin miners experienced a 22.4% decline.

Featured Image via Pixabay